What's Affecting Markets Today

Asia-Pacific Markets Rise on China Rate Cut, Wall Street Extends Gains

Asia-Pacific markets advanced Tuesday after the People’s Bank of China cut key lending rates by 10 basis points to support its slowing economy amid rising trade tensions. The 1-year loan prime rate was reduced to 3.0% from 3.1%, while the 5-year LPR was trimmed to 3.5% from 3.6%.

Hong Kong’s Hang Seng Index climbed 1.28%, buoyed by a strong debut from battery giant Contemporary Amperex Technology, which surged over 11% in its Hong Kong listing. China’s CSI 300 rose 0.48%.

In Japan, the Nikkei 225 added 0.45% and the Topix gained 0.32%. South Korea’s Kospi rose 0.29%, while the tech-heavy Kosdaq advanced 0.62%.

Overnight in the U.S., equity markets posted modest gains as investors looked past Moody’s downgrade of the U.S. credit outlook. The S&P 500 edged up 0.09% to 5,963.60, marking a sixth straight advance. The Nasdaq Composite rose 0.02% to 19,215.46. The Dow gained 137 points, or 0.32%, boosted by an 8% rebound in UnitedHealth shares.

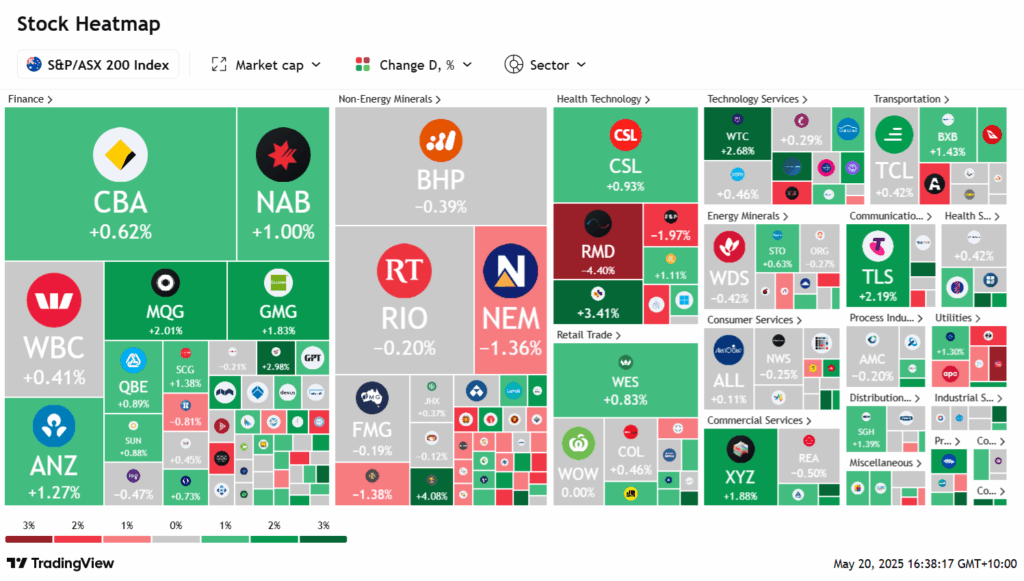

ASX Stocks

ASX 200 - 8,343.3 (+0.60%)

ASX Rallies as RBA Cuts Rates Again

The ASX extended gains after the Reserve Bank of Australia delivered a widely expected 25 basis point rate cut—its second for the year—lifting the S&P/ASX 200 by 0.5% intraday. All 11 sectors traded higher, led by financials, technology, and real estate.

Macquarie gained 2.1%, while WiseTech rose 2.9%. Goodman Group advanced 1.4%. Commonwealth Bank eased from early highs to close up 0.2%, while NAB added 1.9%, ANZ climbed 2.2%, and Macquarie rose 1.7%.

The RBA’s dovish tone pushed the Australian dollar down to US64.27¢, while bond yields declined, with the three-year yield falling to 3.59% and the 10-year to 4.47%.

TechnologyOne surged 10.8% on strong half-year results and a 30% dividend boost. Telstra gained 1.6% after announcing price hikes. Tower rose 3.8% on a 53% profit increase.

Conversely, Kogan.com fell 10.3% amid profit concerns for its Mighty Ape division. Newmont lost 2.1% and Mercury NZ dropped 3.1% as investors rotated out of defensive stocks. South32 rose 3.6%, shrugging off Citi’s earnings downgrade.

Leaders

TNE Technology One Ltd (+11.33%)

ZIM Zimplats Holdings Ltd (+9.27%)

IPX Iperionx Ltd (+5.66%)

BVS Bravura Solutions Ltd (+4.43%)

LTR Liontown Resources Ltd (+4.41%)

Laggards

NAN Nanosonics Ltd (-8.49%)

VGL Vista Group International Ltd (-6.61%)

RPL Regal Partners Ltd (-5.68%)

CYL Catalyst Metals Ltd (-5.01%)

RMD ResMed Inc (-4.40%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!