What's Affecting Markets Today

Asian markets rallied as China unveiled sweeping interest rate cuts to stimulate growth amid escalating trade tensions. Hong Kong’s Hang Seng Index led regional gains, climbing 2.07%, after China’s central bank and financial regulators moved to cut key lending rates in a bid to support the economy.

The positive sentiment extended across the region, buoyed by news that U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will meet Chinese officials in Switzerland this week to resume trade talks. Japan’s Nikkei 225 rose 0.22%, the Topix gained 0.38%, South Korea’s Kospi advanced 0.32%, while Australia’s S&P/ASX 200 edged up 0.17%. Mainland China’s CSI 300 gained 1.01%, though South Korea’s Kosdaq slipped 0.7%.

In currency markets, Asian currencies strengthened against the U.S. dollar as investors reduced exposure to greenback-denominated assets. “There is a clear dislocation in USD correlations, with global investors repatriating capital,” said Peter Kinsella of Union Bancaire Privée.

The upcoming talks follow recent tariff escalations, with Trump raising duties on Chinese goods to 145%, prompting swift retaliatory measures from Beijing.

ASX Stocks

ASX 200 - 8,182.9 (+0.40%)

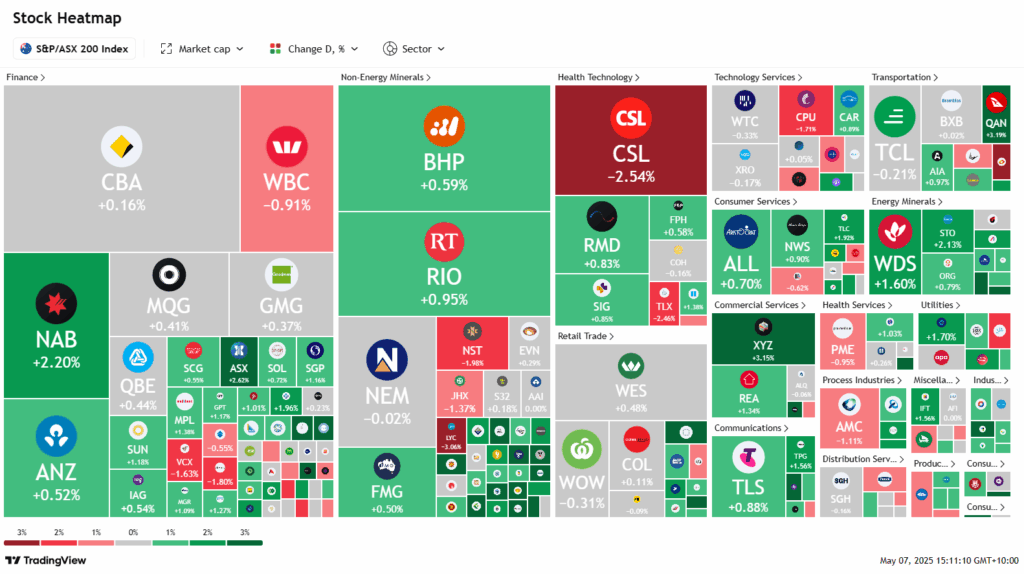

The ASX is poised to break a two-day losing streak as investor sentiment improves on the back of renewed China-US trade dialogue and fresh stimulus measures from Beijing. The S&P/ASX 200 rose 0.3% to 8178.6 near 2pm, with eight of eleven sectors trading higher. The All Ordinaries also advanced 0.3%.

Optimism lifted after China’s central bank announced a 25 basis point rate cut to 1.5% and pledged further support for listed companies. The move followed news that US Treasury Secretary Scott Bessent will meet Chinese officials in Switzerland this Thursday to discuss trade.

Commodity prices rallied, with Brent crude nearing $US63 a barrel, supporting energy stocks. Woodside rose 1.5% and Santos 2%, while iron ore majors BHP and Rio Tinto gained 0.7% and 1.1% respectively.

NAB jumped 2.5% after beating earnings expectations, lifting the banking sector, while healthcare lagged with CSL and Telix retreating. Notable movers included Nuix (-16.8%), Zip (+11.8%), Boss Energy (+10.2%), Temple & Webster (+7.2%), and AUB Group (+7%) on earnings and guidance updates.

Investors now await Thursday’s US Fed decision.

Leaders

KLS – Kelsian Group Ltd (+16.85%)

ZIP – ZIP Co Ltd (+11.77%)

BOE – Boss Energy Ltd (+10.45%)

MFG – Magellan Financial (+8.70%)

PNV – Polynovo Ltd (+8.33%)

Laggards

NXL – NUIX Ltd (‑17.09%)

IMD – IMDEX Ltd (‑4.63%)

QAL – Qualitas Ltd (‑3.70%)

LYC – Lynas Rare EARTHS Ltd (‑3.06%)

TLX – TELIX Pharma(‑2.75%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!