What's Affecting Markets Today

Asia-Pacific Markets Decline on Tariff Concerns and Weak Tech Earnings

Asia-Pacific markets retreated on Friday as investor sentiment was weighed down by newly imposed U.S. tariffs and underwhelming tech earnings from Wall Street. President Donald Trump announced revised “reciprocal” tariffs on several trading partners, with rates ranging from 10% to 41%, sparking renewed trade tensions.

Indian equities opened lower, with the Nifty 50 and BSE Sensex both down around 0.35% by 9:30 a.m. IST. Across Asia, technology stocks bore the brunt of the decline. Japan’s Tokyo Electron plunged 17%, leading losses among Japanese tech names. Lasertec fell 4.67%, Advantest dropped 2.51%, and SoftBank declined 2.07%.

In South Korea, SK Hynix tumbled 5.12%, while Samsung Electronics slid 1.92%. Taiwan’s TSMC lost 1.72%, although Foxconn gained 1.12%. Hong Kong’s Hang Seng Tech Index fell 0.23%, with China Petroleum & Chemical Corp, Zhongsheng Group, and Li Auto posting sharp declines.

Adding to the pressure, China’s Caixin manufacturing PMI dropped to 49.5 in July, signaling contraction. S&P Global cited subdued export demand and rising input costs as contributing factors.

ASX Stocks

ASX 200 8,670.70 (-0.82%)

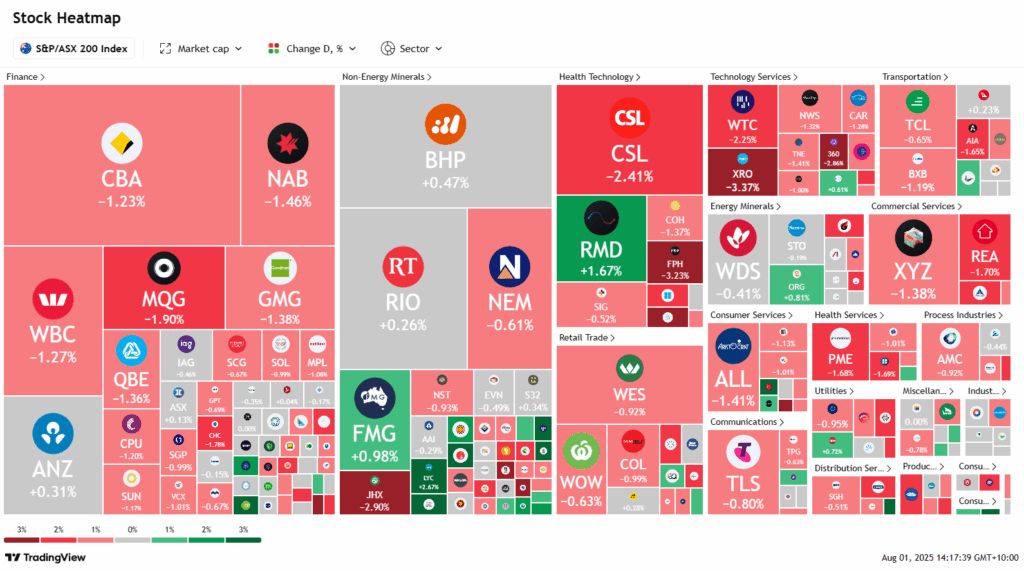

ASX Trims Losses as Miners Rebound Amid Tariff Tensions

The ASX narrowed earlier losses on Friday as a rebound in iron ore prices lifted major miners, despite renewed global trade tensions and inflation concerns. The S&P/ASX 200 was down 71.70 points, or 0.8%, to 8671.10 at 12:10 p.m., recovering from an intraday drop of 1% to 8650.9. The partial recovery followed a modest improvement in S&P 500 futures, which trimmed losses to 0.2%.

Market sentiment was pressured after U.S. President Donald Trump raised tariffs on key trading partners, including an increase from 25% to 35% on Canadian imports, as part of a broader 10% base tariff. The tariff move contributed to stronger-than-expected U.S. inflation data for June, reinforcing expectations of delayed rate cuts.

Iron ore futures climbed 0.4% above US$100/tonne, supporting gains in BHP (+0.9%), Rio Tinto (+0.8%), and Fortescue (+0.6%). Mineral Resources rebounded 3.4%.

Major banks dragged the index lower, with NAB down 1.9% and CBA off 1.7%. Star Entertainment slumped 7.3% after its Queen’s Wharf sale collapsed. ResMed rose 3% on upbeat earnings, while Novonix slid 1.1% after scrapping its graphite IPO.

Leaders

CSC Capstone Copper Corp (+8.47%)

SFR Sandfire Resources Ltd (+4.14%)

CU6 Clarity Pharmaceuticals Ltd (+3.89%)

MIN Mineral Resources Ltd (+3.20%)

BFL BSP Financial Group Ltd (+3.12%)

Laggards

WAF West African Resources Ltd (-4.68%)

PNV Polynovo Ltd (-4.46%)

FCL Fineos Corporation (-3.99%)

FPH Fisher & Paykel Healthcare (-3.32%)

XRO Xero Ltd (-3.24%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!