What's Affecting Markets Today

Singapore stocks hit record high; Asia-Pacific markets mixed on Powell remarks

Singapore’s benchmark index reached an all-time high on Wednesday, defying mixed sentiment across the Asia-Pacific region as investors weighed U.S. Federal Reserve Chair Jerome Powell’s latest comments.

The Straits Times Index rose 0.4% to a record 4,005.39 points in morning trade, according to LSEG data. Gains came despite a lackluster regional backdrop and cautious global sentiment.

Powell told U.S. lawmakers on Tuesday that the Fed would likely have already begun cutting rates were it not for the inflationary pressures stemming from President Donald Trump’s tariff initiatives. His remarks reinforced expectations of a delayed easing cycle, injecting uncertainty into markets.

Elsewhere in Asia, Japan’s Nikkei 225 fell 1.32%, and the broader Topix shed 0.64% amid ongoing profit-taking. South Korea’s Kospi dipped 0.42%, while the Kosdaq traded flat.

Hong Kong’s Hang Seng Index gained 0.73%, helped by buying in tech and consumer sectors, while China’s CSI 300 was unchanged, reflecting continued caution over domestic growth momentum.

Australia’s S&P/ASX 200 edged up 0.49%, supported by mining and real estate stocks.

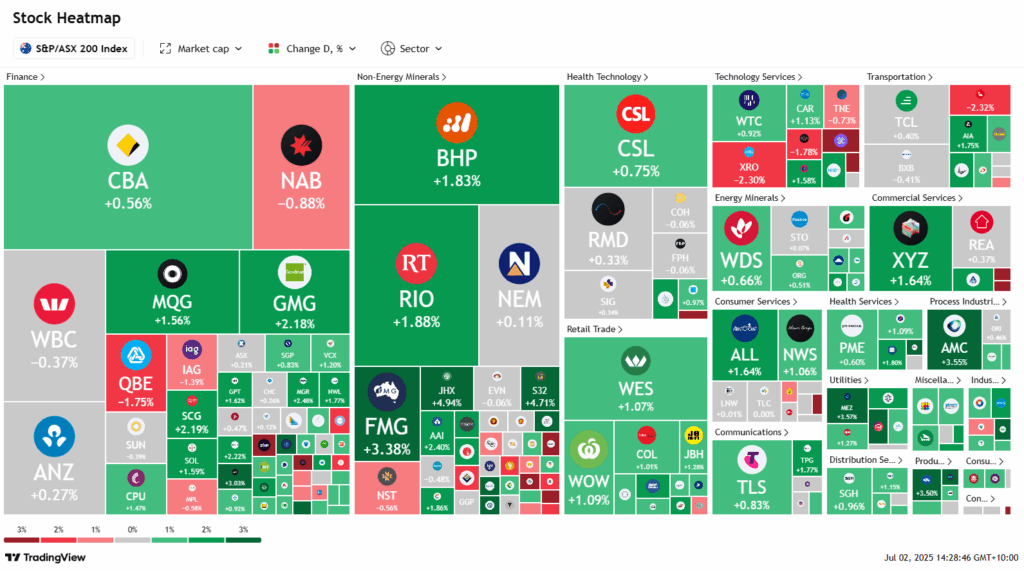

ASX Stocks

ASX 200 8,597.5 (+0.65%)

ASX rallies 0.6% as rate cut bets rise; Domino’s, Helia tumble on company news

The S&P/ASX 200 Index climbed 0.6% to 8588.8 on Wednesday afternoon, buoyed by weak domestic retail sales data that bolstered expectations of a July rate cut from the RBA. Nine of 11 sectors advanced, led by miners and real estate.

BHP and Rio Tinto rose 1.8% while Fortescue jumped 3.4% on improved Chinese manufacturing data and firmer commodity prices. Goodman Group and Scentre rallied more than 2% on falling rate expectations.

Domino’s Pizza shares plunged 26% after CEO Mark van Dyck announced he would step down in December, less than a year into the role. Helia dropped 23.5% after ING Bank joined CBA in shifting away from its LMI services, prompting a strategic business review.

Qantas fell 3.4% after disclosing a cyberattack affecting 6 million customers.

Among gainers, James Hardie rose 4.5% after completing its Azek acquisition, while Perpetual surged 9.2% on a UBS upgrade. Magellan added 6.2% on positive broker sentiment.

Technology stocks tracked US weakness, with Life360 down 3.8% and Xero off 2.6%.

Leaders

PPT – Perpetual Ltd (+8.86%)

MFG – Magellan Financial Group Ltd (+5.96%)

SNZ – Summerset Group Holdings Ltd (+5.79%)

JHX – James Hardie Industries Plc (+4.72%)

S32 – South32 Ltd (+4.55%)

Laggards

HLI – Helia Group Ltd (-22.08%)

DMP – Domino’s Pizza Enterprises Ltd (-17.13%)

MSB – Mesoblast Ltd (-8.70%)

ZIP – ZIP Co Ltd (-6.39%)

VGL – Vista Group International Ltd (-5.00%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!