What's Affecting Markets Today

Asia-Pacific markets mixed as Trump tariff stance rattles investors

Asia-Pacific equities were mixed on Monday following renewed tariff threats from U.S. President Donald Trump. The president confirmed that “reciprocal” tariffs, initially announced in April, will take effect from August 1 for countries without finalized trade agreements.

In a further escalation, Trump announced an additional 10% tariff targeting nations “aligning with the anti-American policies of BRICS,” though specifics were not disclosed. The comments coincided with the BRICS summit held in Rio de Janeiro.

U.S. Treasury Secretary Scott Bessent clarified that while August 1 is not a new deadline, it provides room for ongoing negotiations. The move has injected further uncertainty into global trade dynamics.

In regional markets, Japan’s Nikkei 225 dropped 0.53% and the Topix fell 0.57%. South Korea’s Kospi rose 0.19%, while the Kosdaq edged up 0.16%. Hong Kong’s Hang Seng declined 0.61%, and China’s CSI 300 slipped 0.12%.

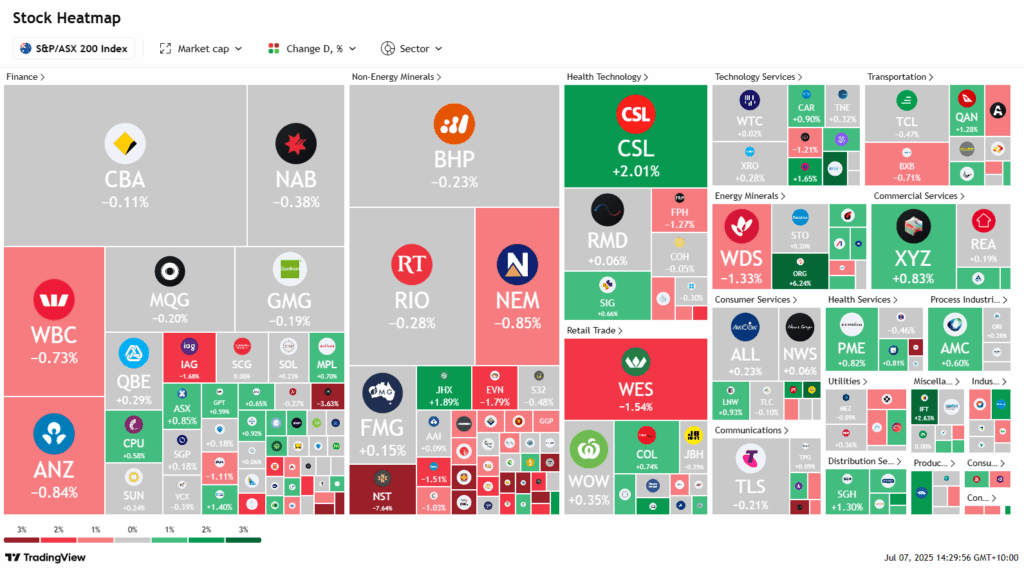

Australia’s ASX 200 dipped 0.11% ahead of the Reserve Bank of Australia’s policy meeting, where a 25 basis point rate cut to 3.60% is widely anticipated.

ASX Stocks

ASX 200 8,592.1 (-0.015%)

ASX edges lower; Northern Star slumps; Virgin rated ‘neutral’

Australian shares slipped on Monday, weighed by declines in energy and materials, as investors monitored President Trump’s proposed tariffs set to take effect August 1. The S&P/ASX 200 fell 10.3 points, or 0.1%, to 8592.7 by 2pm AEST, with six of 11 sectors in positive territory.

Origin Energy rose 5.3% following reports that UK-based Octopus Energy, in which Origin holds a 23% stake, plans to spin off its Kraken tech arm in a demerger that could value the business at $10 billion.

In contrast, Northern Star Resources dropped 6% after its quarterly production came in at the low end of guidance, with higher capex flagged to lift output.

Investors are also focused on Tuesday’s RBA rate decision, with economists expecting a second consecutive cut amid subdued inflation and growth. Some anticipate as many as six rate cuts through 2026.

Elsewhere, South32 dipped 0.5% after agreeing to sell its Cerro Matoso asset. HUB24 gained 3.2% after UBS upgraded the stock to “buy” with a $105 target, citing strong near-term growth potential.

Leaders

CBO Cobram Estate Olives Ltd (+8.84%)

ORG Origin Energy Ltd (+6.19%)

AX1 Accent Group Ltd (+3.45%)

HUB HUB24 Ltd (+3.27%)

NAN Nanosonics Ltd (+2.86%)

Laggards

OBM Ora Banda Mining Ltd (-8.11%)

NST Northern Star Resources Ltd (-8.10%)

SX2 Southern Cross Gold (-7.88%)

LTR Liontown Resources Ltd (-5.96%)

CU6 Clarity Pharmaceuticals Ltd (-5.78%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!