What's Affecting Markets Today

Asia-Pacific Markets Climb as Trump Tariffs Ruled Unlawful; Nvidia Boosts Sentiment

Asia-Pacific equities advanced on Thursday, lifted by a U.S. federal court ruling that President Donald Trump overstepped his authority in implementing “reciprocal” tariffs, undermining a key pillar of his economic agenda. The decision, combined with strong earnings from Nvidia, supported investor sentiment.

South Korea’s Kospi gained 1.76% and the Kosdaq rose 0.83% after the Bank of Korea cut its policy rate by 25 basis points to 2.5%, its lowest since August 2022. Japan’s Nikkei 225 climbed 1.63%, while the broader Topix rose 1.44%. Australia’s S&P/ASX 200 added 0.31%.

Hong Kong’s Hang Seng index increased 0.84%, and China’s CSI 300 rose 0.7%. In India, the Nifty 50 and BSE Sensex opened 0.29% and 0.34% higher, respectively.

Investors are watching regional semiconductor stocks closely after Nvidia posted stronger-than-expected earnings, driven by a 73% year-over-year surge in data center revenue. U.S. futures responded positively—S&P 500 futures jumped 1.44%, Nasdaq 100 rose 1.76%, and Dow futures added 1.15%.

Overnight, U.S. benchmarks closed lower amid mixed earnings and cautious Fed minutes.

ASX Stocks

ASX 200 8,416.6 (+0.23%)

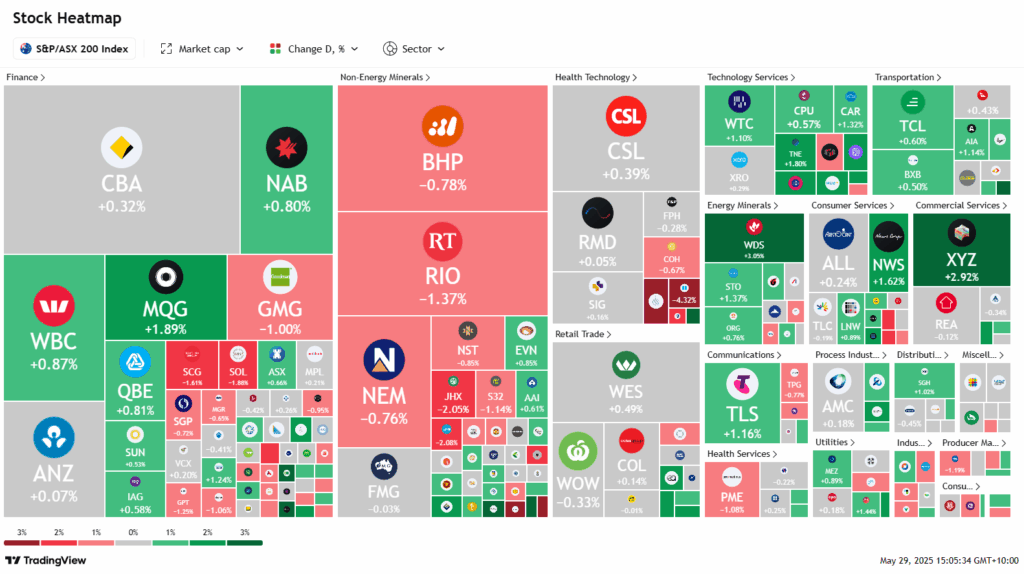

ASX Rises Modestly as Energy Stocks Outperform; Rio Tinto Weighs

The Australian sharemarket edged higher on Thursday, buoyed by energy stocks, while weakness in the mining sector tempered broader gains. The S&P/ASX 200 Index rose 0.2%, or 20.4 points, to 8417.3 by 2pm. The All Ordinaries also advanced 0.2%, with seven of 11 sectors trading in the green.

Energy stocks led gains, with Woodside up 2.8% and Santos gaining 1.3%, following a rally in oil prices and news that the Albanese government would extend the North West Shelf gas project. Meanwhile, a 5% surge in Nvidia shares in extended US trading had little impact on the tech-light ASX, as investors exhibited “tariff fatigue” following a US court ruling against President Trump’s tariff actions.

Mining stocks dragged, with Rio Tinto falling 1.2% and BHP down 0.9% amid weaker iron ore sentiment. Gold miners also retreated as bullion extended losses.

In company news, Megaport and DigiCo Infrastructure REIT each added 2.1% on AI optimism, while Champion Iron rose 0.9% after a strong earnings update. Elders gained 1.5%, and Resolute Mining dropped 3.2% amid regulatory uncertainty in Guinea.

Leaders

WEB Web Travel Group Ltd (+11.11%)

GDG Generation Dev Group Ltd (+6.39%)

XYZ Block, Inc (+4.78%)

WDS Woodside Energy (+3.99%)

MAF MA Financial Group Ltd (+3.79%)

Laggards

IPX Iperionx Ltd (-7.05%)

SLX SILEX Systems Ltd (-6.74%)

PDN Paladin Energy Ltd (-5.88%)

BOE Boss Energy Ltd (-4.36%)

EBO Ebos Group Ltd (-4.30%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!