What's Affecting Markets Today

ASX edges higher as oil surges; Santos soars on takeover bid; Chinese retail jumps

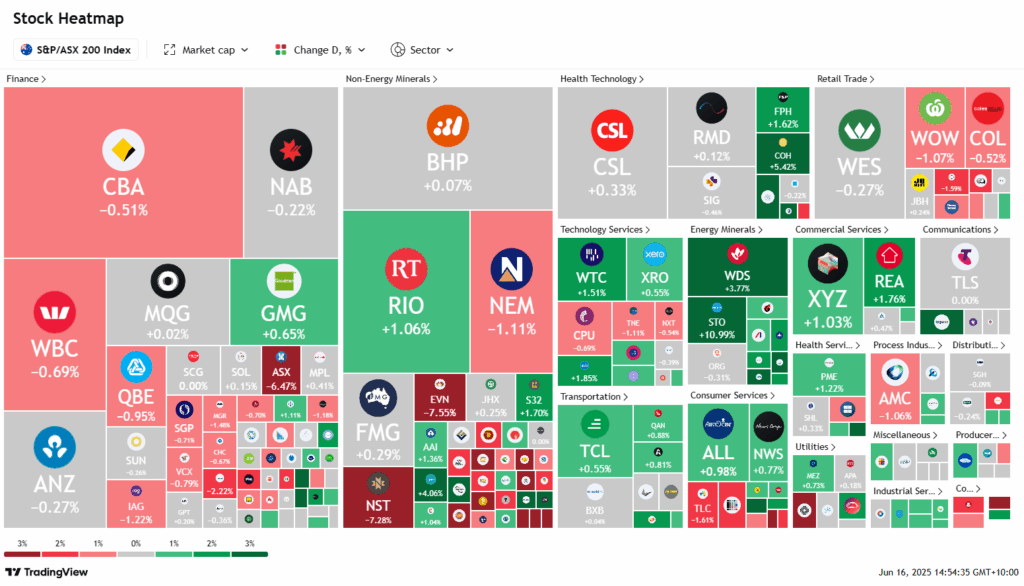

Australian shares edged up on Monday, with energy stocks driving gains after a surge in oil prices and a $30 billion takeover bid for Santos. The S&P/ASX 200 rose 0.03% to 8549.7 points by 2:03pm AEST.

Santos rallied 10.8% after confirming a $US5.761-per-share bid from a consortium led by Abu Dhabi’s ADNOC and Carlyle Group. Energy stocks climbed 5.7% overall, with Woodside up 3.8% and Ampol gaining 1.4%.

Oil jumped as much as 14% following Israeli strikes on Iranian energy assets, before settling 7.5% higher at $US73 a barrel. Rising tensions in the Middle East, including the potential closure of the Strait of Hormuz, have rattled markets.

Chinese retail sales rose 6.4% in May, beating expectations, although steel output declined as Beijing curbs production.

Gold miners were mixed. Newmont and Genesis advanced, while Evolution and Northern Star fell over 6% after UBS downgrades.

ASX Ltd dropped 5.9% amid a fresh ASIC inquiry. Tourism Holdings soared 57.5% on a $471m buyout offer. Major banks were mostly weaker.

ASX Stocks

ASX 200 8,547.3 (-0.01%)

ASX edges higher as oil surges; Santos soars on takeover bid; Chinese retail jumps

Australian shares edged up on Monday, with energy stocks driving gains after a surge in oil prices and a $30 billion takeover bid for Santos. The S&P/ASX 200 rose 0.03% to 8549.7 points by 2:03pm AEST.

Santos rallied 10.8% after confirming a $US5.761-per-share bid from a consortium led by Abu Dhabi’s ADNOC and Carlyle Group. Energy stocks climbed 5.7% overall, with Woodside up 3.8% and Ampol gaining 1.4%.

Oil jumped as much as 14% following Israeli strikes on Iranian energy assets, before settling 7.5% higher at $US73 a barrel. Rising tensions in the Middle East, including the potential closure of the Strait of Hormuz, have rattled markets.

Chinese retail sales rose 6.4% in May, beating expectations, although steel output declined as Beijing curbs production.

Gold miners were mixed. Newmont and Genesis advanced, while Evolution and Northern Star fell over 6% after UBS downgrades.

ASX Ltd dropped 5.9% amid a fresh ASIC inquiry. Tourism Holdings soared 57.5% on a $471m buyout offer. Major banks were mostly weaker.

Leaders

SLX SILEX Systems Ltd (+24.07%)

DYL Deep Yellow Ltd (+19.31%)

PDN Paladin Energy Ltd (+15.32%)

IPX Iperionx Ltd (+14.81%)

BOE Boss Energy Ltd (+14.67%)

Laggards

CYL Catalyst Metals Ltd (-9.39%)

NST Northern Star Resources Ltd (-7.21%)

EVN Evolution Mining Ltd (-6.79%)

RMS Ramelius Resources Ltd (-6.49%)

OBM Ora Banda Mining Ltd (-5.74%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!