What's Affecting Markets Today

Asia-Pacific Markets Fall as Middle East Escalation Spurs Oil Spike, Investor Caution

Asia-Pacific equities declined on Monday as heightened geopolitical tensions in the Middle East weighed on investor sentiment. The downturn followed U.S. airstrikes on three nuclear sites in Iran, triggering fears of broader conflict and pushing oil prices higher.

Brent crude rose 1.95% to US$78.51 per barrel by 12:06 p.m. Singapore time, while West Texas Intermediate climbed 2.06% to US$75.36.

Japan’s Nikkei 225 slipped 0.32%, with the broader Topix down 0.43%. In South Korea, the Kospi fell 0.41% and the Kosdaq plunged 1.42%, reflecting increased risk aversion in smaller-cap stocks.

Chinese markets were also lower. The Hang Seng Index dipped 0.13% in early trade, and the CSI 300 fell 0.2% amid cautious trading. Australia’s S&P/ASX 200 dropped 0.43% in line with regional weakness.

Indian equities saw steeper losses, with the Nifty 50 falling 0.9% and the BSE Sensex retreating 0.74%, as investors assessed the broader implications of rising oil prices and geopolitical instability for inflation and regional growth prospects.

ASX Stocks

ASX 200 8,467.6 (-0.45%)

ASX Hits 20-Day Low Amid Iran Conflict Escalation; Tech and Industrials Weigh

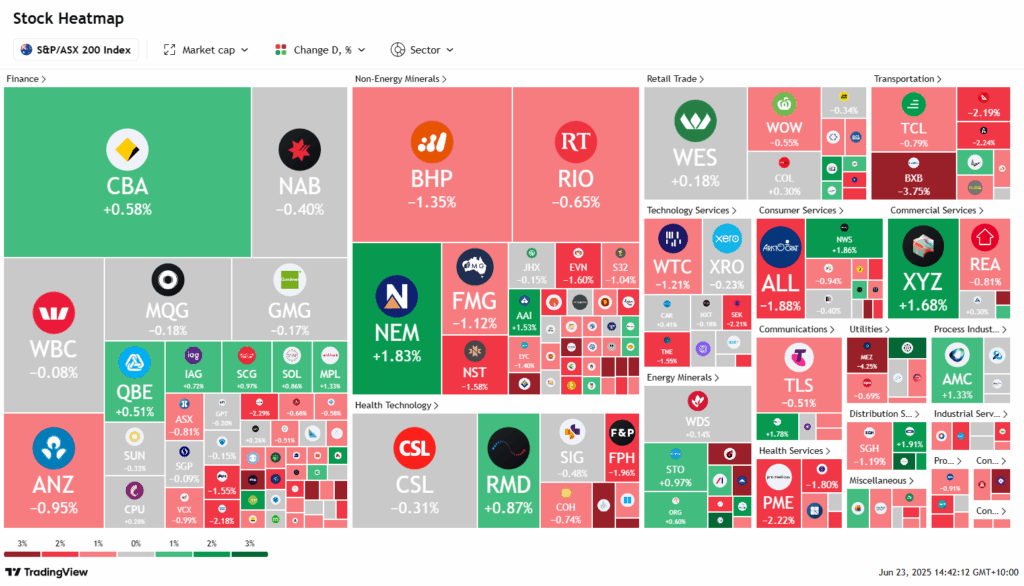

The ASX fell to a 20-day low on Monday as geopolitical tensions rattled markets following U.S. strikes on Iranian nuclear facilities. The S&P/ASX 200 Index dropped 36.5 points, or 0.4%, to 8469 by 2pm AEST, with nine of 11 sectors in decline. Technology, healthcare, and industrials led losses, while energy stocks gained on surging oil prices.

The Australian dollar weakened to US64.18¢, as investors assessed the risk of Iranian retaliation. Bond yields declined, with the 3-year yield down 2bps to 3.31% and the 10-year yield easing to 4.2%.

SPI Asset Management’s Stephen Innes noted the conflict had transitioned from a regional proxy war to a direct U.S.-led confrontation, heightening risks to energy markets and global sentiment.

Technology names like WiseTech and TechnologyOne fell over 1%, while Pro Medicus slid 2.5%. Energy stocks rose, with Santos up 1.2%, Ampol 0.9% higher, and Beach Energy gaining 2%. Gold prices climbed on safe-haven demand, lifting Newmont by 1.6%. Miners BHP and Fortescue both fell 1.3%, while Rio Tinto shed 0.7%.

Leaders

RSG – Resolute Mining Ltd (+5.88%)

VEA – Viva Energy Group Ltd (+4.11%)

MTS – Metcash Ltd (+3.11%)

MCY – Mercury NZ Ltd (+2.90%)

DBI – Dalrymple Bay (+2.57%)

Laggards

BLX – Beacon Lighting Group Ltd (-6.50%)

PNR – Pantoro Gold Ltd (-5.98%)

DGT – Digico Infrastructure REIT (-5.57%)

DRO – Droneshield Ltd (-5.24%)

OBM – Ora Banda Mining Ltd (-5.16%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!