What's Affecting Markets Today

Asia-Pacific Markets Climb on Trade Optimism; Japan’s Topix Hits Record

Asia-Pacific equities opened higher on Thursday, buoyed by progress in U.S.-Japan trade talks and signs of a potential deal with the European Union. Japan’s Topix surged 1.2% to a record high, while the Nikkei 225 added 1.09%. South Korea’s Kospi and Kosdaq rose 1.17% and 0.64% respectively. Australia’s ASX 200 gained 0.15%.

Overnight, the S&P 500 advanced 0.78% to a record close of 6,358.91. Meanwhile, U.S. President Donald Trump is set to visit the Federal Reserve—marking the first official presidential visit in nearly 20 years—intensifying his campaign against Chair Jerome Powell.

In South Korea, SK Hynix jumped 2.6% after posting record Q2 revenue and operating profit, supported by strong demand for high-bandwidth memory in AI chipsets. Revenue rose 35% year-on-year to 22.23 trillion won, exceeding forecasts.

South Korea also avoided a technical recession, with Q2 GDP rising 0.6%, outpacing expectations. Meanwhile, the Chinese yuan strengthened to its highest level since November 2024, and the Thai baht hit a two-year high.

ASX Stocks

ASX 200 8,707.50 (-0.35%)

ASX Edges Lower as Macquarie and Bapcor Weigh on Sentiment

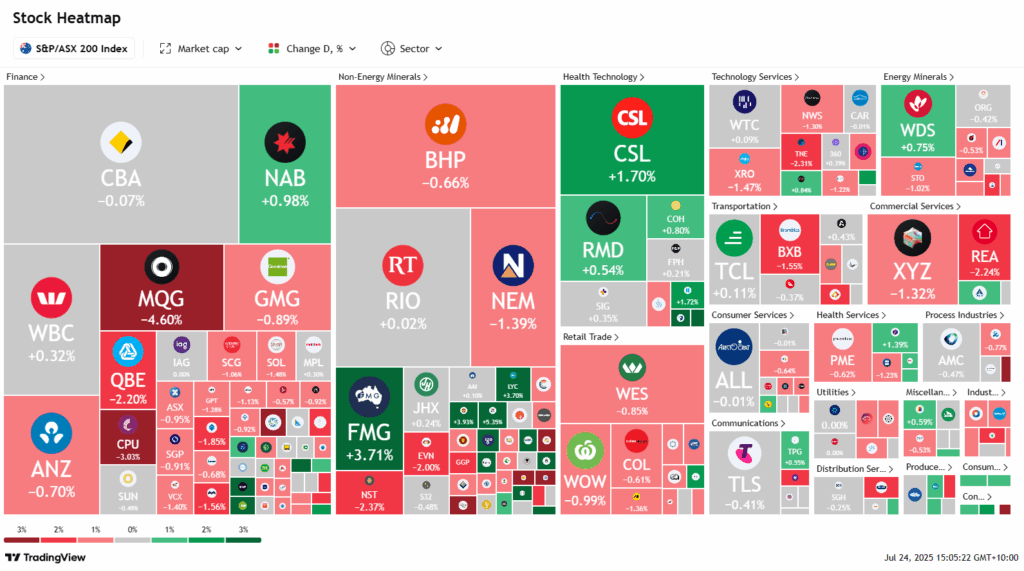

The Australian sharemarket turned lower on Wednesday as investors took profits following a strong prior session and awaited developments on a potential EU-US trade agreement. The S&P/ASX 200 slipped 0.3% to 8,710.8 by 2pm AEST, with losses across seven of the 11 sectors, led by financials.

Macquarie Group dropped 4% after announcing the departure of long-serving CFO Alex Harvey and flagging a potential protest vote on its remuneration report amid recent regulatory issues. Bapcor plunged 28% following weaker-than-expected May-June trading, $50 million in post-tax impairments, and the resignation of three directors.

Gold miners declined as easing trade tensions pressured bullion, with Northern Star (-2%) abandoning its hedging policy despite operational challenges at its Super Pit. Evolution and Regis fell 3.2% and 3.7%, respectively.

Healthcare outperformed, led by CSL (+1.3%) and modest gains for ResMed and Cochlear. Fortescue climbed 3.4% on record iron ore shipments and a bullish outlook. Lynas rose 3.4% after signing an MOU with Korea’s JS Link. Karoon Energy slipped 3.1% on weaker quarterly revenue despite higher output.

Leaders

PXA Pexa Group Ltd (+15.14%)

IPX Iperionx Ltd (+13.25%)

CU6 Clarity Pharmaceuticals Ltd (+8.95%)

SLX SILEX Systems Ltd (+8.55%)

NEU Neuren Pharmaceuticals Ltd (+6.82%)

Laggards

BAP Bapcor Ltd (-30.72%)

MQG Macquarie Group Ltd (-4.83%)

BOE Boss Energy Ltd (-4.83%)

DRO Droneshield Ltd (-4.75%)

WGX Westgold Resources Ltd (-4.70%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!