What's Affecting Markets Today

Asia-Pacific Markets Retreat Amid Escalating Middle East Tensions

Asia-Pacific equities declined on Friday following Israeli airstrikes on Iran’s nuclear facilities, prompting warnings of imminent retaliation from Tehran. Japan’s Nikkei 225 shed 1.12%, while the Topix fell 0.96%. South Korea’s Kospi dropped 0.98% and the tech-heavy Kosdaq plunged 2.91%. Australia’s S&P/ASX 200 lost 0.23%.

In China, Hong Kong’s Hang Seng and the mainland CSI 300 each fell 0.72%. India’s Nifty 50 slipped 1.01%, while the BSE Sensex declined 1.42%.

Israeli Defense Minister Israel Katz declared a “special situation,” warning of an imminent missile and drone attack in response to Israel’s pre-emptive strikes. U.S. officials confirmed the attacks but said the U.S. was not involved.

Oil prices spiked on the news, with WTI surging 10.21% to $74.99 per barrel and Brent rising 10.28% to $76.48. MST Marquee’s Saul Kavonic said the market had underestimated geopolitical risks, though the attacks may ultimately pressure negotiations and de-escalate.

Meanwhile, U.S. PPI data came in softer than expected, lifting investor sentiment and easing bond yields.

ASX Stocks

ASX 200 8,529.4 (-0.42%)

ASX Slips as Middle East Tensions Drive Oil and Gold Rally

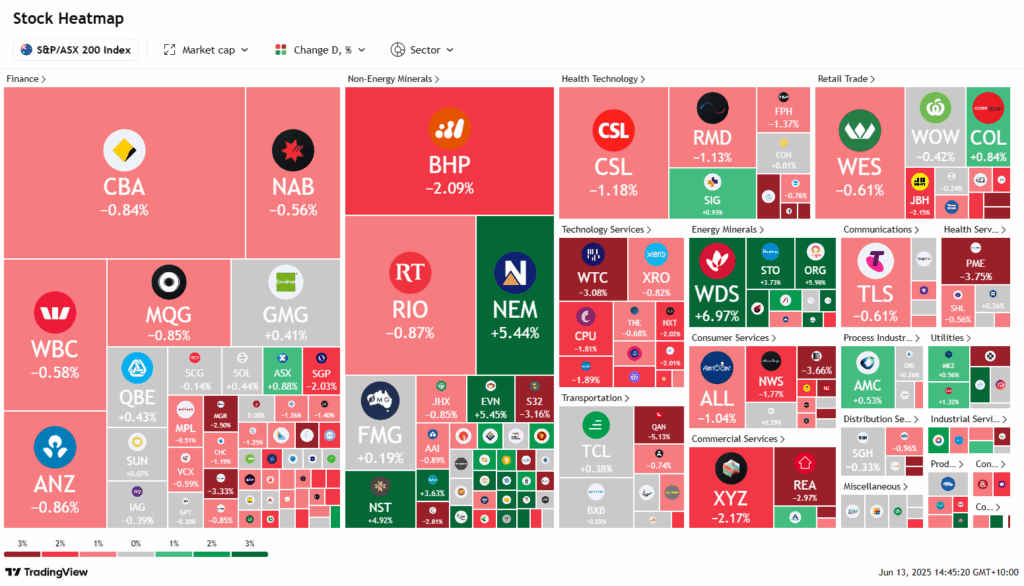

Australian shares edged lower on Friday despite strength in energy and gold stocks, following Israeli air strikes on Iran that rattled investor sentiment. The S&P/ASX 200 fell 14.9 points, or 0.2%, to 8550.2 by 2pm AEST, with seven of 11 sectors in decline.

IG market analyst Tony Sycamore said the timing of the Israeli strikes was significant, coinciding with macro funds rebuilding long positions. “Risk sentiment is deteriorating ahead of the weekend as traders unwind exposure in anticipation of further escalation,” he noted.

WTI crude surged 6.2% after US President Donald Trump warned of a “massive conflict” risk. Gold miners also rallied, with Evolution up 5.5%, Newmont 5.4%, and Genesis 2%.

Energy stocks led the ASX, with Woodside up 7.6%, Santos 4.2%, and Origin 7.2%. However, major banks lagged, with CBA down 0.5% and NAB off 0.3%.

Among laggards, Cettire plunged 20.3% following a second profit downgrade. Accent Group dived 23% on weak retail sales. Qantas fell 4.9%, and Dalrymple Bay lost 5.6% after Brookfield sold down its stake.

Leaders

KAR Karoon Energy Ltd (+11.03%)

WDS Woodside Energy Group Ltd (+7.39%)

CMM Capricorn Metals Ltd (+6.75%)

ORG Origin Energy Ltd (+6.08%)

EMR Emerald Resources NL (+5.63%)

Laggards

AX1 Accent Group Ltd (-23.27%)

SLX SILEX Systems Ltd (-10.42%)

PNV Polynovo Ltd (-7.71%)

NEU Neuren Pharmaceuticals Ltd (-6.98%)

CCP Credit Corp Group Ltd (-6.33%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!