What's Affecting Markets Today

Asia-Pacific Markets Gain Amid Tariff Uncertainty; China Outlook Mixed

Asia-Pacific equities traded mostly higher on Friday, despite renewed trade tensions after U.S. President Donald Trump announced a 35% tariff on Canadian imports effective August 1 and signaled broader tariffs of 15–20% on most trading partners in an NBC News interview.

Trump claimed the tariffs were “well-received,” citing record highs in U.S. equity markets following the announcement.

Singapore’s Straits Times Index extended its rally, rising 0.51% to a record 4,096 points—its fifth straight day of gains, according to LSEG data.

In China, markets opened higher with the Hang Seng Index up 0.93% and the CSI 300 gaining 0.2%. UOB remains “relatively optimistic” on China, citing attractive valuations, potential AI-driven growth, and expectations for further stimulus. However, the bank warned of growing caution due to a weakening real estate sector and a lack of clear policy direction amid ongoing trade negotiations.

UOB analysts favor AI and tourism sectors for long-term growth potential, and high-yield dividend stocks for defensive exposure within the Chinese equity landscape.

ASX Stocks

ASX 200 8,591.4 (+0.03%)

ASX Flat as Miners Rally, Rare Earths Surge

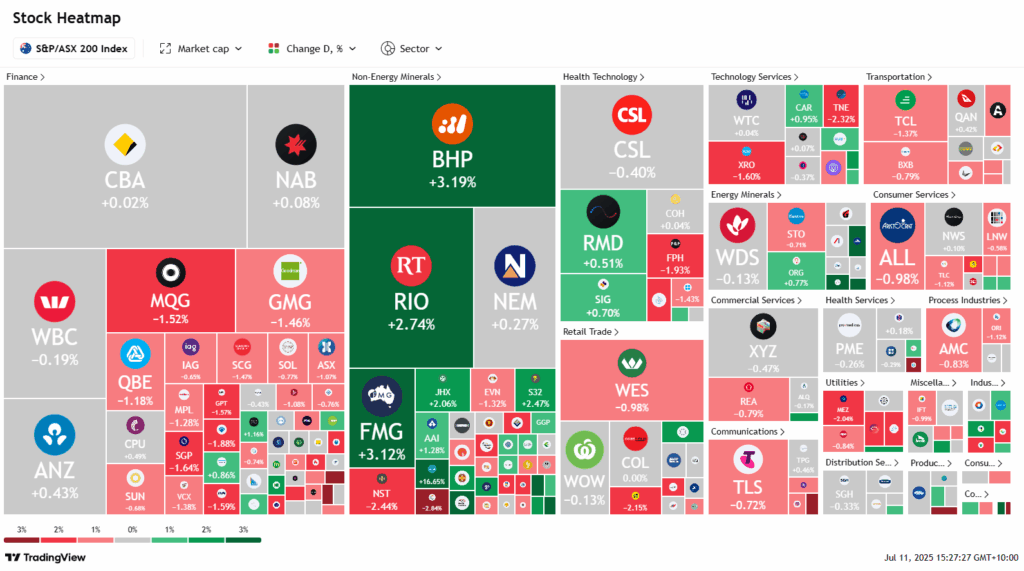

The ASX 200 seesawed on Friday, trading flat at 8589.5 points by 2pm AEST despite opening above the 8600 level. Gains in materials helped offset declines in real estate, tech, and retail sectors, as investor sentiment was shaken by US President Donald Trump’s threat to impose 15–20% blanket tariffs on trading partners.

Materials led the market, buoyed by iron ore futures nearing US$100/tonne. BHP and Fortescue each rose 3.4%, while Rio Tinto added 3.1%. Rare earths miners soared, with Lynas up 17% and Iluka jumping 21.4%, following MP Materials’ 51% surge after a multibillion-dollar US defence deal.

Lithium miners gained, led by Liontown (+4.4%), Pilbara Minerals (+3.4%) and IGO (+1.2%), despite IGO exiting a JV with Carawine Resources.

Meanwhile, property stocks retreated, including Charter Hall (-2.6%), Stockland (-1.6%), and GPT (-1.3%). Tech also softened, with TechnologyOne down 2.8% and Xero off 1.4%.

In corporate news, Johns Lyng soared 21.5% on a $1bn takeover by PEP. ASM rose 12.2% after cutting $900m in capital costs from its Dubbo Project. Ventia slipped 1.7% despite a $280m NBN contract upgrade.

Leaders

JLG – Johns Lyng Group Ltd (+22.01%)

ILU – Iluka Resources Ltd (+21.73%)

LYC – Lynas Rare Earths Ltd (+16.71%)

IPX – IperionX Ltd (+14.39%)

MIN – Mineral Resources Ltd (+7.88%)

Laggards

VUL – Vulcan Energy Resources Ltd (-12.50%)

OBM – Ora Banda Mining Ltd (-9.66%)

CYL – Catalyst Metals Ltd (-5.77%)

TUA – Tuas Ltd (-5.45%)

GTK – Gentrack Group Ltd (-4.80%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!