What's Affecting Markets Today

Asia-Pacific Markets Mixed as U.S.-China Tariff Truce Remains Unresolved; Australian Inflation Falls

Asia-Pacific markets traded mixed on Wednesday amid uncertainty surrounding the U.S.-China trade truce. High-level talks in Sweden concluded without an agreement to extend the current tariff pause, with U.S. officials confirming that any extension requires final approval from President Donald Trump. Commerce Secretary Howard Lutnick reiterated that the Friday deadline for broader tariff hikes remains firm.

Japan’s Nikkei 225 opened flat, while South Korea’s Kospi rose 0.48%. Australia’s S&P/ASX 200 declined 0.19%. Futures pointed to a lower open for Hong Kong’s Hang Seng Index and Japan’s Nikkei.

In Australia, inflation eased more than expected in Q2, with annual CPI falling to 2.1%, the lowest since March 2021, supporting the case for an RBA rate cut. Core inflation also moderated to 2.7%. The Australian dollar weakened, and bond yields fell.

In equity news, Li Auto shares plunged over 11% amid investor disappointment with its new i8 model. Analysts cited underwhelming features, unclear order volumes, and intensifying competition in the EV segment as key concerns.

Singapore’s central bank held monetary policy steady, warning of a slowdown in H2 2025.

ASX Stocks

ASX 200 8,772.2 (+0.75%)

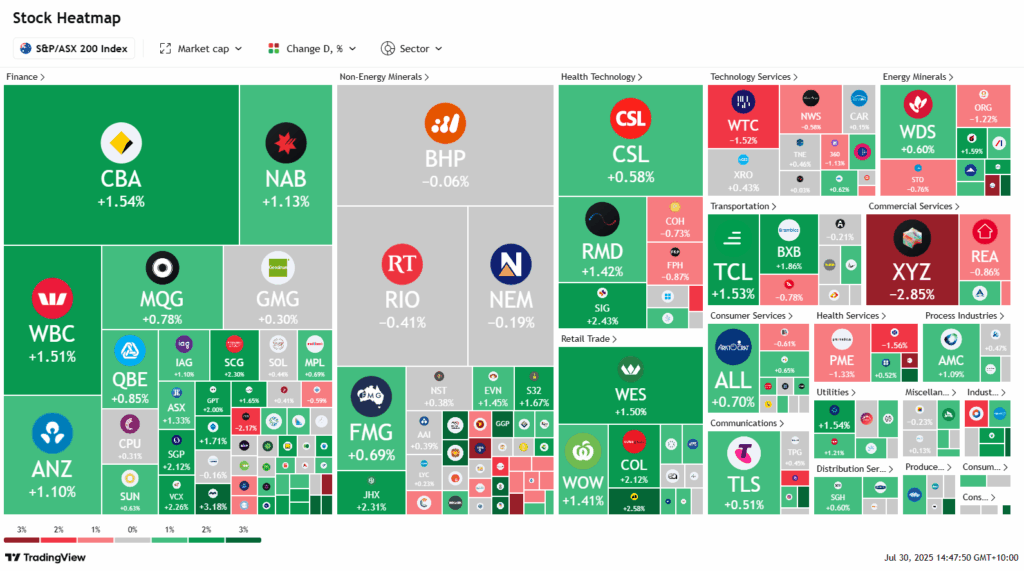

ASX Nears Record High as Inflation Cools, Real Estate and Banks Lead Rally

The Australian sharemarket surged towards a record high on Wednesday after softer-than-expected inflation data bolstered expectations of an imminent interest rate cut. At 2:05pm AEST, the S&P/ASX 200 rose 56.9 points, or 0.7%, to 8761.50, surpassing the previous record of 8757.20 set on July 18. The broader All Ordinaries Index posted similar gains.

The June quarter consumer price index rose just 0.7%, taking annual inflation to 2.1%, down from 2.4%. Core inflation, the Reserve Bank’s preferred measure, slowed to 2.7%. The figures sent the Australian dollar lower to US65¢ and drove three-year bond yields down 7bps to 3.35%. Money markets are now nearly fully pricing in an RBA rate cut next month.

Rate-sensitive real estate stocks rallied, with Mirvac (+2.7%), Vicinity Centres (+2.3%) and Scentre Group (+1.9%) leading gains. The major banks also advanced, led by CBA (+1.6%).

Among individual stocks, PolyNovo jumped 8.2% on strong earnings. Pilbara Minerals (+5.1%) and Mineral Resources (+2.8%) gained on positive production updates, while IGO (-7.1%) and Appen (-12.2%) fell on weak outlooks.

Leaders

PNV Polynovo Ltd (+8.57%)

OBM Ora Banda Mining Ltd (+7.66%)

DRO Droneshield Ltd (+7.10%)

GGP Greatland Resources Ltd (+6.58%)

PLS Pilbara Minerals Ltd (+5.67%)

Laggards

SLX SILEX Systems Ltd (-9.28%)

IGO IGO Ltd (-6.80%)

EMR Emerald Resources NL (-6.25%)

SNZ Summerset Group Holdings Ltd (-5.27%)

SX2 Southern Cross Gold (-4.30%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!