What's Affecting Markets Today

Asia-Pacific markets mostly advanced on Tuesday as investors monitored evolving trade negotiations between the U.S. and regional economies, while a weakening U.S. dollar supported gains in several Asian currencies.

India reportedly proposed zero tariffs on select imports—including steel, auto components, and pharmaceuticals—on a reciprocal basis, signaling progress in trade discussions. Malaysia also indicated the U.S. had agreed to further talks, potentially leading to tariff reductions.

U.S. Treasury Secretary Scott Bessent said Monday that trade agreements were “very close,” aligning with President Donald Trump’s statement that deals could be reached as early as this week.

Chinese equities resumed trading after the Labor Day holiday, with markets buoyed by signs of a thaw in U.S.-China tensions. The CSI 300 rose 0.95%, and Hong Kong’s Hang Seng Index gained 0.67%. However, China’s Caixin services PMI slipped to 50.7 in April, marking a seven-month low and reflecting softer growth in the services sector.

In India, the Nifty 50 edged down 0.15%, while the BSE Sensex added 0.14% in early trade, showing mixed sentiment across domestic equities.

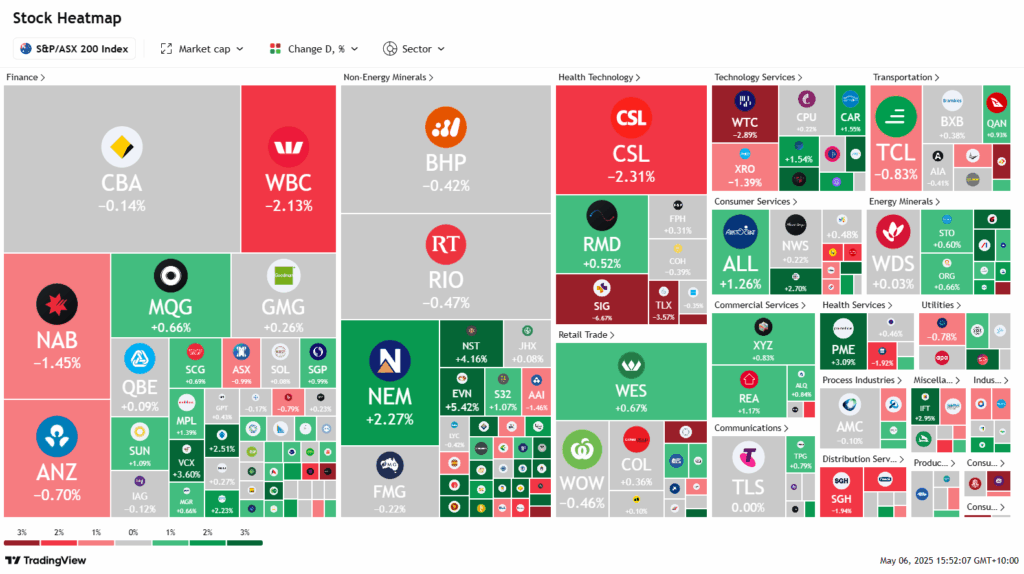

ASX Stocks

ASX 200 - 8,149.6 (-0.10%)

Australian shares fluctuated on Tuesday as investors digested a flurry of updates from Macquarie’s annual investment conference and ongoing weakness in the banking sector. The S&P/ASX 200 rose 0.1% to 8163.1 points by mid-afternoon, supported by gains in mining and consumer discretionary stocks.

Major banks extended their losses following Westpac’s underwhelming interim results. Shares in Westpac fell 1.8% after reporting margin compression and rising costs, prompting downgrades from Citi and JPMorgan. NAB and CBA also declined 1.4% and 0.3% respectively.

NextDC surged 7.9% after announcing a doubling in its pro forma forward order book, while Tabcorp led the index with a 7.9% gain, citing steady consumer demand. Wesfarmers rose 1% despite CEO Rob Scott noting softer retail spending. WiseTech fell 2.9% on tariff-related concerns, and Sigma Healthcare declined 4.4% due to $42.4 million in transaction costs.

Energy stocks stabilized as Brent crude rose 1.6% to $US61.19. Woodside and Santos advanced modestly. Meanwhile, Platinum Asset Management dropped 6.7% after losing a $958 million mandate, and HMC Capital slid 6% amid asset negotiations.

Leaders

PNR – Pantoro Gold Ltd (+11.29%)

RSG – Resolute Mining Ltd (+9.90%)

NXT – NEXTDC Ltd (+8.06%)

TAH – Tabcorp Holdings Ltd (+7.90%)

OBM – Ora Banda Mining Ltd (+7.21%)

Laggards

SLX – SILEX Systems Ltd (-13.14%)

HMC – HMC Capital Ltd (-6.29%)

SIG – Sigma Healthcare Ltd (-5.56%)

PNV – Polynovo Ltd (-5.14%)

SKC – Skycity Entertainment Group Ltd (-4.55%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!