What's Affecting Markets Today

Asia-Pacific Markets Slip as Investors Digest Tariff Reprieve

Asia-Pacific equities mostly declined on Tuesday as investors evaluated the global trade outlook following U.S. President Donald Trump’s decision to delay a planned 50% tariff on European Union imports.

Japan’s Nikkei 225 slipped 0.19%, while the broader Topix index was little changed. In South Korea, the Kospi dropped 0.49%, pulling back from a three-month high, and the Kosdaq edged down 0.12%.

China’s CSI 300 lost 0.56% in volatile trading despite April industrial profits rising 1.4%, improving from a 0.8% increase in March. Hong Kong’s Hang Seng Index also declined, down 0.3%.

Indian markets opened lower, with the Nifty 50 falling 0.49% and the BSE Sensex down 0.63% amid broader regional caution.

Australia’s S&P/ASX 200 bucked the trend, gaining 0.33% as tech and banking stocks helped lift the index.

U.S. markets remained closed for the Memorial Day holiday, offering limited direction for regional investors. Attention now turns to inflation and trade data for further cues on the global economic trajectory.

ASX Stocks

ASX 200 8,407.6 (+0.56%)

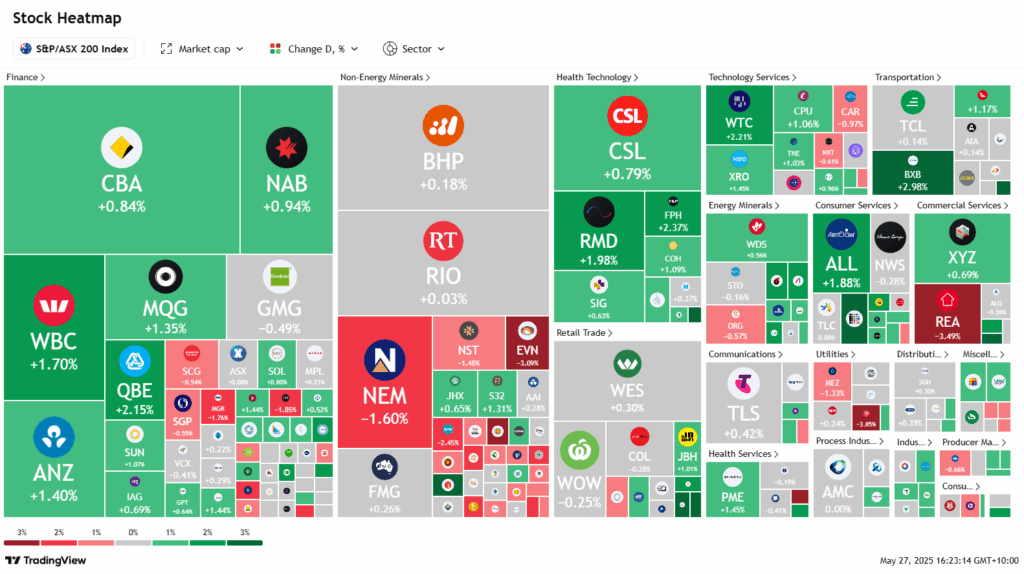

ASX Edges Higher on Tech, Banks; Iron Ore Weakens

The ASX 200 rose 0.3% to 8388 on Tuesday, tracking gains in European markets and US futures after easing trade tensions between the US and EU. The All Ordinaries also gained 0.3%, with eight of 11 sectors in positive territory, led by energy.

Technology and bank stocks supported the market. WiseTech rose 2.3% and Aristocrat Leisure added 2.4%, following a 1% lift in Nasdaq futures. Commonwealth Bank neared a record high, while Westpac advanced 0.8%. Healthcare also gained, with Fisher & Paykel up 1.6% and Pro Medicus climbing 1.8%.

Focus turns to April CPI data due Wednesday, expected to show inflation easing to 2.3%, well within the RBA’s target range.

Iron ore miners weighed on the index as Singapore futures hit a three-week low. Fortescue fell 0.6% and BHP slipped 0.3%.

In corporate news, copper stocks surged on takeover speculation, with Capstone Copper up 5.7% and Sandfire rising 3.4%. REA Group declined 1.2% amid ACCC scrutiny. The AUD gained 1.6% to US64.84¢ as the USD weakened.

Leaders

DYL Deep Yellow Ltd (+16.87%)

PDN Paladin Energy Ltd (+13.61%)

BOE Boss Energy Ltd (+9.55%)

NXG Nexgen Energy (Canada) Ltd (+7.62%)

IPX Iperionx Ltd (+6.62%)

Laggards

ELD Elders Ltd (-6.36%)

MYR Myer Holdings Ltd (-5.45%)

CAT Catapult Group International Ltd (-4.90%)

ORG Origin Energy Ltd (-4.39%)

VSL Vulcan Steel Ltd (-3.68%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!