What's Affecting Markets Today

Asia-Pacific markets advanced after China signaled it was evaluating the potential for renewed trade talks with the United States, lifting investor sentiment across the region. Gains were also supported by a strong overnight performance on Wall Street, driven by optimism that slowing global growth will not hinder developments in artificial intelligence.

Hong Kong led regional gains, with the Hang Seng Index rising 1.74% and the Hang Seng Tech Index jumping 3.45%. Japan’s Nikkei 225 added 0.87%, while the broader Topix rose 0.3%. South Korea’s Kospi edged up 0.19%, and the Kosdaq climbed 0.76%. Australia’s S&P/ASX 200 rose 0.94%, tracking the positive momentum. Indian equities were mixed, with the Nifty 50 up 0.46% and the BSE Sensex trading flat. Mainland Chinese markets remained closed for the Labor Day holiday.

U.S. stock futures inched higher on the back of China’s trade remarks. Overnight, the Dow rose 0.21% to 40,752.96, the S&P 500 gained 0.63%, and the Nasdaq surged 1.52%, driven by strong earnings from Meta and Microsoft, easing concerns about AI growth amid economic uncertainty.

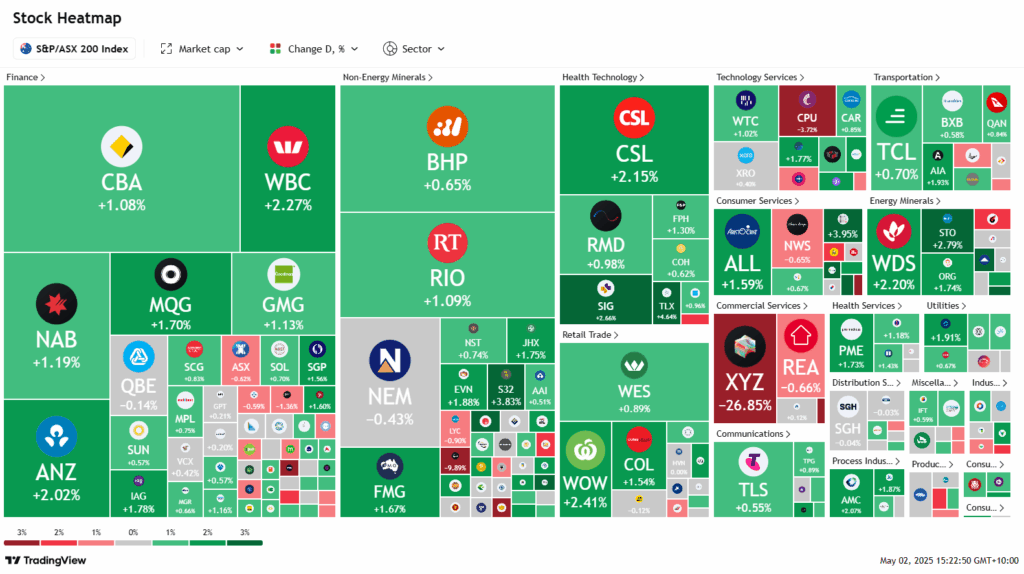

ASX Stocks

ASX 200 - 8,230.6 (+1.00%)

The Australian sharemarket is poised to close at a two-month high, buoyed by hopes of easing trade tensions after China signaled openness to negotiations with the United States. The S&P/ASX 200 climbed 0.9% or 73.5 points to 8219 near 2pm, marking its seventh straight session of gains, with the All Ordinaries also up 0.9%. Ten of the 11 sectors traded higher, led by energy stocks, as crude oil prices rebounded following a three-day decline.

China’s stance boosted investor sentiment globally, lifting US futures and local equities. Woodside and Santos rose 2.4% and 2.5% respectively. BHP added 0.9% amid a broader recovery in iron ore miners.

Banks and healthcare firms supported the rally, with Commonwealth Bank hitting a new high and Westpac rising 2.1%. CSL advanced 1.6%, and Sigma Healthcare gained 2.5% after an “overweight” rating from Morgan Stanley.

In tech, WiseTech rose 1.1% on acquisition speculation, while Block slumped 25.9% after cutting its profit outlook. Capstone Copper surged 4.6% on record revenue. Corporate Travel Management dropped 9.2% citing weaker demand.

Leaders

FCL Fineos Corporation Holdings Plc (+9.46%)

NEU Neuren Pharmaceuticals Ltd (+6.57%)

NIC Nickel Industries Ltd (+6.36%)

BOE Boss Energy Ltd (+5.59%)

LIC Lifestyle Communities Ltd (+5.40%)

Laggards

XYZ Block, Inc (-26.41%)

CTD Corporate Travel Management Ltd (-9.77%)

WEB WEB Travel Group Ltd (-4.26%)

ADT Adriatic Metals Plc (-4.11%)

ZIP ZIP Co Ltd (-3.91%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!