What's Affecting Markets Today

Asia-Pacific Markets Mixed as Trump Threatens New Tariffs on Key Trading Partners

Asia-Pacific equities traded in a narrow range on Tuesday as investors digested fresh tariff threats from former U.S. President Donald Trump. In letters posted to Truth Social, Trump outlined plans to impose 25% tariffs on goods from Japan, South Korea, Malaysia, Kazakhstan, and Tunisia, effective August 1. Additional levies include a 32% duty on Indonesian exports, 35% on Bangladesh, and 36% on Cambodia and Thailand. Imports from Laos and Myanmar are set to face 40% tariffs.

Notably, countries such as India, Taiwan, the Philippines, and Pakistan were absent from the list. Citi economists speculated these may be targeted for future framework agreements. U.S. Treasury Secretary Scott Bessent hinted up to 100 letters may be issued to smaller trade partners, potentially facing a baseline 10% tariff.

Barclays analysts said the tariff risk could pressure global growth forecasts but noted the new deadline allows time for negotiation.

Regionally, Japan’s Nikkei 225 rose 0.29%, South Korea’s Kospi gained 1.47%, and the CSI 300 added 0.74%. Hong Kong’s Hang Seng climbed 0.8%.

ASX Stocks

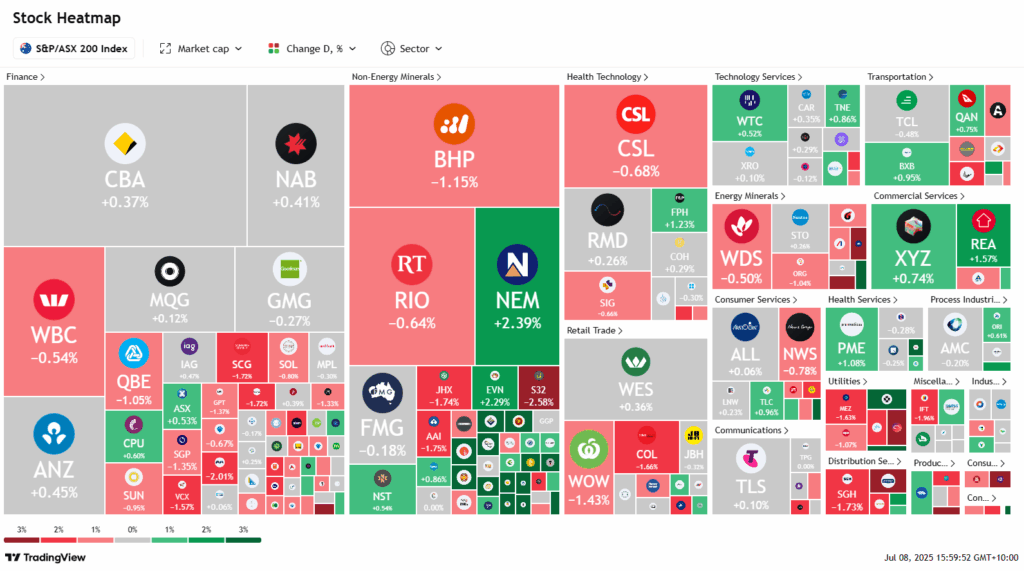

ASX 200 8,575.1 (-0.15%)

ASX Slides After Surprise RBA Decision to Hold Rates

The Reserve Bank of Australia surprised markets by holding the cash rate steady at 3.8 per cent, defying expectations of a third rate cut this year. The Australian dollar spiked to US65.45¢ from US65.10¢ on the news, while three-year bond yields rose from 3.34 per cent to 3.38 per cent. Economists and traders had largely priced in a 25 basis point cut to 3.6 per cent. Governor Michele Bullock is expected to provide further commentary at a 3.30pm press conference.

The S&P/ASX 200 Index slipped 0.3 per cent to 8558.97 following the announcement, having earlier swung between gains and losses. Seven of the 11 sectors declined.

BHP and Rio Tinto fell 1.5 and 0.9 per cent respectively, dragging the materials sector. CSL and Telix also weighed on healthcare. Meanwhile, CBA edged higher, breaking a recent losing streak, and technology stocks posted modest gains.

Notable moves included Platinum Asset Management (+4.4%), Domino’s (+2.1%), Amplitude Energy (+3.2%), and DigitalX (+16%). Guzman y Gomez dropped 2.2% after JPMorgan initiated coverage with an “underweight” rating.

Leaders

RSG Resolute Mining Ltd (+8.80%)

VAU Vault Minerals Ltd (+8.44%)

OBM Ora Banda Mining Ltd (+7.61%)

CYL Catalyst Metals Ltd (+7.45%)

SNZ Summerset Group (+6.69%)

Laggards

A2M The a2 Milk Company Ltd (-4.55%)

HMC HMC Capital Ltd (-4.50%)

CU6 Clarity Pharmaceuticals Ltd (-4.18%)

RPL Regal Partners Ltd (-4.02%)

REH Reece Ltd (-3.86%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!