What's Affecting Markets Today

Asia-Pacific Markets Rise Despite Trade Tensions; ASX Nears 4-Month High

Asia-Pacific equities mostly advanced on Tuesday, tracking Wall Street’s gains despite escalating global trade tensions. The S&P/ASX 200 rose 0.42%, briefly touching a near four-month high before paring gains. Australia’s Q1 current account deficit came in at A$14.7 billion, wider than the A$13.1 billion forecast but narrower than the prior quarter’s revised A$16.3 billion shortfall.

Japan’s Nikkei 225 edged up 0.2%, while the broader Topix dipped 0.12% amid volatile trading. Hong Kong’s Hang Seng Index jumped 1.55%, and China’s CSI 300 added 0.21%.

Tensions resurfaced as China rejected U.S. claims of breaching a temporary trade pact, blaming Washington for undermining the deal. Simultaneously, the European Union criticized President Trump’s proposed hike in steel tariffs to 50%, warning of potential countermeasures.

In economic data, China’s Caixin/S&P Global manufacturing PMI fell to 48.3 in May from 50.4 in April, missing forecasts and indicating contraction for the first time since September 2024. South Korean markets remained closed for polling day.

ASX Stocks

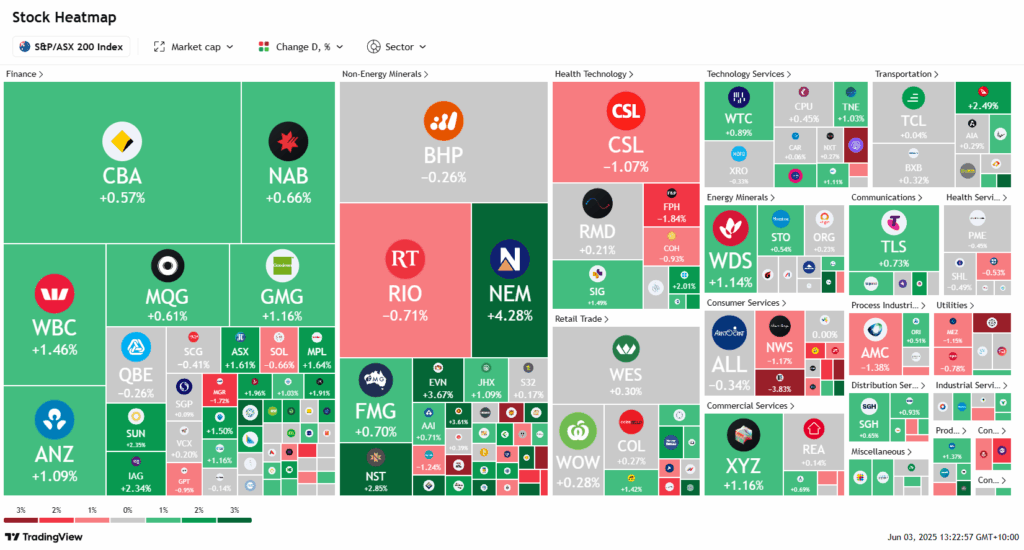

ASX 200 8,449.7 (+0.41%)

ASX Rises Amid Renewed Trade Talk Hopes; Newmont Gains 3.7%

The Australian sharemarket advanced on Tuesday, tracking overnight gains on Wall Street as hopes resurfaced for renewed trade negotiations between the US and China. The S&P/ASX 200 rose 0.5% to 8451.7 by midday, with nine of 11 sectors in positive territory, led by financials. The All Ordinaries added 0.4%.

Investor sentiment lifted after the White House pushed for a call between Donald Trump and Xi Jinping, and the US Customs and Border Protection extended a tariff pause on Chinese goods to August. Earlier stagflation concerns had weighed on US markets, with weak manufacturing data and rising bond yields pushing the 30-year Treasury above 5%.

Gold hovered near US$3400 following a 2.8% jump, driving gains in local miners. Genesis Minerals surged 5.4% and Newmont climbed 3.7%. Iron ore stocks remained mixed.

Major banks rallied, with Westpac up 1% and ANZ 0.9%.

Notable movers included IDP Education, down 41.5% on a bleak FY25 outlook, and Tasmea, up 7.3% after declaring a special dividend. Domino’s and Meridian Energy both declined over operational updates.

Leaders

DRO – Droneshield Ltd (+8.59%)

CYL – Catalyst Metals Ltd (+7.46%)

GMD – Genesis Minerals Ltd (+6.51%)

SX2 – Southern Cross Gold (+6.06%)

KLS – Kelsian Group Ltd (+5.68%)

Laggards

IEL – IDP Education Ltd (-43.37%)

FCL – Fineos Corporation (-6.82%)

ELD – Elders Ltd (-4.83%)

VGL – Vista Group Int(-4.51%)

MIN – Mineral Resources Ltd (-4.49%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!