What's Affecting Markets Today

Australian equities declined Monday, with the S&P/ASX 200 falling 0.84% in late trade, pulling back from recent highs. The drop followed Prime Minister Anthony Albanese’s re-election, marking the first back-to-back term for a PM in 21 years—a sign of voters favouring policy continuity amid global economic uncertainty. The Australian dollar edged 0.33% higher to US$0.6462.

Most Asian markets were closed for public holidays, though Taiwan’s Taiex slipped 0.72% in volatile trade. The New Taiwanese dollar surged 3.16% to 29.738 against the greenback, its strongest in nearly three years. India’s Nifty 50 rose 0.66%, and the Sensex gained 0.57%, with sentiment buoyed by reports that Indian billionaire Gautam Adani’s representatives are in talks with the Trump administration to resolve overseas bribery charges. Adani Group stocks rallied, with Adani Enterprises up 4.66% and Adani Ports gaining 4.22%.

Indonesia’s economy grew 4.87% in Q1, missing forecasts and marking the slowest pace since 2021. Meanwhile, oil prices plunged after OPEC+ signaled further supply increases—Brent crude fell 3.59% to US$59.09 per barrel.

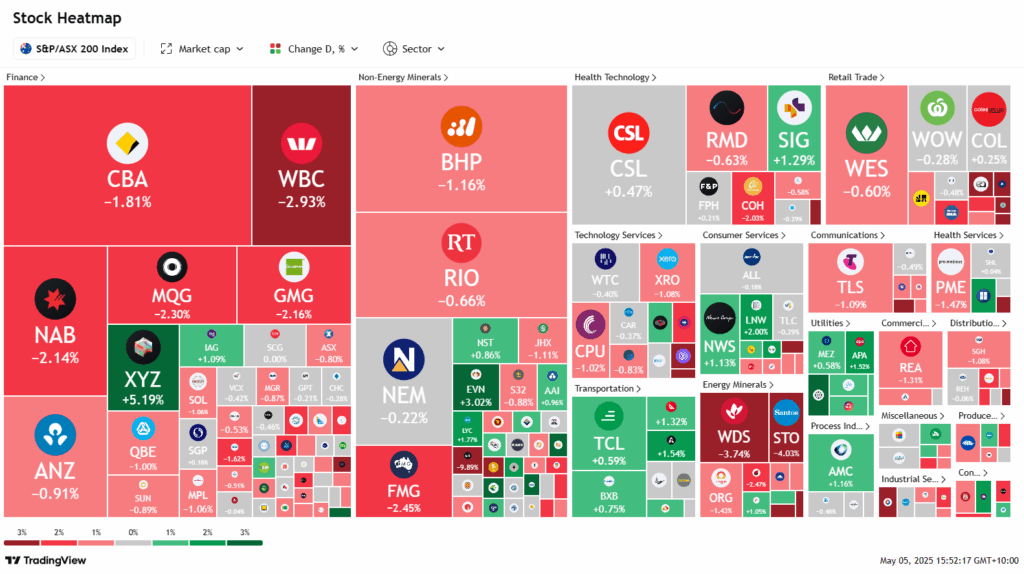

ASX Stocks

ASX 200 - 8,161.3 (-0.90%)

The ASX snapped a seven-day winning streak as weak earnings from Westpac and a sharp decline in oil prices weighed on financial and energy stocks. The S&P/ASX 200 fell 0.7% to 8181.4, on track for its largest one-day drop since April 11, with eight of 11 sectors trading lower.

Westpac’s interim profit missed expectations, triggering a 2.6% decline in its shares and dragging down peers. Commonwealth Bank and NAB fell 1.8% and 1.9% respectively. Sequoia’s Patrick Trindade noted the result highlighted continued challenges for the sector.

Energy stocks followed Brent crude’s 3.9% slump below US$60 after OPEC+ signaled higher output. Woodside and Santos fell 3.5% and 3.7%. Qantas, however, rose 2.4% on lower fuel price expectations.

Gold Road Resources surged 9.6% after accepting a $3.7 billion revised takeover bid from Gold Fields. Smartpay jumped 22.4% after entering exclusive acquisition talks, while Tyro Payments gained 9%. Endeavour rose 1.7% on solid retail guidance. Meanwhile, Reliance Worldwide dropped 2.2% on tariff impact forecasts. The Australian dollar climbed to US64.81¢ amid a weaker greenback.

Leaders

GOR – Gold Road Resources Ltd (+10.10%)

MCY – Mercury NZ Ltd (+5.76%)

XYZ – Block, Inc (+4.92%)

LIC – Lifestyle Communities Ltd (+4.91%)

CEN – Contact Energy Ltd (+4.30%)

Laggards

SDR – Siteminder Ltd (-6.68%)

NXL – NUIX Ltd (-6.67%)

NGI – Navigator Global (-6.36%)

CU6 – Clarity Pharma (-6.15%)

HLI – Helia Group Ltd (-5.87%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!