What's Affecting Markets Today

Asia-Pacific markets traded mixed on Tuesday following Wall Street’s sharp rally, spurred by a surprise U.S.–China trade agreement that includes a 90-day tariff pause and a significant 115-point reduction in reciprocal tariffs.

Nomura analysts upgraded Chinese equities to a “tactical overweight,” citing the unexpectedly large tariff rollback as a catalyst for near-term risk appetite. “This reduction is much larger than anticipated and offers meaningful relief for global, including Asian, equities,” wrote Asia-Pacific equity strategist Chetan Seth. To fund the China upgrade, Nomura trimmed its overweight position in India.

Despite the trade optimism, Hong Kong markets reversed prior gains. The Hang Seng Index dropped 1.74%, while the Hang Seng Tech Index slid 3.06%. Mainland China’s CSI 300 was little changed.

Indian equities also pulled back after Monday’s strong rally, which followed ceasefire optimism with Pakistan. The Nifty 50 declined 0.34%, and the BSE Sensex lost 0.39%.

Japan outperformed, with the Nikkei 225 climbing 1.71% and the Topix advancing 1.28%. South Korea’s Kospi was flat, while the Kosdaq rose 1.15%, supported by strength in small-cap stocks.

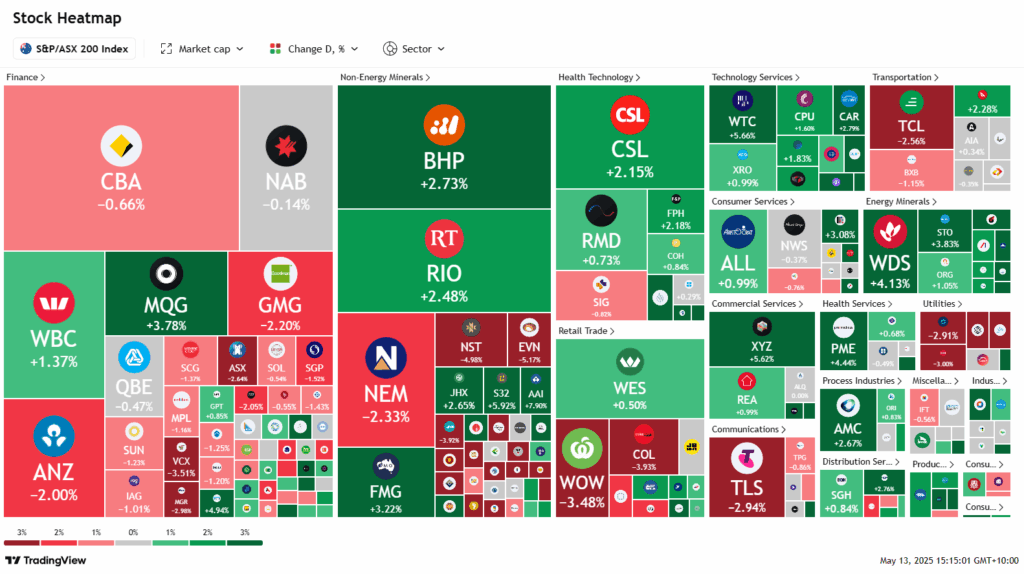

ASX Stocks

ASX 200 - 8,267.1 (+0.40%)

The Australian sharemarket rallied on the back of a global rebound, as the US and China agreed to a 90-day truce in their trade dispute, easing tariff tensions and restoring investor confidence. The S&P/ASX 200 climbed 0.5% to 8270.4 by midday, led by gains in technology and energy sectors. The All Ordinaries also rose 0.5%.

Wall Street surged, with the Nasdaq jumping 4.4% – its strongest session in over a month – as investors rotated into risk assets. Amazon and Meta led gains, up 8.1% and 7.9% respectively. Iron ore prices breached $US100 a tonne, while gold retreated below $US3300 as demand for safe havens fell.

Australian tech mirrored US sentiment, with WiseTech up 5.9% and Life360 soaring 12.3%. Energy stocks tracked stronger oil prices, with Woodside and Santos rising over 3%. Miners BHP and Rio Tinto followed iron ore higher.

Conversely, gold miners slumped on weaker prices, with Capricorn Metals down 11.6%. Clarity Pharmaceuticals rose 13.5% on US policy optimism. PolyNovo jumped 10.5% on positive trial results. Ampol, Abacus Storage King, and Telix Pharmaceuticals also made notable moves.

Leaders

RIC Ridley Corporation Ltd (+19.31%)

PNV Polynovo Ltd (+13.01%)

360 LIFE360 Inc (+11.70%)

ZIP ZIP Co Ltd (+11.51%)

MIN Mineral Resources Ltd (+10.48%)

Laggards

PNR Pantoro Gold Ltd (-13.11%)

CMM Capricorn Metals Ltd (-10.62%)

GMD Genesis Minerals Ltd (-10.34%)

RMS Ramelius Resources Ltd (-9.59%)

PRU Perseus Mining Ltd (-9.27%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!