What's Affecting Markets Today

Asia-Pacific Markets Decline as Investors Await Key U.S. Events; Singapore Airlines Slumps

Asia-Pacific markets traded lower on Tuesday as investors remained cautious ahead of the U.S. Federal Reserve’s policy decision and developments in U.S.-China trade negotiations.

Japan’s Nikkei 225 fell 0.61%, while the broader Topix declined 0.76%. South Korea’s Kospi shed 1.09% and the Kosdaq dropped 0.88%. Australia’s S&P/ASX 200 lost 0.42%. Opening indicators also pointed to a subdued session, with futures for Japan’s Nikkei and Hong Kong’s Hang Seng Index both trading below their previous closes. ASX 200 futures indicated a weaker start at 8606, down from Monday’s 8697.70 close.

In corporate news, Singapore Airlines shares slumped over 8%, marking their largest intraday drop in nearly a year after the company reported a 59% fall in Q1 net profit to S$186 million. The decline was attributed to reduced interest income and losses from associates.

Meanwhile, shares of Chinese babycare companies rallied after Beijing announced an annual childcare subsidy of 3,600 yuan for children born after January 1, 2025. Beingmate surged over 9%, and China Feihe rose as much as 8.3%.

ASX Stocks

ASX 200 8,685.6 (-0.14%)

ASX Drifts Lower Ahead of Key Inflation Data

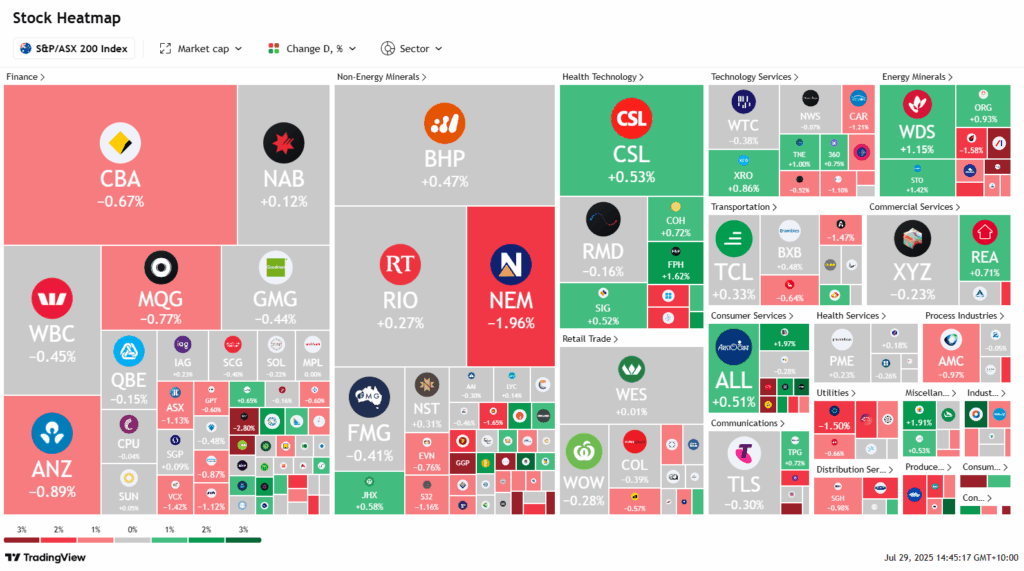

The Australian sharemarket traded marginally lower on Tuesday as investors exercised caution ahead of Wednesday’s critical quarterly CPI release, a key determinant for the Reserve Bank of Australia’s next interest rate decision.

By 2pm AEST, the S&P/ASX 200 was down 0.3% to 8673.70, recovering from an early 0.6% decline. Seven of the 11 sectors traded in negative territory, with financials and real estate underperforming.

Major banks extended losses, led by ANZ (-1.5%) and Commonwealth Bank (-0.8%), which announced 45 redundancies following a chatbot rollout. Real estate stocks Mirvac and Vicinity Centres both fell more than 1.5%, as rate-sensitive sectors remained under pressure.

Commodity-linked miners were mixed, with Fortescue down 0.5%, while BHP and Rio Tinto posted modest gains. Energy stocks outperformed, supported by stronger oil prices. Woodside rose 1.2% after assuming operatorship of the Bass Strait gas assets.

In company news, Viva Energy slumped 8.2% on weaker retail and refining margins. Boss Energy continued its slide, falling 4.7% after production guidance cuts. Newmont declined 2% on a US$2bn bond buyback announcement.

Leaders

TEA Tasmea Ltd (+5.26%)

CAT Catapult Group Int (+3.20%)

EVT EVT Ltd (+3.11%)

CU6 Clarity Pharma (+3.09%)

BCI BCI Minerals Ltd (+2.99%)

Laggards

GGP Greatland Resources Ltd (-19.45%)

VEA Viva Energy Group Ltd (-7.76%)

TUA Tuas Ltd (-5.82%)

PDN Paladin Energy Ltd (-5.36%)

SLX SILEX Systems Ltd (-5.19%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!