What's Affecting Markets Today

Asia-Pacific Markets Rally on Ceasefire Optimism Despite Lack of Confirmation

Asia-Pacific equities advanced on Tuesday following an announcement by former U.S. President Donald Trump that Iran and Israel had agreed to a ceasefire. Trump stated on Truth Social that a “Complete and Total CEASEFIRE” had been agreed upon for 12 hours, after which the war would be “considered ended.” However, as of Tuesday afternoon, neither Iran nor Israel had publicly confirmed the ceasefire or its terms.

Despite the uncertainty, investor sentiment improved across the region. Japan’s Nikkei 225 gained 1.59%, and the broader Topix index rose 1.32%, buoyed by tech and industrial stocks. South Korea’s Kospi surged 2.09%, while the Kosdaq climbed 1.71%.

Australia’s S&P/ASX 200 advanced 0.69%, supported by strength in mining and banking stocks, although energy shares lagged due to falling oil prices.

Hong Kong’s Hang Seng Index rose 1.38%, led by gains in consumer and technology sectors. Meanwhile, mainland China’s CSI 300 was little changed, reflecting investor caution amid ongoing domestic economic concerns.

ASX Stocks

ASX 200 8,550.2 (+0.89%)

ASX Rallies on Ceasefire Hopes; Greatland Gold and Virgin Australia Shine on Debut

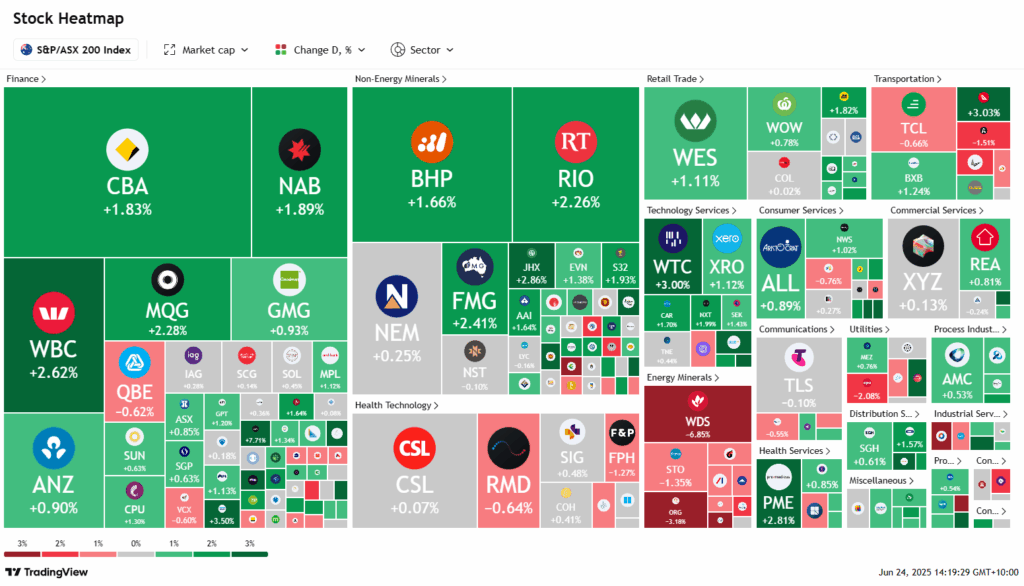

The ASX surged on Tuesday as easing geopolitical tensions and strong IPO performances boosted investor confidence. The S&P/ASX 200 rose 1% to 8556.2 by 2pm AEST, with nine of 11 sectors in the green. A tentative ceasefire between Iran and Israel, announced by former US President Donald Trump, helped spark a broad-based rally.

Mining, financials, and tech stocks led gains. BHP and CBA each advanced over 1.5%, with CBA hitting a record high. WiseTech and Pro Medicus climbed more than 3%.

Travel stocks gained as Virgin Australia jumped 7.5% to $3.12 on its ASX debut. Qantas rose 2.6%, buoyed by lower oil prices.

Greatland Gold also made a strong debut, up 7.9% to $7.46 from its $6.60 IPO price.

Collins Foods soared 18.5% despite a sharp drop in profit, as investors bet on a recovery.

However, the energy sector lagged, with crude falling below $US67. Woodside plunged 7.3%, and Santos and Ampol declined over 1.5% each.

Leaders

CKF – Collins Foods Ltd (+18.46%)

GQG – GQG Partners Inc (+7.46%)

LFG – Liberty Financial Group (+7.23%)

WA1 – WA1 Resources Ltd (+7.20%)

BVS – Bravura Solutions Ltd (+6.53%)

Laggards

KAR – Karoon Energy Ltd (-8.25%)

WDS – Woodside Energy Group Ltd (-7.43%)

DRO – Droneshield Ltd (-3.83%)

WOR – Worley Ltd (-3.44%)

FBU – Fletcher Building Ltd (-3.33%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!