What's Affecting Markets Today

Asia-Pacific Markets Mixed as Trump Renews Tariff Threats; RBI Holds Rates

Asia-Pacific markets traded mixed on Wednesday, tracking overnight losses on Wall Street amid renewed tariff concerns and softer U.S. economic data. Investor sentiment was weighed by comments from U.S. President Donald Trump, who announced plans to impose fresh tariffs on semiconductors to encourage domestic production. The official announcement is expected within a week.

The move pressured Asian chipmakers. Japan’s Renesas Electronics dropped 3.68%, Tokyo Electron lost 3.46%, and South Korea’s SK Hynix and Samsung Electronics declined 2.09% and 1.43% respectively. Taiwan’s TSMC fell 2.17%.

In India, the Reserve Bank of India held its benchmark rate steady at 5.5%, following a 50 basis point cut in June. The central bank also shifted to a “neutral” stance, citing limited policy space for further easing.

Australian equities led regional gains, with the S&P/ASX 200 hitting a record high of 8824 in early trade. Major banks including Commonwealth Bank (+1.0%) and Westpac (+0.74%) advanced, while BHP rose 0.28%.

Meanwhile, Cathay Pacific shares slipped 0.58% ahead of earnings and reports of a Boeing aircraft order.

ASX Stocks

ASX 200 8,830.7 (-0.05%)

ASX Edges Lower Amid Health Care Weakness; Westgold Jumps on Production Outlook

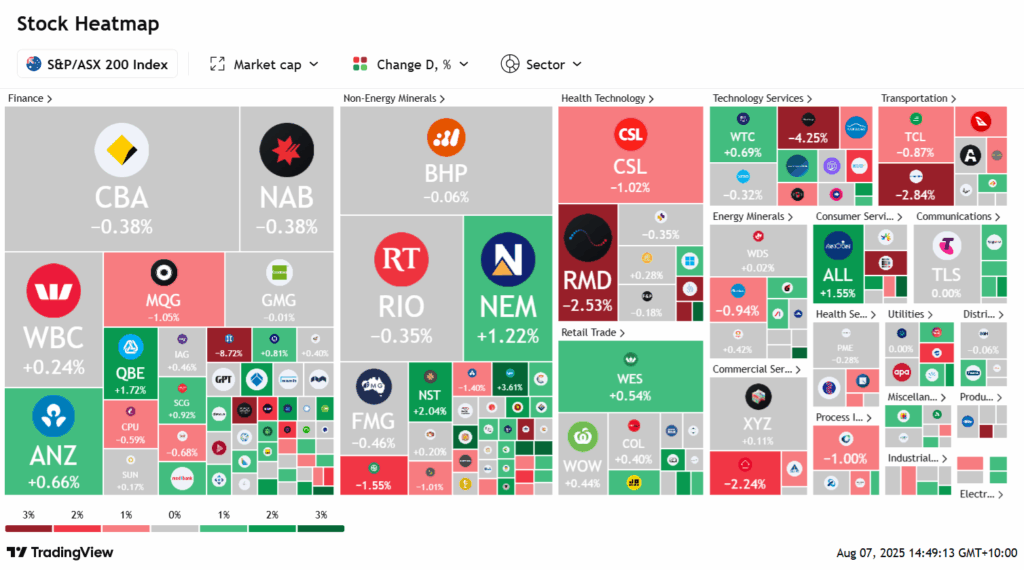

The S&P/ASX 200 Index slipped 0.2% or 16.4 points to 8827.30 by 2:05pm AEST on Thursday, easing after a record close in the previous session. Losses in healthcare and financials outweighed gains in technology and retail as markets digested fresh US semiconductor tariffs announced by President Donald Trump.

Healthcare led declines, with CSL down 1.1% and ResMed off 2.5%. Financials saw profit-taking, with NAB falling 0.7%, CBA 0.5%, and Westpac 0.1%, while ANZ gained 0.4%.

ASX Ltd plunged 8.5% after Treasurer Jim Chalmers signalled a potential end to its market monopoly. The exchange also flagged $25–$35 million in compliance costs from an ASIC probe.

Retailers outperformed ahead of a possible RBA rate cut, with JB Hi-Fi up 1.2%, Wesfarmers 0.5%, and Eagers Automotive 1.8%. Tech stocks also advanced, supported by overnight strength in US tech, as WiseTech rose 0.5% and TechnologyOne 0.9%.

Westgold Resources surged 5.4% on upgraded FY production and cash flow guidance. Neuren Pharmaceuticals gained 3.1% on positive results from partner Acadia, while Light & Wonder fell 2.6% on Nasdaq delisting news.

Leaders

EOS Electro Optic Systems (+13.15%)

PDI Predictive Discovery Ltd (+7.14%)

WGX Westgold Resources Ltd (+5.44%)

ZIM Zimplats Holdings Ltd (+5.40%)

WA1 WA1 Resources Ltd (+4.68%)

Laggards

SLX SILEX Systems Ltd (-14.80%)

ASX ASX Ltd (-9.09%)

CU6 Clarity Pharmaceuticals Ltd (-5.37%)

LFG Liberty Financial Group (-4.20%)

NWS News Corporation (-4.20%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!