What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Digest Japan GDP and Await Regional Data

Asia-Pacific equities were mixed on Friday as investors assessed Japan’s weaker-than-expected GDP figures and looked ahead to additional economic releases from the region.

Japan’s Nikkei 225 slipped 0.23%, while the broader Topix edged up 0.12% after data showed the Japanese economy contracted 0.2% quarter-on-quarter in Q1, exceeding Reuters’ forecast for a 0.1% decline. The soft reading comes as Japan continues trade negotiations with the U.S., though talks have yet to yield significant progress.

The weaker GDP print may temper expectations of near-term rate hikes from the Bank of Japan. Commonwealth Bank of Australia noted this could support the USD/JPY, with resistance around 148.13. The yen was last trading at 145.52 per dollar.

Australia’s S&P/ASX 200 rose 0.44%, while South Korea’s Kospi advanced 0.33%. The Kosdaq, however, slipped 0.2%. In India, the Nifty 50 fell 0.25% at the open.

Hong Kong’s Hang Seng Index declined 0.66%, and mainland China’s CSI 300 dipped 0.2%. Investors are also watching for upcoming GDP reports from Hong Kong and Malaysia later in the day.

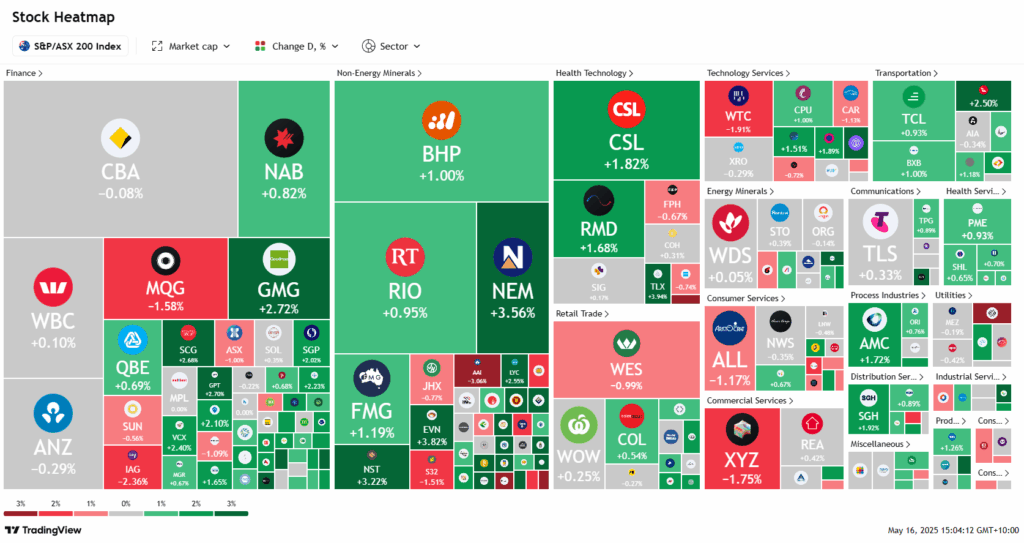

ASX Stocks

ASX 200 - 8,338.9 (+41.4%)

ASX Eyes Weekly Gain as Rate Cut Bets Boost Sentiment

The ASX is poised to end the week on a high, supported by mounting expectations of rate cuts following soft economic data from both Australia and the US. By 2pm, the S&P/ASX 200 was up 0.5% to 8341.4, heading for its eighth consecutive gain and a 1.4% rise over the week.

Weak US retail and producer price data heightened expectations the Federal Reserve may ease policy, driving equities and pushing US 10-year Treasury yields down 10 basis points. In Australia, bond markets held firm on forecasts for a rate cut next Tuesday, despite a surprise jobs surge.

Real estate led sector gains, with Goodman Group up 2.4% and Vicinity Centres rising 2.8%. CBA slipped 0.2% after touching a record high, while NAB added 0.9%.

Gold stocks climbed, with Evolution Mining up 4.5%. Appen surged 23.2% after issuing upbeat guidance. NRW Holdings recovered 2.8% despite a $113 million impairment linked to Whyalla port. Meanwhile, Dexus fell 1.4% amid a legal dispute, and IAG dropped 2.4% following a UBS downgrade.

Leaders

PNR – Pantoro Gold Ltd (+6.44%)

RSG – Resolute Mining Ltd (+5.91%)

RPL – Regal Partners Ltd (+5.46%)

GMD – Genesis Minerals Ltd (+5.44%)

LTR – Liontown Resources Ltd (+5.38%)

Laggards

PDN – Paladin Energy Ltd (-7.80%)

DYL – Deep Yellow Ltd (-6.77%)

BOE – Boss Energy Ltd (-6.36%)

MCY – Mercury NZ Ltd (-4.46%)

CSC – Capstone Copper Corp (-3.30%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!