What's Affecting Markets Today

Asia Markets Mixed as Trade, Chip and Crypto Developments Dominate Headlines

Asia-Pacific markets traded mixed following U.S. President Donald Trump’s announcement of a preliminary trade agreement with Indonesia, which includes a 19% tariff on Indonesian exports to the U.S.—a softening from the previously threatened 32%. Indonesia’s Jakarta Composite Index rose 0.26%, though confirmation from Jakarta on the deal remains unclear. Investors also awaited the Bank Indonesia policy decision due later in the day.

Chip stocks in the region extended gains after the U.S. lifted export restrictions on AI processors to China. Nvidia confirmed it would resume H20 chip sales to Chinese firms, boosting optimism across the sector. TSMC gained 0.9%, Hon Hai rose 0.31%, while Japan’s Advantest and SoftBank added 0.73% and 0.48% respectively.

Cryptocurrency-related sentiment improved after Trump announced House Republicans had reversed their stance and would now support the GENIUS Act and related crypto bills, clearing the path for advancement.

Opening futures signaled a mixed start: Japan’s Nikkei 225 was slightly lower, ASX 200 futures pointed down, while Hong Kong’s Hang Seng was set to open higher.

ASX Stocks

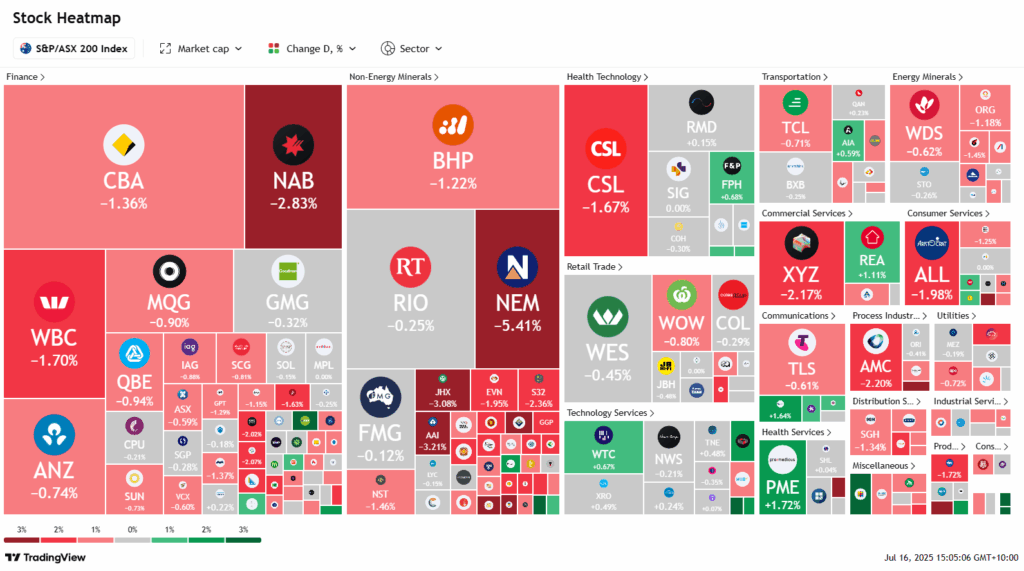

ASX 200 8,551.10 (-0.91%)

ASX Set for Sharpest Fall Since May as Miners Weigh on Sentiment

The Australian sharemarket is on track for its worst one-day drop since May, as risk appetite deteriorates on the back of hotter-than-expected US inflation data and renewed tariff concerns. At 2pm AEST, the S&P/ASX 200 was down 0.8% at 8564.10. If sustained, it would mark the steepest decline since May 5.

The materials sector led losses after Citi advised investors to “fade the rally” in iron ore, citing speculative drivers rather than fundamentals. BHP slipped 1%, while Rio Tinto held flat, supported by a robust quarterly production update.

Rare earth miners outperformed, buoyed by a $US500 million supply deal between MP Materials and Apple. Iluka Resources gained 4.9% and Lynas added 0.2%.

In corporate news, Newmont dropped 5.3% after CFO Karyn Ovelmen resigned unexpectedly. The company also sold $470 million in non-core assets. South32 fell 3.3% after UBS cut its target price, citing Mozambique risks. Evolution Mining eased 0.5% after highlighting strong FY26 cash flow prospects. Lendlease shed 1.5% despite securing a $2.5 billion development site in Sydney’s CBD.

Leaders

MP1 Megaport Ltd (+6.28%)

IPX Iperionx Ltd (+5.46%)

DRO Droneshield Ltd (+5.38%)

ILU Iluka Resources Ltd (+5.13%)

IFT Infratil Ltd (+4.10%)

Laggards

SNZ Summerset Group Holdings Ltd (-6.70%)

NEM Newmont Corporation (-5.27%)

GMD Genesis Minerals Ltd (-4.28%)

PPM Pepper Money Ltd (-4.15%)

PRN Perenti Ltd (-4.04%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!