What's Affecting Markets Today

Asia-Pacific Markets Mixed as Japan Surges; China, India Lag

Asia-Pacific markets traded mixed on Friday as investors weighed overnight weakness on Wall Street and escalating trade tensions following fresh U.S. tariffs. Two of the three major U.S. indices ended lower, curbing momentum across the region.

Japan led regional gains, with the Nikkei 225 soaring 2.22% to 41,968.68 by late morning trade. The broader Topix index added 1.65% to 3,037.11, marking its first-ever move above the 3,000 threshold. Gains were driven by strong earnings from technology firms and renewed strength in real estate and consumer cyclicals. Shares of SoftBank Group hit a fresh record high after posting better-than-expected quarterly results.

By contrast, Indian equities declined as investors digested the implications of U.S. President Donald Trump’s 50% tariffs on the country. The Nifty 50 slipped 0.31%, while the BSE Sensex dropped 0.18% in early trade.

Chinese and Hong Kong stocks also traded lower. The Hang Seng Index fell 0.76% and the mainland CSI 300 dipped 0.25% by mid-morning, reflecting cautious sentiment amid a mixed regional performance.

ASX Stocks

ASX 200 8,821.5 (-0.12%)

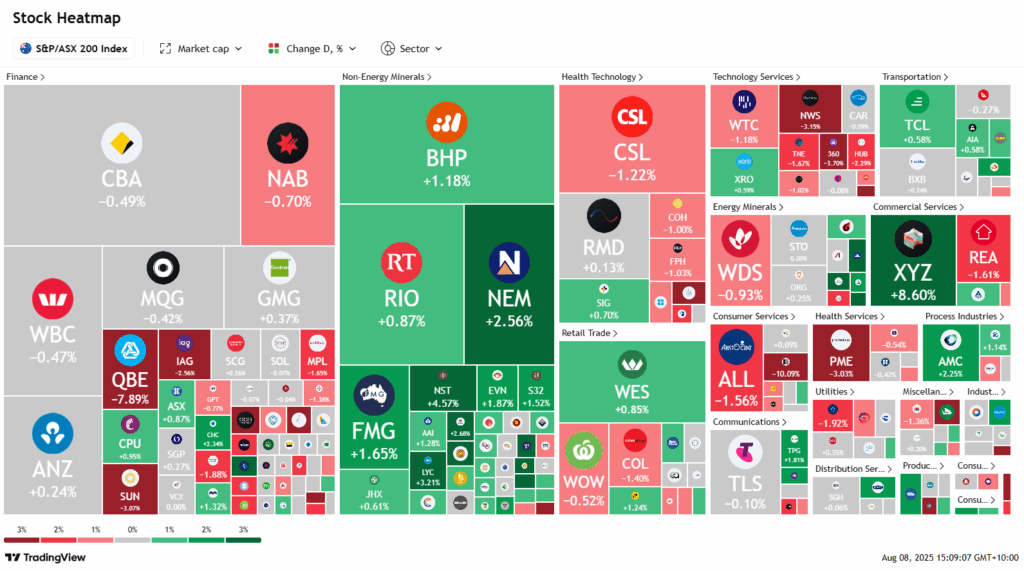

ASX Retreats as Financials Weigh; GQG and QBE Slump

Australian shares eased on Friday, with the S&P/ASX 200 down 0.2% or 20.2 points to 8811.20 at 2:05pm AEST, though the index remains on track for its first weekly gain in three weeks, up 1.7%. Market sentiment softened as US President Donald Trump’s sweeping new tariffs—impacting over 90 countries—took effect, lifting the average US import rate to over 17%, the highest since the Great Depression.

Materials outperformed as gold surged past US$3400/oz and Trump appointed a Fed governor aligned with his dovish stance. Northern Star rose 4.7%, Westgold 6.2%, and Fortescue added 1.4% after securing a $3 billion syndicated loan from Chinese banks.

In contrast, healthcare and financials dragged. CSL slipped 1.3%, while QBE tumbled 8.1% on concerns about profit quality. GQG Partners plunged 14.4% on $US1.4 billion in July outflows.

Among individual movers, Iress surged 10.9% on Blackstone takeover talks. Nick Scali jumped 9.3% on strong margins, and Block rose 7.6% on solid Afterpay-linked results. PointsBet advanced 4.6% on an improved takeover bid from Mixi.

Leaders

IRE Iress Ltd (+11.93%)

NCK Nick Scali Ltd (+9.44%)

XYZ Block, Inc (+8.09%)

PLS Pilbara Minerals Ltd (+7.35%)

WGX Westgold Resources Ltd (+6.55%)

Laggards

GQG GQG Partners Inc (-14.36%)

CU6 Clarity Pharmaceuticals Ltd (-11.30%)

LNW Light & Wonder Inc (-10.16%)

QBE QBE Insurance Group Ltd (-7.36%)

PNI Pinnacle Investment (-5.86%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!