What's Affecting Markets Today

Asia-Pacific Markets Mixed After Wall Street Rallies on Strong U.S. Jobs Data

Asia-Pacific markets traded mixed on Friday, as a strong U.S. jobs report eased recession concerns and lifted Wall Street to new highs. Japan’s Nikkei 225 rose 0.23% in volatile trade, while the broader Topix added 0.17%. In contrast, South Korea’s Kospi fell 1.09% and the Kosdaq declined 1.51%.

Mainland China’s CSI 300 dipped 0.11%, while Hong Kong’s Hang Seng Index dropped 1.43%, weighed down by continued weakness in tech and property names. Australia’s S&P/ASX 200 edged 0.21% higher, supported by gains in tech and consumer sectors.

Overnight in the U.S., markets rallied after job data came in stronger than expected, reducing fears of an economic slowdown. The Dow Jones Industrial Average climbed 344.11 points, or 0.77%, to 44,828.53. The S&P 500 rose 0.83% to a record 6,279.35, while the Nasdaq Composite gained 1.02% to 20,601.10, also marking a new high.

U.S. markets were closed Friday in observance of the Independence Day public holiday. Trading is set to resume Monday.

ASX Stocks

ASX 200 8,599.7 (+0.03%)

ASX Eyes Record Close Despite Pullback in Miners and CBA

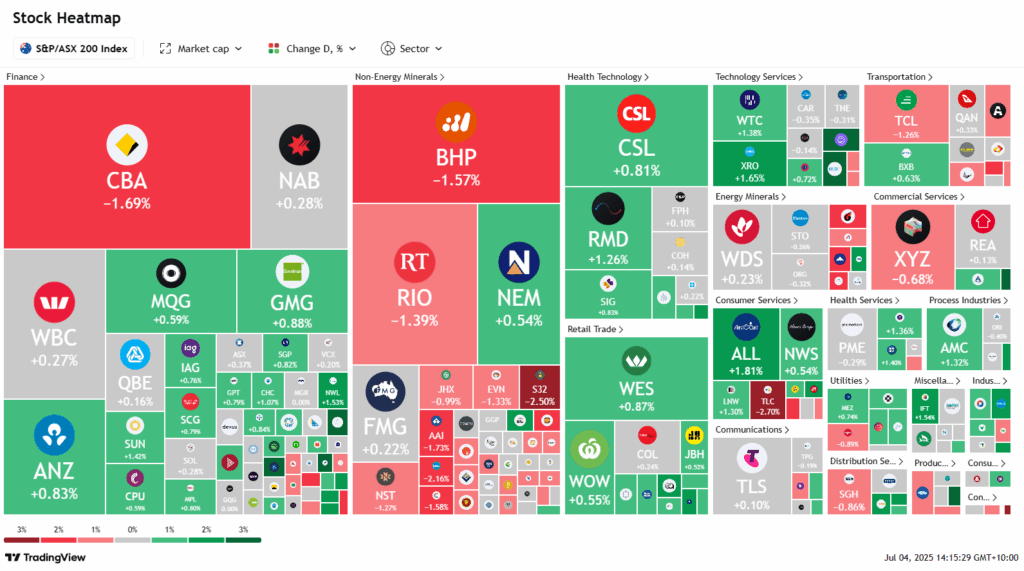

Australian shares edged slightly higher on Friday, with the S&P/ASX 200 Index up 3.3 points to 8599.1 as of 2pm AEST—poised to surpass its record close of 8597.7 set on Wednesday. Gains in tech and retail helped offset declines in major miners and Commonwealth Bank.

The Materials sector fell 1.1% as BHP and Rio Tinto each dropped over 1.5%, while South32 and Pilbara Minerals lost 2.3% and 2.2%, respectively. CBA declined 1.5%, though ANZ, Westpac, and NAB edged higher.

Tech outperformed, mirroring Wall Street’s rally, with Appen up 6%, Life360 gaining 2.8%, and WiseTech and Xero both rising over 1.5%. Retail also lifted on rate cut hopes: Wesfarmers and Myer gained 1%, Aristocrat 1.7%, and Premier Investments 2.5%.

Cleanaway rose 2.2% after ACCC cleared its $377m acquisition of Contract Resources. Silk Logistics soared 22.4% on ACCC approval of its $174m takeover by DP World. Monadelphous gained 1.6% on $100m in new Shell Crux contracts.

Pro Medicus eased 0.6% after a sharp rally, while G8 Education dropped 4.3%, extending its decline.

Leaders

FCL – Fineos Corporation Holdings Plc (+12.77%)

CU6 – Clarity Pharmaceuticals Ltd (+9.27%)

RDX – REDOX Ltd (+5.00%)

AMP – AMP Ltd (+4.61%)

ARB – ARB Corporation Ltd (+4.28%)

Laggards

ZIM – Zimplats Holdings Ltd (-5.85%)

DRO – Droneshield Ltd (-3.64%)

GLF – Gemlife Communities Group (-3.23%)

IPX – Iperionx Ltd (-3.08%)

SX2 – Southern Cross Gold (-2.97%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!