What's Affecting Markets Today

Asia-Pacific markets closed mostly higher after the U.S. Federal Reserve left interest rates unchanged, as expected. The Federal Open Market Committee held the benchmark rate steady at 4.25% to 4.5%, where it has remained since December. While the decision was widely anticipated, Fed Chair Jerome Powell cautioned that elevated tariffs could weigh on economic growth and drive long-term inflation higher.

Japan’s Nikkei 225 rose 0.41% to 36,928.63, while the Topix was flat at 2,698.72. South Korea’s Kospi edged up 0.22% and the Kosdaq climbed 0.94%. Australia’s S&P/ASX 200 gained 0.16% to close at 8,191.7. In Greater China, Hong Kong’s Hang Seng Index advanced 0.37%, and the mainland CSI 300 rose 0.56% to 3,852.90.

Investors are closely monitoring developments ahead of U.S.-China trade talks, with U.S. Treasury Secretary Scott Bessent set to meet Chinese officials in Switzerland.

U.S. futures were little changed following the Fed announcement. The S&P 500 futures and Nasdaq-100 futures each dipped 0.1%, while Dow futures fell 42 points. Overnight, the Dow led gains with a 0.70% rise.

ASX Stocks

ASX 200 - 8,237.7 (+0.60%)

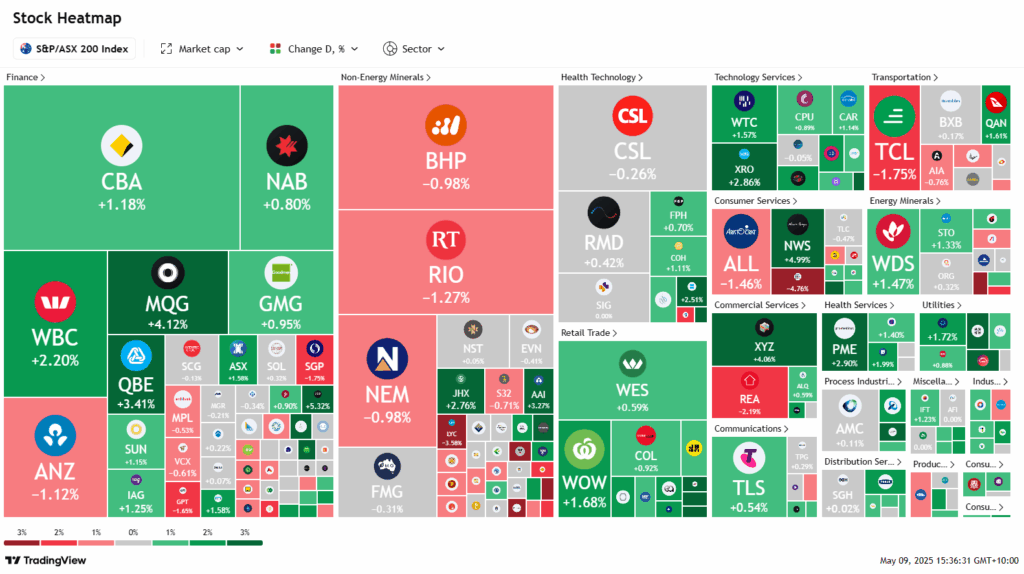

The Australian sharemarket is set to post its first weekly decline in four weeks, with a late rally in bank stocks failing to offset earlier losses. The S&P/ASX 200 Index rose 0.4% to 8225.3 points by mid-afternoon Friday, narrowing the weekly loss to 0.6%. While seven of the index’s 11 sectors traded higher, earlier selling pressure driven by weaker-than-expected earnings from major banks weighed on overall performance.

Macquarie Group led the rebound with a 4% gain following a rise in annual profit, while Commonwealth Bank added 1%. ANZ fell, diverging from the broader trend. Energy stocks advanced alongside higher oil prices, with Woodside and Santos each gaining 1.8%. In contrast, miners underperformed despite a lift in iron ore futures, with BHP slipping 1.1%.

In corporate news, CoStar secured a $3 billion deal to acquire Domain, sending Domain shares up 2.9% and majority owner Nine Entertainment up 7.2%. Chrysos Corporation surged 18.9% after signing a major deal with Newmont. Healius plunged 25% after going ex-dividend, while REA Group declined 1.6%.

Leaders

LTR Liontown Resources Ltd (+16.20%)

DRO Droneshield Ltd (+8.87%)

NEC Nine Entertainment Co. Holdings Ltd (+6.88%)

GQG GQG Partners Inc (+5.56%)

SUL Super Retail Group Ltd (+5.12%)

Laggards

OBM Ora Banda Mining Ltd (-5.98%)

SLX SILEX Systems Ltd (-5.75%)

SIQ Smartgroup Corporation Ltd (-5.40%)

VAU Vault Minerals Ltd (-5.16%)

PDI Predictive Discovery Ltd (-4.61%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!