What's Affecting Markets Today

Asia-Pacific markets were mostly lower on Thursday as investors monitored geopolitical developments, including the ongoing ceasefire between Israel and Iran.

Japan’s Nikkei 225 advanced 1.04%, while the broader Topix gained 0.32%, supported by continued momentum in heavyweight exporters. In contrast, South Korea’s Kospi fell 1.81% and the Kosdaq dropped 2%, with tech stocks leading the declines.

Australia’s S&P/ASX 200 edged down 0.21%, while Hong Kong’s Hang Seng Index slipped 0.72% and mainland China’s CSI 300 dipped 0.31% amid cautious sentiment across the region.

In Washington, U.S. Federal Reserve Chair Jerome Powell struck a measured tone during his second day of testimony to Congress, reiterating that while disinflation is underway, the central bank remains cautious. Powell acknowledged the potential for rate cuts if inflation proves transitory but refrained from offering a specific timeline, despite mounting political pressure from the White House.

Overnight on Wall Street, major U.S. indices ended mixed. The S&P 500 closed near flat at 6,092.16, the Nasdaq gained 0.31% to 19,973.55, while the Dow Jones slipped 0.25%, settling at 42,982.43.

ASX Stocks

ASX 200 8,552.3 (-0.08%)

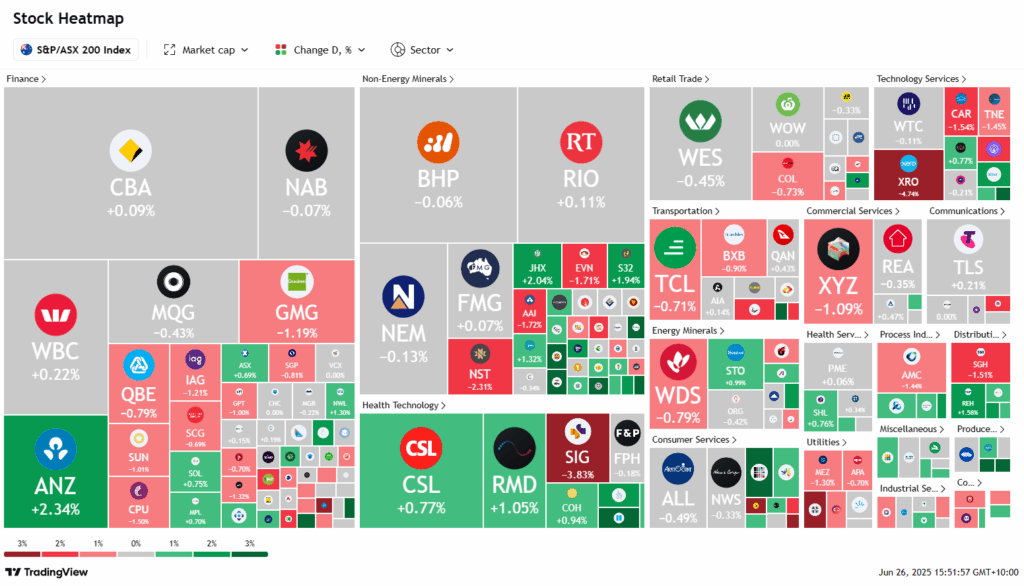

The ASX dipped slightly on Thursday, with the S&P/ASX 200 down 5 points, or 0.1%, to 8554.2 by 2pm AEST, as weakness in technology stocks offset gains elsewhere.

Xero fell nearly 5% after announcing a $3.9 billion acquisition of U.S. fintech Melio Payments, raising investor concerns over the size and strategic fit of the deal. Fellow tech names Life360 and TechnologyOne also lost ground, down 2.3% and 1.6% respectively.

Despite the pullback, sentiment remains upbeat following softer inflation data on Wednesday, which strengthened expectations for a July rate cut by the RBA. IG’s Tony Sycamore noted investor optimism that the recent correction in the ASX 200 is over, with the index potentially retesting its record high of 8639.

Among major banks, CBA traded flat at $191.53, while NAB and Westpac edged lower. ANZ gained 2% amid news of executive changes.

Neuren Pharmaceuticals surged over 10% after securing a U.S. patent for a rare disease treatment. DroneShield added 5.4%, building on Wednesday’s rally, while Humm Group rose 4.7% on continued takeover speculation.

Leaders

NEU – Neuren Pharmaceuticals Ltd (+7.66%)

PLS – Pilbara Minerals Ltd (+7.03%)

DRO – Droneshield Ltd (+7.01%)

WA1 – WA1 Resources Ltd (+6.52%)

ILU – Iluka Resources Ltd (+6.02%)

Laggards

XRO – Xero Ltd (-5.75%)

DGT – Digico Infrastructure REIT (-4.29%)

OBM – Ora Banda Mining Ltd (-4.22%)

SIG – Sigma Healthcare Ltd (-3.99%)

NCK – Nick Scali Ltd (-3.39%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!