What's Affecting Markets Today

Asia-Pacific markets mostly advanced on Friday as investors responded to a positive phone call between U.S. President Donald Trump and Chinese President Xi Jinping. The two leaders agreed that trade negotiators from both countries would meet soon to resume efforts to resolve the ongoing trade dispute.

Trump described the 90-minute call as “very good,” stating it focused “almost entirely” on trade and ended with a “very positive conclusion for both countries,” according to a post on Truth Social.

Japan’s Nikkei 225 rose 0.31% and the Topix gained 0.4%. South Korea’s Kospi surged 1.49%, with the Kosdaq up 0.8%. Australia’s S&P/ASX 200 edged 0.16% higher. However, Hong Kong’s Hang Seng Index slipped 0.18% at the open, while China’s CSI 300 remained flat.

Commonwealth Bank chief economist Luke Yeaman noted the call reflects a mutual economic “pain threshold” and removes some downside risk. However, he warned that tensions will remain elevated, with further flare-ups likely. Over the longer term, both nations are expected to continue pursuing economic self-reliance.

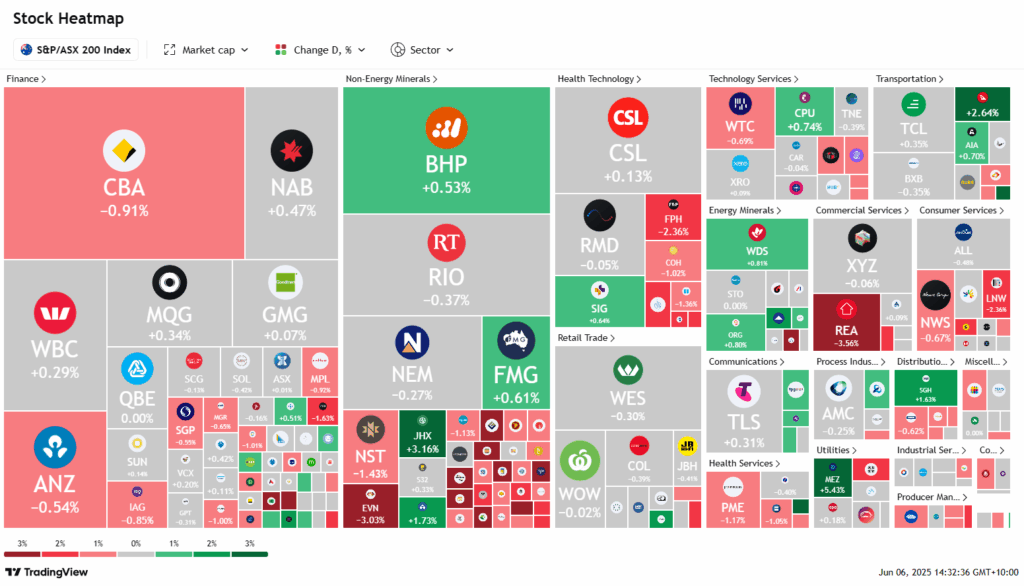

ASX Stocks

ASX 200 8,520.8 (-0.21%)

The Australian sharemarket dipped slightly on Friday, mirroring Wall Street’s cautious tone ahead of key US jobs data. The S&P/ASX 200 slipped 0.1% to 8529 points by early afternoon, with seven of eleven sectors in decline, though the index remains within reach of a new record high. The All Ordinaries fell 0.2%.

US markets closed lower ahead of May’s non-farm payrolls report, with the S&P 500 down 0.3%. Analysts expect jobs growth to slow to 126,000, while unemployment holds steady.

Locally, profit-taking weighed on tech and bank stocks, with Commonwealth Bank falling 0.9%. In contrast, energy and miners rose as renewed US-China trade talks supported commodity demand. BHP and Fortescue gained over 1%, and Woodside rose 0.9%. Iron ore rose 1.2% to US$96 a tonne.

Critical minerals stocks fell on easing Chinese export fears—Pilbara Minerals and IGO dropped over 4%. Bitcoin declined over 3%, nearing $100,000.

Ora Banda fell 9.2% on production concerns, while Qantas gained 2.3%. Whitehaven rose 3% on a Morgan Stanley upgrade. EBR Systems added 3.6% following a successful US product launch.

Leaders

ZIM – Zimplats Holdings Ltd (+12.50%)

SNZ – Summerset Group Holdings Ltd (+5.96%)

BGP – Briscoe Group Australasia Ltd (+5.18%)

MEZ – Meridian Energy Ltd (+4.85%)

JHX – James Hardie Industries Plc (+3.45%)

Laggards

OBM – Ora Banda Mining Ltd (-10.94%)

IPX – Iperionx Ltd (-7.32%)

RDX – REDOX Ltd (-6.39%)

WAF – West African Resources Ltd (-6.30%)

PLS – Pilbara Minerals Ltd (-5.74%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!