What's Affecting Markets Today

Asia-Pacific markets declined on Monday as investors digested weaker-than-expected Chinese economic data and Moody’s downgrade of the U.S. sovereign credit rating. Hong Kong’s Hang Seng fell 0.73%, China’s CSI 300 shed 0.48%, while Japan’s Nikkei 225 and Topix dropped 0.54% and 0.36% respectively. South Korea’s Kospi slid 0.47% and the Kosdaq lost 0.77%. The Reserve Bank of Australia also commenced its two-day policy meeting.

Moody’s cut the U.S. credit rating from Aaa to Aa1, citing persistent fiscal deficits and elevated refinancing costs in a high-rate environment. The move aligns Moody’s with S&P and Fitch, which downgraded the U.S. in 2011 and 2023 respectively. While unlikely to trigger a major market sell-off, the downgrade reinforces long-standing concerns around U.S. debt sustainability.

U.S. futures turned lower after a four-day rally, with Dow futures down 292 points (0.7%), S&P 500 futures off 0.7%, and Nasdaq 100 futures dropping 0.8%. On Friday, the S&P 500 rose 0.7% to 5,958.38, notching a fifth consecutive gain. The Dow added 0.78%, turning positive year-to-date.

ASX Stocks

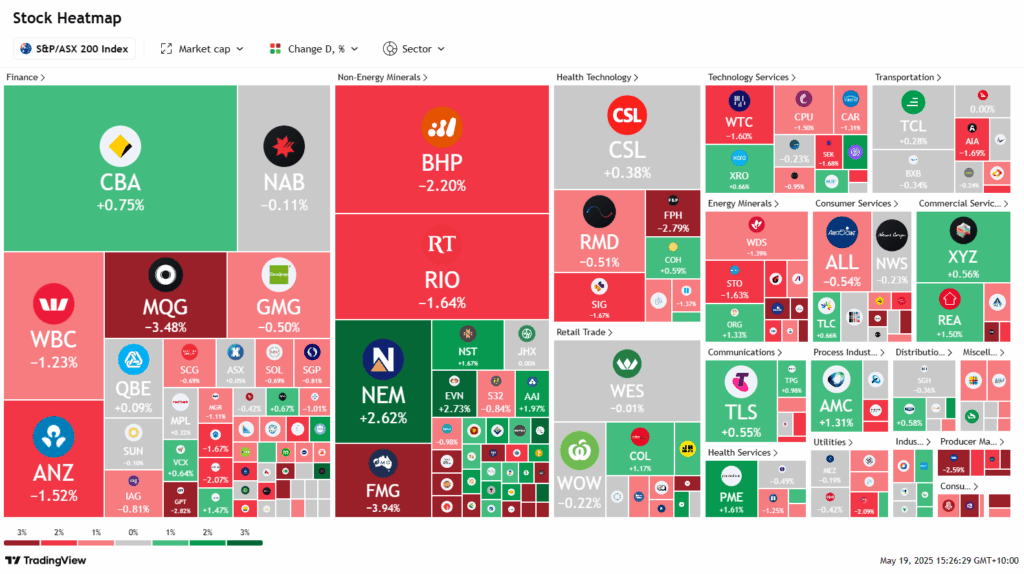

ASX 200 - 8,293.4 (-0.60%)

The Australian sharemarket snapped its longest winning streak since August, retreating alongside US futures amid renewed risk-off sentiment. The S&P/ASX 200 fell 0.5% or 42.1 points to 8301.6 by 2pm, ending an eight-session rally. The All Ordinaries dropped 0.6%, with materials and energy stocks leading the decline.

Investor sentiment turned negative following Moody’s downgrade of the US credit rating from AAA to Aa1, citing rising fiscal deficits and ballooning interest costs. The move drove 10-year Treasury yields higher and boosted gold prices nearly 1% as investors shifted to safe-haven assets. Nasdaq 100 futures fell over 1%.

China’s weaker-than-expected industrial output and retail sales data further weighed on markets, particularly resource-linked stocks. BHP dropped 2.2%, Mineral Resources slid 9.7%, and New Hope plunged 7.6% after cutting coal output guidance.

Gold miners gained, with Evolution Mining up 2.8% and Northern Star 1.1%. Electro Optic Systems soared over 17% after securing a $53 million European defence contract. In other moves, Gentrack fell 4.3%, Domino’s dropped 2.8%, while Lendlease added 1.4% on a new UK joint venture.

Leaders

PXA Pexa Group Ltd (+3.20%)

PNR Pantoro Gold Ltd (+2.96%)

CMM Capricorn Metals Ltd (+2.73%)

NEM Newmont Corporation (+2.60%)

RRL Regis Resources Ltd (+2.58%)

Laggards

LTR Liontown Resources Ltd (-14.72%)

CU6 Clarity Pharmaceuticals Ltd (-12.00%)

PLS Pilbara Minerals Ltd (-8.65%)

NHC New Hope Corporation Ltd (-8.40%)

CIA Champion Iron Ltd (-7.32%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!