What's Affecting Markets Today

Asia-Pacific Markets Mostly Higher as China’s GDP Beats Expectations

Asia-Pacific equities traded mostly higher on Tuesday following stronger-than-expected economic data out of China. The country’s GDP grew 5.2% year-on-year in the second quarter, slightly ahead of the 5.1% consensus forecast from economists polled by Reuters. However, growth decelerated from 5.4% in Q1, reflecting ongoing challenges from trade tensions, deflation, and a sluggish property sector.

Chinese and Hong Kong stocks opened higher, with the Hang Seng Index up 1.12% and the CSI 300 gaining 0.38%. In Australia, the S&P/ASX 200 rose 0.66%, tracking gains on Wall Street. Japan’s Topix index added 0.32%, while the Nikkei 225 was flat. South Korea’s Kospi slipped 0.31%, but the tech-heavy Kosdaq edged up 0.26%.

Indian markets also advanced in early trade, with the Nifty 50 up 0.17% and the Sensex rising 0.21%.

Meanwhile, spot gold continued its upward momentum, trading at $3,348.80 per ounce, supported by renewed investor interest amid fresh U.S. tariff threats.

Investors now await key U.S. inflation data and second-quarter earnings for further market direction.

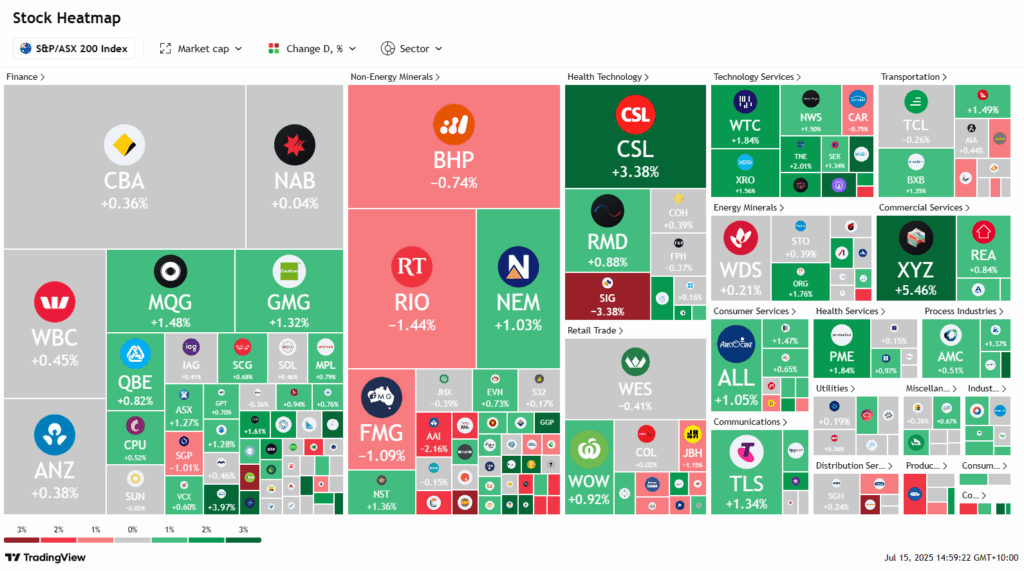

ASX Stocks

ASX 200 8,616.9 (+0.54%)

ASX on Track for Record Close Amid Tariff Optimism; Tech and Healthcare Lead Gains

The ASX advanced on Tuesday, buoyed by easing tariff concerns and stronger-than-expected Chinese economic data. The S&P/ASX 200 Index climbed 43.2 points, or 0.5%, to 8613.6 by 2:02pm AEST, surpassing its previous record of 8603 set on July 4. Gains were broad-based, with nine of 11 sectors in positive territory, led by technology and healthcare.

Tech stocks followed the Nasdaq higher, with WiseTech Global up 1.8%, Xero rising 1.3%, and Life360 jumping 7.5%. Healthcare also rallied, driven by CSL (+3.1%) and Pro Medicus (+1.8%). Major banks gained, while the materials sector declined 0.5%, as BHP, Fortescue, and Rio Tinto each fell around 1%.

US President Trump signalled openness to renewed trade talks, softening fears over potential 30% tariffs on the EU and Mexico. UBS maintained its base case for a 15% effective US tariff rate, supporting further S&P 500 upside.

In corporate news, Hub24 surged 6.5% after reporting record Q4 platform inflows. Paladin rose 4.8% on a Bell Potter price target upgrade. Tyro Payments fell 6.5% after new RBA surcharge rules.

Leaders

DRO Droneshield Ltd (+8.49%)

360 LIFE360 Inc (+6.99%)

HSN Hansen Technologies Ltd (+6.51%)

HUB HUB24 Ltd (+6.01%)

XYZ Block, Inc (+5.33%)

Laggards

PLS Pilbara Minerals Ltd (-4.85%)

CMW Cromwell Property Group (-4.00%)

RSG Resolute Mining Ltd (-3.36%)

IPX Iperionx Ltd (-3.04%)

SIG Sigma Healthcare Ltd (-3.03%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!