What's Affecting Markets Today

Asia-Pacific Markets Mixed as Trump Doubles Down on Steel Tariffs

Asia-Pacific markets opened mixed on Monday after U.S. President Donald Trump announced a steep increase in tariffs on steel imports. Speaking to U.S. steelworkers late Friday, Trump said the current 25% tariff would rise to 50%, effective June 4, in a bid to further support domestic steel producers.

Japan’s Nikkei 225 fell 0.89% and the Topix dropped 0.65% at the open. Hong Kong’s Hang Seng index declined 1.66%. South Korea’s Kospi edged up 0.16%, while the Kosdaq was flat. Australia’s S&P/ASX 200 opened flat. Markets in China, Malaysia, and New Zealand remained closed for public holidays.

The tariff hike announcement, confirmed on Trump’s Truth Social account, has added fresh uncertainty to global trade dynamics and weighed on investor sentiment at the start of a new trading month.

U.S. stock futures declined in early trade, with S&P 500 and Nasdaq-100 futures both down 0.3%. Dow Jones futures slipped 108 points. On Friday, the S&P 500 closed nearly flat, while the Nasdaq dipped 0.32% and the Dow added 0.13%.

ASX Stocks

ASX 200 8,411.8 (-0.25%)

ASX Dips as Trade Tensions Resurface; Alcoa and South32 Decline

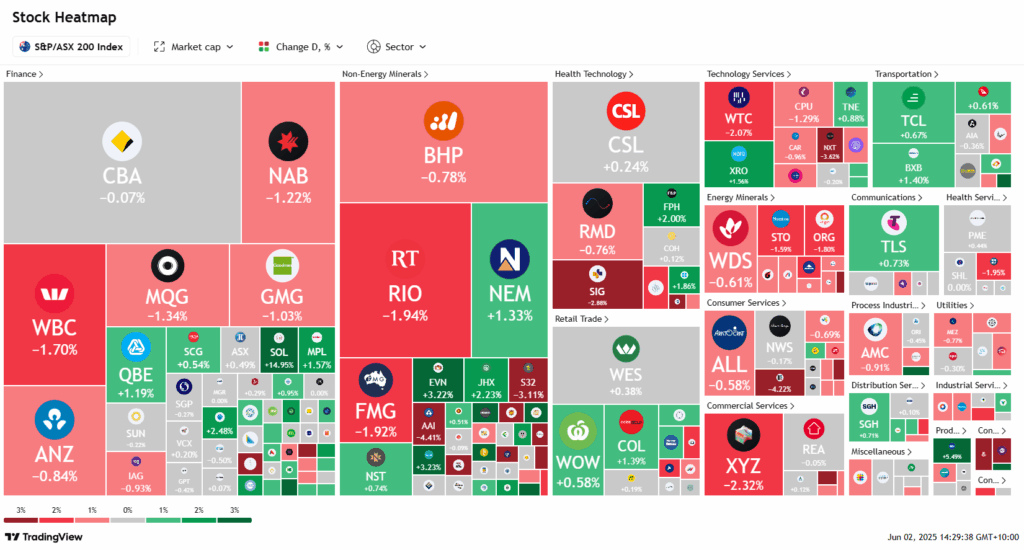

The Australian sharemarket edged lower on Monday amid renewed global trade tensions following US President Donald Trump’s decision to double steel and aluminium tariffs. The S&P/ASX 200 fell 0.3% to 8406.4 by 2pm, with eight of 11 sectors in the red, led by declines in energy and utilities.

President Trump escalated his trade war by lifting tariffs on key metals to 50%, just hours after accusing China of breaching trade agreements. The announcement triggered a reversal on Wall Street, which flowed through to the local market. Major banks declined, with Westpac down 1.8% and NAB off 1.2%.

Aluminium-related stocks were hit, with Alcoa falling 4.5% and South32 3.1%. Iron ore miners also retreated on fears of reduced demand, as Rio Tinto slipped 1.9%.

BlueScope Steel gained 5.1%, expected to benefit from US tariff hikes. Soul Patts and Brickworks soared 14.2% and 23.8% respectively after unveiling a $14 billion merger. James Hardie rose 2.3% after securing $3.5 billion in debt financing. Perenti advanced 3.9% on a $1.1 billion mining contract.

Leaders

BKW Brickworks Ltd (+23.96%)

SOL Washington H Soul (+14.14%)

BSL Bluescope Steel Ltd (+5.58%)

OBM Ora Banda Mining Ltd (+4.80%)

ORA Orora Ltd (+4.55%)

Laggards

MIN Mineral Resources Ltd (-8.20%)

IPX Iperionx Ltd (-6.78%)

LTR Liontown Resources Ltd (-6.61%)

PLS Pilbara Minerals Ltd (-5.44%)

A2M The a2 Milk Company Ltd (-5.10%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!