What's Affecting Markets Today

Asia-Pacific markets mixed as investors weigh Wall Street rally and looming U.S. tariff decisions

Asia-Pacific equities traded mixed on Tuesday as investors digested record highs on Wall Street and monitored developments surrounding U.S. President Donald Trump’s tariff policies, with a 90-day reprieve set to expire next week.

U.S. Treasury Secretary Scott Bessent noted some countries were negotiating in good faith but warned tariffs could “spring back” to previously announced levels if talks stall.

China’s CSI 300 index was flat, with the Caixin/S&P Global manufacturing PMI for June beating expectations at 50.4 versus the 49 forecast by Reuters.

Japan’s Nikkei 225 slipped 1% after hitting an 11-month high in the prior session, while the broader Topix fell 0.8%. In South Korea, the Kospi advanced 1.41% and the Kosdaq rose 0.65%.

India’s Nifty 50 edged up 0.21%, while the BSE Sensex was little changed.

Hong Kong markets remained closed for a public holiday.

Investors continue to weigh the potential impact of renewed U.S. tariffs on global trade sentiment, with uncertainty clouding the near-term outlook across Asian markets.

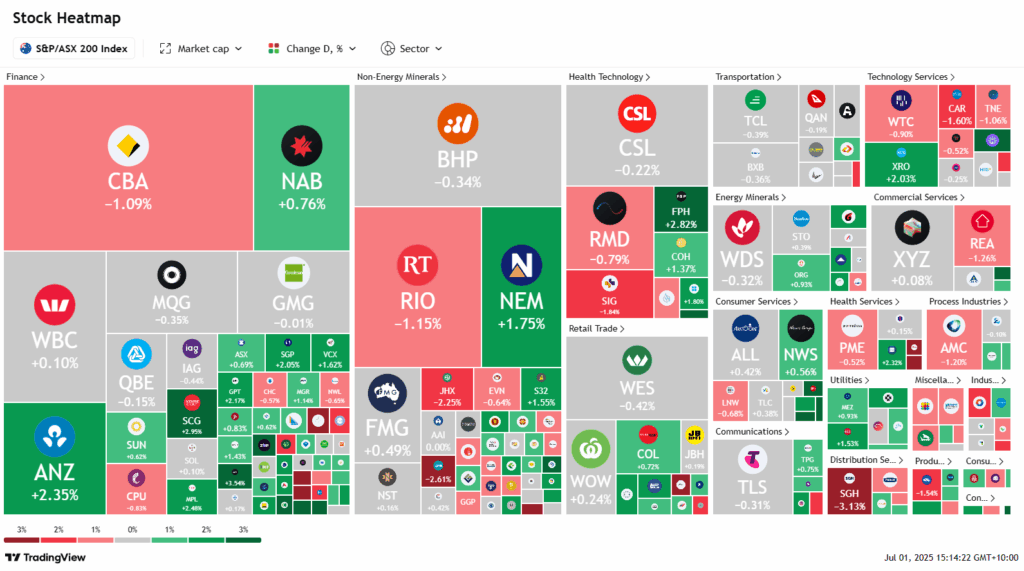

ASX Stocks

ASX 200 8,544.8 (+0.03%)

ASX edges higher as tech and real estate lift; SGH, HMC under pressure

The ASX rose modestly on Tuesday, buoyed by strength in tech, retail, and real estate sectors amid optimism over US trade negotiations. The S&P/ASX 200 gained 14.1 points, or 0.2%, to 8556.4 by midday, with eight of 11 sectors trading higher.

Technology stocks led gains, with Xero and Life360 up 2.2% and 3.8%, respectively. Retail names including Coles, Treasury Wine, Endeavour Group, and Harvey Norman all advanced around 1%. Real estate stocks surged on falling bond yields, with Stockland climbing 2.5% and Scentre up 3.4%.

CBA slipped 1% on profit-taking, though ANZ gained 2%, and NAB and Westpac edged higher.

Among key movers, Seven Group Holdings fell 2.8% after Boral CEO Vik Bansal announced his resignation. HMC Capital plunged over 14% as its energy transition head stepped down and a key acquisition was delayed.

Insignia Financial jumped 5.7% after CC Capital reaffirmed takeover interest. Biotech Tetratherix rose 8%, while Mesoblast surged 8.6% on FDA progress. Medibank rose 2.5% after a Morgan Stanley upgrade.

Leaders

DRO Droneshield Ltd (+9.21%)

IEL IDP Education Ltd (+8.17%)

MSB Mesoblast Ltd (+8.16%)

CU6 Clarity Pharmaceuticals Ltd (+7.60%)

DYL Deep Yellow Ltd (+5.69%)

Laggards

HMC HMC Capital Ltd (-15.49%)

IPX Iperionx Ltd (-5.37%)

BOE Boss Energy Ltd (-4.07%)

SNZ Summerset Group Holdings Ltd (-4.02%)

PPC Peet Ltd (-3.82%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!