What's Affecting Markets Today

Asia-Pacific markets advanced on Monday as optimism grew around the outcome of US-China trade talks, despite the lack of specific details. The White House announced a “trade deal” with China, while both sides issued statements highlighting a positive outcome. US officials emphasized progress in narrowing the trade deficit, and Chinese leaders noted an “important consensus.”

US Treasury Secretary Scott Bessent described the discussions as “highly productive,” with a joint statement expected Monday. Chinese Vice Premier He Lifeng added that the agreement includes “good news for the world.”

In regional markets, India led gains after announcing a ceasefire with Pakistan following one of the most intense cross-border exchanges in decades. The Nifty 50 surged 2.29% at the open, while the BSE Sensex climbed 2.27%.

Hong Kong’s Hang Seng Index rose 0.88%, and mainland China’s CSI 300 gained 0.61%. South Korea’s Kospi added 0.49%, and the Kosdaq inched 0.12% higher. Japan’s Nikkei 225 fell 0.17%, while the broader Topix dipped 0.21%, as traders remained cautious amid ongoing volatility.

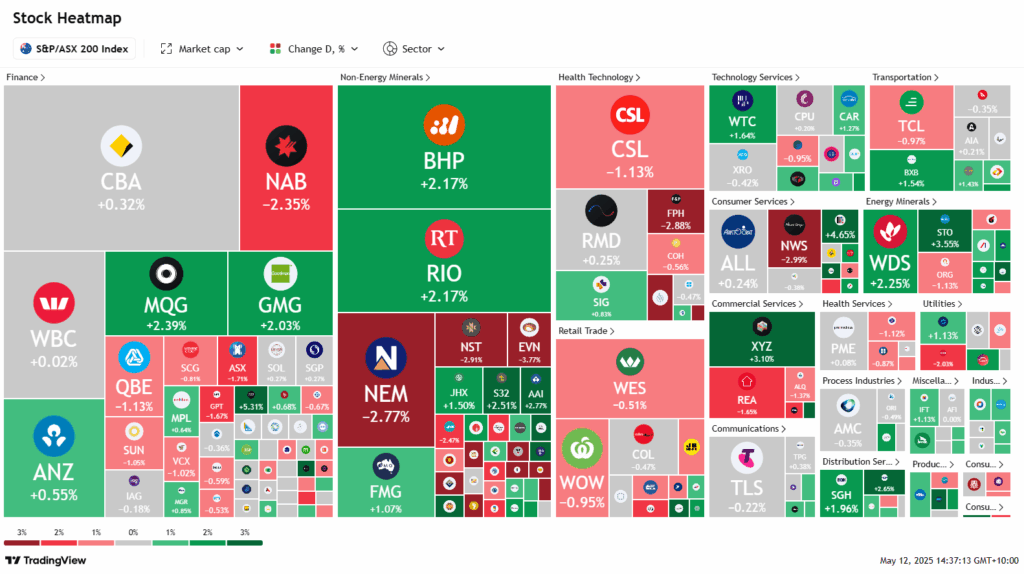

ASX Stocks

ASX 200 - 8,243.1 (+0.10%)

The Australian sharemarket edged higher on Monday, supported by gains in energy and mining stocks ahead of anticipated updates on US-China trade negotiations. The S&P/ASX 200 rose 0.2% to 8248.8 near 2pm, with energy leading sector gains as seven of eleven sectors traded in the green.

US stock futures provided a positive lead as investors awaited the outcome of discussions in Geneva. US Trade Representative Jamieson Greer signalled narrowing differences, while China noted “sustainable development” in the talks. Pepperstone’s Chris Weston noted that any tariff reduction would materially impact sentiment, though markets remain sensitive to a lack of progress.

Commodity-linked stocks advanced on optimism around Chinese demand. BHP rose 2% amid reports of a major copper find in Argentina. Iron ore futures gained 1.6%, lifting miners. Woodside and Santos rose 2.4% and 3.6% respectively.

Macquarie gained 2.3% following a Citi upgrade to “neutral”, while Goodman Group climbed 1.8% on a UBS upgrade to “buy”. South32 rose 3.1% despite CEO transition news. Losses in healthcare and utilities, including Neuren and Clarity, capped broader gains.

Leaders

LTR Liontown Resources Ltd (+8.27%)

MIN Mineral Resources Ltd (+7.98%)

GQG GQG Partners Inc (+5.31%)

KAR Karoon Energy Ltd (+4.88%)

LNW Light & Wonder Inc (+4.71%)

Laggards

BOT Botanix Pharmaceuticals Ltd (-16.67%)

NEU Neuren Pharmaceuticals Ltd (-8.05%)

TLX TELIX Pharmaceuticals Ltd (-7.95%)

CU6 Clarity Pharmaceuticals Ltd (-7.20%)

HLS Healius Ltd (-6.28%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!