What's Affecting Markets Today

Asia-Pacific Markets Retreat as U.S. Economic Concerns and Tariff Uncertainty Weigh

Asia-Pacific equities ended lower on Friday amid mounting concerns over a slowing U.S. economy, persistent inflation pressures, and renewed legal uncertainty surrounding President Donald Trump’s “reciprocal” tariffs.

The U.S. Court of International Trade ruled Wednesday that Trump had exceeded his authority in imposing the tariffs, ordering them vacated. However, the administration swiftly appealed the decision, and an appellate court reinstated the levies Thursday afternoon. Officials indicated a potential Supreme Court filing as early as Friday.

In Japan, the Nikkei 225 shed 1.37% and the broader Topix fell 0.52% as investors digested April’s inflation data. Tokyo’s core CPI, which excludes fresh food, rose 3.6% year-on-year—the fastest pace since January 2023.

South Korea’s Kospi dropped 0.72%, while the Kosdaq slipped 0.12% in volatile trading. Mainland China’s CSI 300 declined 0.33%, and Hong Kong’s Hang Seng Index led regional losses, down 1.48%.

India’s Nifty 50 opened flat, with the BSE Sensex edging 0.24% lower. In Australia, the S&P/ASX 200 traded unchanged amid cautious investor sentiment.

ASX Stocks

ASX 200 8,419.10 (+0.11%)

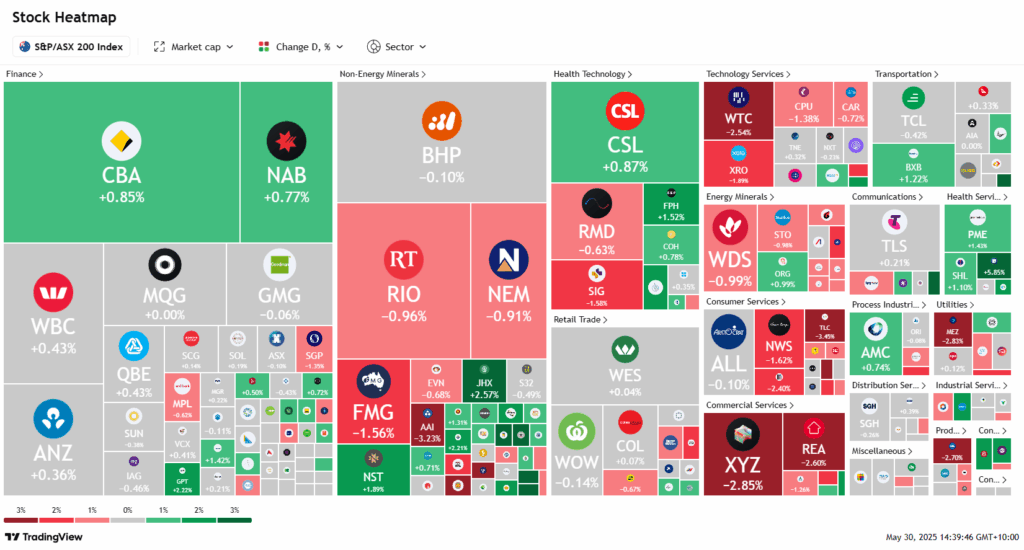

ASX Set for Second Monthly Gain Despite Tech Drag; WiseTech Falls

The Australian sharemarket is on track for a second consecutive monthly gain, supported by easing global trade tensions following a US court ruling against President Trump’s tariffs. By 2pm, the S&P/ASX 200 had dipped 0.1% to 8405.4, though the index remains up 3.4% for April. The All Ordinaries also fell 0.1%, heading for its eighth straight weekly advance.

Wall Street closed slightly higher despite volatility after a federal court ruled Trump’s tariffs unlawful, only for the administration to win leave to reinstate them. Oil and iron ore prices declined, though iron ore remains on pace for its first monthly rise since January.

Technology led local sector declines, with WiseTech down 2.6% and Xero falling 1.9%. Energy stocks were weaker as oil prices slid, with Woodside and Santos both down 1.3%. Lithium stocks sold off after a UBS downgrade, with Pilbara Minerals dropping 4.6%.

Among movers, HealthCo REIT jumped 9.3% on positive rent deferral news, while NRW Holdings rose 1.4% after securing a $157m Rio Tinto contract. Findi plunged 8.9% despite reporting a 54% profit increase.

Leaders

CAT Catapult Group International Ltd (+10.27%)

SLX SILEX Systems Ltd (+5.64%)

VGL Vista Group International Ltd (+5.59%)

IPX Iperionx Ltd (+5.31%)

RHC Ramsay Health Care Ltd (+5.28%)

Laggards

PLS Pilbara Minerals Ltd (−4.94%)

JDO Judo Capital Holdings Ltd (−4.07%)

IGO IGO Ltd (−4.02%)

VUL Vulcan Energy Resources Ltd (−3.75%)

DYL Deep Yellow Ltd (−3.72%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!