What's Affecting Markets Today

Asia Markets Dip as Investors Weigh U.S.-China Trade Pause

Asia-Pacific markets broadly declined on Thursday, diverging from Wall Street’s modest gains, as investors assessed the implications of the recent U.S.-China tariff truce and ongoing global macro risks.

Japan’s Nikkei 225 fell 0.90% and the Topix lost 0.75%, while South Korea’s Kospi and Kosdaq dropped 0.29% and 0.37%, respectively. Hong Kong’s Hang Seng declined 0.42%, and China’s CSI 300 shed 0.6%. India’s Nifty 50 was flat at the open. Bucking the regional trend, Australia’s S&P/ASX 200 rose 0.21%.

Markets remain cautious despite the temporary easing in U.S.-China trade tensions. Citi analysts warned of a potential “second wave of volatility,” this time driven by fiscal uncertainty and weakening U.S. hard economic data.

U.S. stock futures slipped in overnight trade following a third consecutive gain for the S&P 500, which rose 0.10% to 5,892.58. The Nasdaq Composite gained 0.72%, closing at 19,146.81, while the Dow Jones Industrial Average slipped 0.21% to 42,051.06, reflecting uneven investor sentiment despite early-week optimism.

ASX Stocks

ASX 200 - 8,297.3 (+0.20%)

ASX Edges Higher Amid Cautious Sentiment

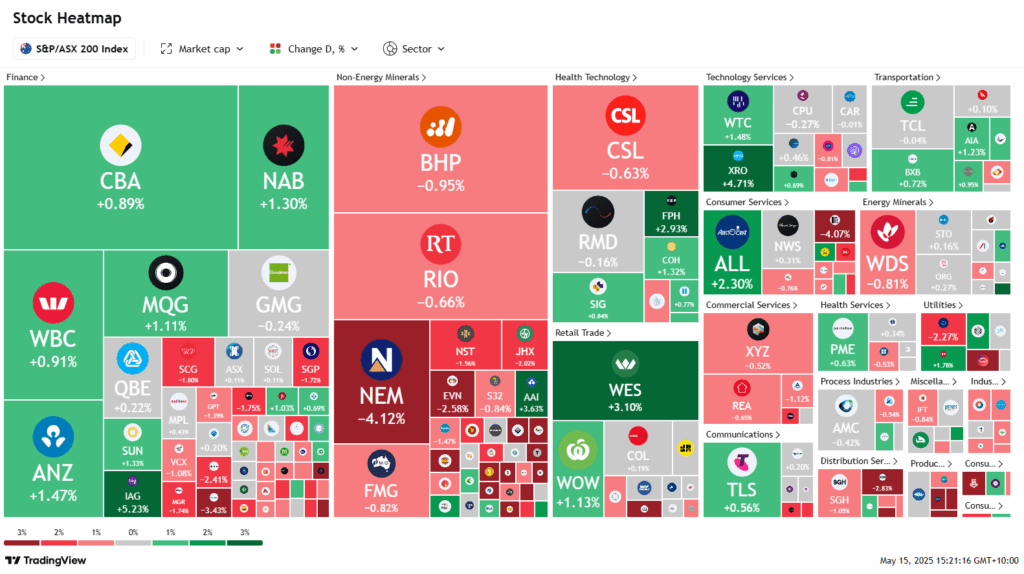

Australian shares edged higher on Thursday, mirroring a modest Wall Street advance as investors awaited fresh catalysts. The S&P/ASX 200 rose 0.2% to 8299.8 points by 2pm, reversing early losses. Technology led gains, while energy and resources lagged.

The local market followed the S&P 500, which closed 0.1% higher. However, sentiment remained cautious amid concerns the recent rebound may have run ahead of fundamentals. AMP chief economist Shane Oliver warned that despite short-term confidence, economic data is likely to soften due to ongoing uncertainty from tariff-driven inflation and recession risks.

Iron ore weakness weighed on miners, with BHP and Rio Tinto down 0.9% and 0.8%, respectively. The energy sector snapped a strong run, mirroring a 2% drop in oil prices.

Technology outperformed, led by Xero (+4.1%) after a 30% lift in full-year profit, and WiseTech (+1.1%). Banks rose following a strong jobs report, with NAB up 1.1% and CBA 0.8%.

Notable movers included Graincorp (+7.8%), Mayne Pharma (+11.5%), and IAG (+4%). NRW Holdings dropped 9.3%, and Treasury Wine Estates fell 5.5% on CEO departure news.

Leaders

GNC Graincorp Ltd (+8.25%)

NGI Navigator Global Investments Ltd (+5.76%)

IAG Insurance Australia Group Ltd (+4.75%)

XRO Xero Ltd (+4.41%)

AAI Alcoa Corporation (+3.64%)

Laggards

NWH NRW Holdings Ltd (-8.62%)

RSG Resolute Mining Ltd (-5.56%)

TWE Treasury Wine Estates Ltd (-5.04%)

IPX Iperionx Ltd (-4.94%)

BVS Bravura Solutions Ltd (-4.86%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!