What's Affecting Markets Today

Asia-Pacific markets advanced on Wednesday, buoyed by a tech-led rally on Wall Street and strong gains in South Korea following a pivotal election result. Nvidia surged nearly 3%, briefly overtaking Microsoft as the world’s most valuable company. Chipmakers Broadcom and Micron rose 3% and 4%, respectively.

South Korea’s Kospi jumped 2.43% to an 11-month high after opposition leader Lee Jae-myung secured the presidency. His proposed commercial law reforms aim to protect minority shareholders and encourage more value-accretive corporate governance, according to J.P. Morgan. The Kosdaq added 1.39%.

J.P. Morgan expects Lee’s administration to implement aggressive fiscal stimulus and adopt a pragmatic approach to trade, supporting a domestic rebound in late 2024 and early 2025, particularly in AI-related high bandwidth memory (HBM), health and beauty, and heavy industry.

Japan’s Nikkei 225 gained 0.82%, while China’s CSI 300 and Hong Kong’s Hang Seng rose 0.52% and 0.72%, respectively. Australia’s ASX 200 rose 0.77%, despite GDP growth of 1.3% year-on-year, missing expectations. India’s Nifty 50 and Sensex posted modest gains of 0.15% and 0.11%.

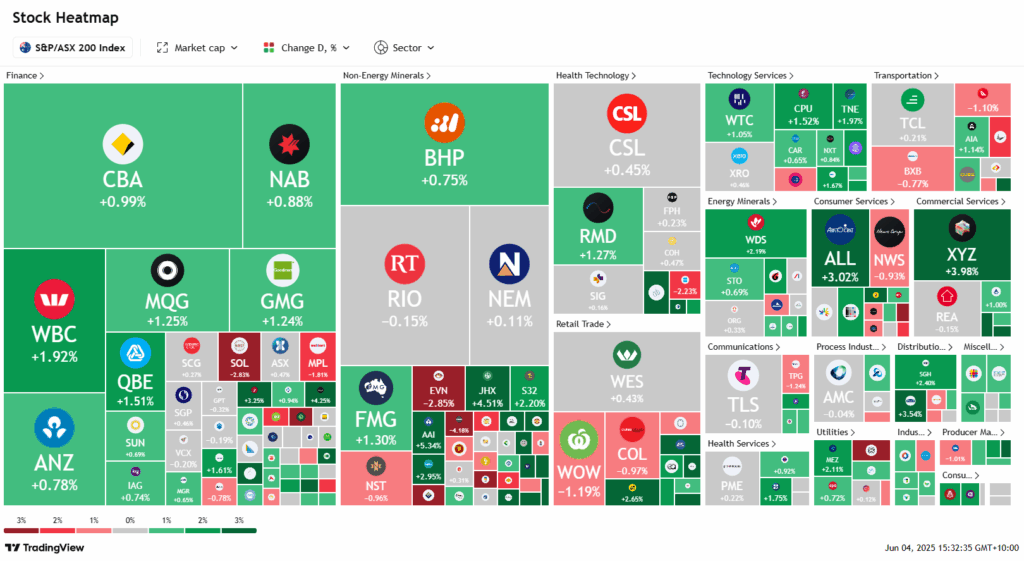

ASX Stocks

ASX 200 8,532.5 (+0.78%)

The Australian sharemarket advanced on Wednesday, lifted by positive cues from Wall Street and a milestone valuation for Commonwealth Bank. The S&P/ASX 200 rose 0.9% to 8538.5 by 2pm, placing it within 20 points of its record high. The All Ordinaries also climbed 0.9%.

A stronger-than-expected US jobs report supported sentiment after job openings rose to 7.4 million in April, defying forecasts of a decline. This boosted the S&P 500, which now sits just 2.8% below its record.

Commonwealth Bank gained 1.2%, surpassing $181 per share and $300 billion in market value. Other major banks followed, with Westpac up 1.9% despite legal action by ASIC against its RAMS unit.

Mining stocks advanced as iron ore rose 1%, lifting BHP and Fortescue by 1% and 1.8% respectively. Energy led sector gains, with Woodside rallying 2.5% as Brent crude climbed.

Uranium stocks surged after Meta backed nuclear power for AI data centres—Paladin rose 7.9%, Deep Yellow 4.3%. Mayne Pharma fell 9.1% after Cosette withdrew its $672m bid. PointsBet surged 10.6% following a higher offer from Japan’s Mixi.

Leaders

ZIP ZIP Co Ltd (+13.63%)

DRO Droneshield Ltd (+12.68%)

MIN Mineral Resources Ltd (+9.08%)

PDN Paladin Energy Ltd (+8.97%)

SLX SILEX Systems Ltd (+8.92%)

Laggards

RDX Redox Ltd (-8.49%)

BKW Brickworks Ltd (-5.53%)

MCY Mercury NZ Ltd (-5.00%)

NUF Nufarm Ltd (-4.44%)

SOL Soul Patts (-4.08%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!