What's Affecting Markets Today

Asia-Pacific Markets Advance on U.S.-China Trade Progress

Asia-Pacific equity markets climbed Wednesday as U.S.-China trade talks yielded a framework agreement, pending final approval from both nations’ leaders. The breakthrough was confirmed by U.S. Commerce Secretary Howard Lutnick and China’s Vice Minister for Commerce, Li Chenggang, following a second day of negotiations in London.

“We have reached a framework to implement the Geneva consensus and the call between the two presidents,” Lutnick stated. While U.S. Treasury Secretary Scott Bessent departed the talks, Lutnick and Trade Representative Jamieson Greer remained to finalize details, with discussions potentially continuing into Wednesday.

Mainland China’s CSI 300 gained 0.77%, while Hong Kong’s Hang Seng Index rose 0.9%. In Japan, the Nikkei 225 advanced 0.45%, though the broader Topix was flat. South Korea’s Kospi rose 0.71%, nearing a 42-month high, and the Kosdaq surged 1.71%.

Australia’s ASX 200 rose 0.29%, briefly touching a new intraday record. India’s Nifty 50 edged up 0.11% at the open. Markets responded positively to signs of easing geopolitical tension and progress on trade stability.

ASX Stocks

ASX 200 8,592.1 (+0.05%)

ASX Hits Record as China-U.S. Trade Talks Progress; Monash IVF Rebounds

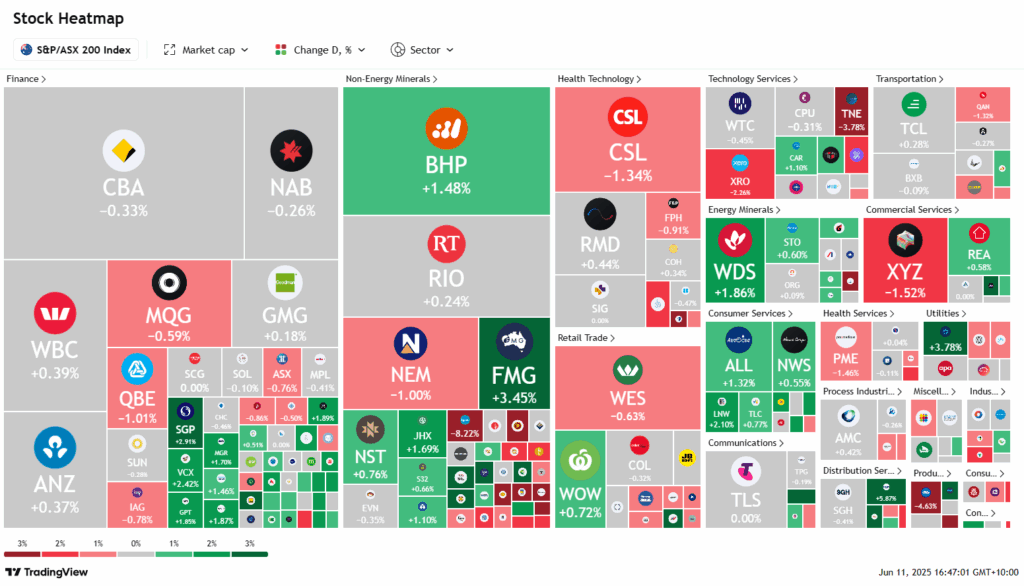

The ASX 200 closed at a record high of 8592.1 on Wednesday, rising 0.1% after reaching an intraday peak of 8639.1. Gains were driven by optimism over China-U.S. trade negotiations, with U.S. Commerce Secretary Howard Lutnick citing productive talks and a new framework agreement emerging post-trade.

Energy and mining stocks led the rally—Woodside Energy gained 1.9% to $23.50, and BHP added 1.5% to $39.10 as iron ore prices ticked up. ANZ and Westpac posted modest gains, while Commonwealth Bank slipped 0.3% after hitting a fresh high of $181.40.

Atlas Funds CIO Hugh Dive noted increased U.S. institutional interest in Australian blue chips like CBA has propelled valuations to elevated levels, sparking concerns over stretched P/E ratios.

Monash IVF rebounded 11% after Tuesday’s 28% drop linked to a laboratory error. Johns Lyng Group surged 17.7% on a non-binding offer from Pacific Equity Partners. Zip Co jumped 15.5% on upgraded earnings guidance, while Fletcher Building rose 10% amid M&A interest. Qantas fell 1.3% after announcing Jetstar Asia’s closure.

Leaders

ZIP ZIP Co Ltd (+15.45%)

FBU Fletcher Building Ltd (+10.00%)

LTR Liontown Resources Ltd (+8.33%)

RIC Ridley Corporation Ltd (+6.72%)

REH Reece Ltd (+5.87%)

Laggards

LYC Lynas Rare Earths Ltd (-8.22%)

BPT Beach Energy Ltd (-7.49%)

PDI Predictive Discovery Ltd (-7.41%)

SLX Silex Systems Ltd (-7.20%)

CU6 Clarity Pharmaceuticals Ltd (-6.70%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!