What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Digest Trump’s China Trade Comments

Asia-Pacific markets traded mixed as investors weighed U.S. President Donald Trump’s assertion that a trade deal with China was “done,” pending final approval. Trump claimed the agreement includes a 55% tariff rate on Chinese imports, a figure later confirmed by Commerce Secretary Howard Lutnick.

Japan’s Nikkei 225 slipped 0.58%, while the broader Topix lost 0.24%. Hong Kong’s Hang Seng Index declined 0.51%, and mainland China’s CSI 300 was flat. Australia’s S&P/ASX 200 also traded flat. In contrast, South Korea’s Kospi gained 0.83%, with the Kosdaq up 0.79%. India’s Nifty 50 rose 0.11% at the open.

U.S. stock futures edged lower, with S&P 500 and Nasdaq 100 futures down 0.2%, while Dow Jones futures slipped 72 points. The moves followed softer-than-expected U.S. inflation data for May. Headline CPI rose 0.1%, below the 0.2% forecast, while core CPI also missed expectations.

Overnight, U.S. equities closed marginally lower as markets paused following a strong run, with investors awaiting clarity on the trade framework.

ASX Stocks

ASX 200 8,592.7 (+0.05%)

Energy Stocks Lift ASX Despite Global Headwinds; Cettire Plunges

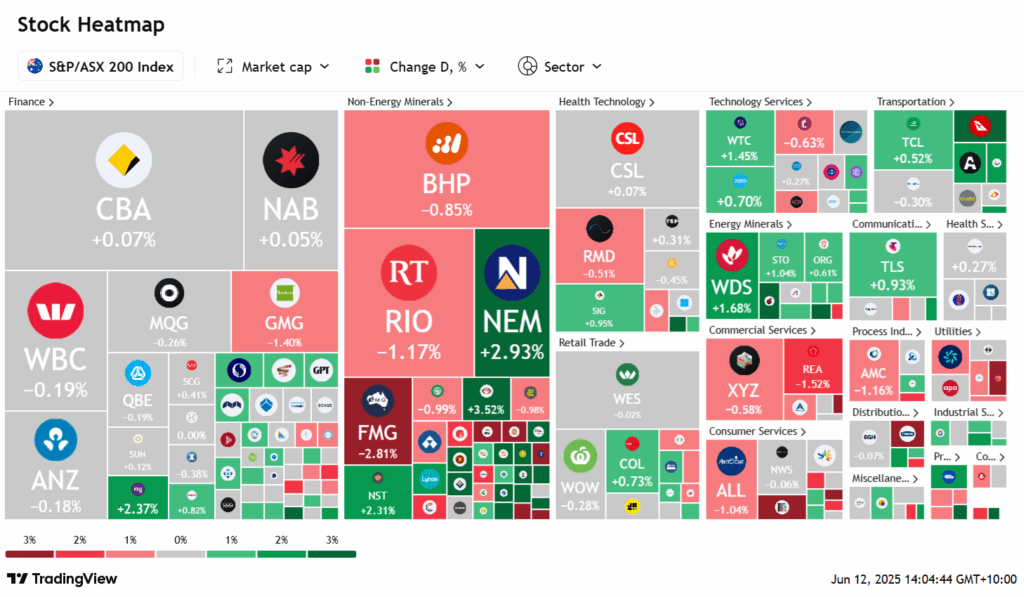

The ASX edged higher by midday, with the S&P/ASX 200 up 21 points, or 0.2%, at 8613.1, supported by a rally in energy stocks following a sharp 5% rise in oil prices. Global sentiment was dampened by a sell-off in US tech giants and rising US-Iran tensions, while the S&P 500 closed 0.3% lower overnight.

Woodside Energy rose over 2%, and Santos added 1.6%, helping offset declines in iron ore majors. Rio Tinto and Fortescue Metals fell 1.2% and 2.8%, respectively, tracking weaker commodity prices. Gold miners gained as bullion climbed nearly 1%, with Northern Star up 2.2% and Newmont up 3.3%.

Cettire plunged 30% after CEO Dean Mintz flagged weaker US demand, despite a modest 1.7% revenue rise to $693.8 million. Monash IVF surged 5.8% following CEO Michael Knaap’s resignation after a second embryo incident. Cochlear slipped 0.2% after cutting earnings guidance, citing slower sales growth. Myer eased 0.7% as board member Jacquie Naylor announced her retirement.

Leaders

DRO Droneshield Ltd (+7.48%)

PDI Predictive Discovery Ltd (+7.33%)

SX2 Southern Cross Gold Consolidated Ltd (+6.66%)

SLX SILEX Systems Ltd (+6.57%)

WAF West African Resources Ltd (+6.50%)

Laggards

MIN Mineral Resources Ltd (-5.83%)

VUL Vulcan Energy Resources Ltd (-4.84%)

CIA Champion Iron Ltd (-4.45%)

WA1 WA1 Resources Ltd (-4.25%)

IPX Iperionx Ltd (-4.00%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!