What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Await U.S.–China Tariff Decision; Crypto Surges

Asia-Pacific markets traded cautiously on Monday as investors awaited confirmation on whether the August 12 U.S.–China tariff truce deadline would be extended. China’s CSI 300 edged up 0.13%, while Hong Kong’s Hang Seng Index gained 0.07%. Morgan Stanley expects Hong Kong’s market to regain momentum later in the year, contingent on trade clarity and China’s next five-year plan.

Cryptocurrencies rallied sharply, with ether reaching $4,335.17—its highest since late 2021—before easing to $4,308.98, up nearly 29% year-to-date. Fundstrat’s Thomas Lee cited ether’s security and compliance as key to Wall Street’s preference. Bitcoin rose 2.8% to $121,733, its strongest since July 14.

Battery giant CATL traded flat after halting production at its Yichun lithium mine due to a lapsed license, with operations to resume once renewed.

In Australia, the S&P/ASX 200 rose 0.43% ahead of Tuesday’s Reserve Bank decision. Reuters’ economist survey expects a 25bp cut to 3.60%, with inflation easing to 2.1% in Q2—its lowest since March 2021. South Korea’s Kospi and Kosdaq were flat.

ASX Stocks

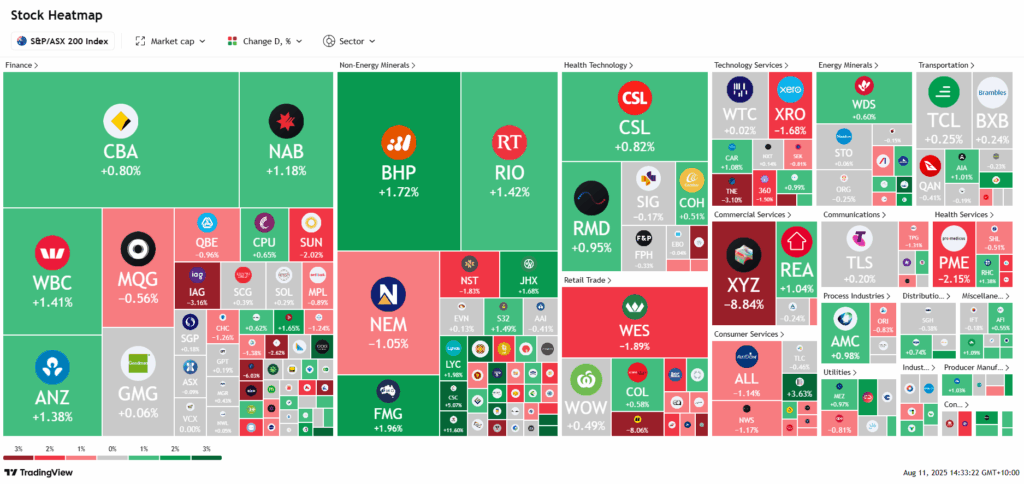

ASX 200 8,832.7 (+0.30%)

Resources Rally Lifts ASX to Fresh Intraday High Ahead of RBA Decision

The Australian sharemarket hit a new intraday high on Monday, buoyed by strong gains in the resources sector. The S&P/ASX 200 rose 0.2% or 21.20 points to 8828.30 at 2:02pm AEST, after briefly reaching 8852.30. Investors are anticipating the Reserve Bank’s third interest rate cut of the year on Tuesday.

Eight of 11 sectors advanced, led by materials after Chinese battery giant CATL suspended operations at a major lithium mine. Pilbara Minerals surged 17.1%, Liontown Resources 16.6% and Mineral Resources 11.4%, with materials up 6.8% over the past five days. Iron ore strength supported BHP (+1.6%), Fortescue Metals (+1.6%) and Rio Tinto (+1.3%).

Consumer discretionary lagged as JB Hi-Fi fell 8.3% following CEO Terry Smart’s resignation. Wesfarmers dropped 1.9% and Eagers Automotive slipped 1.2%.

Car Group gained 0.9% on a 10% NPAT rise to $275m. Iress sank 8.6% on weaker-than-expected half-year results. IDP Education jumped 9.3% after Jefferies lifted its price target to $4.50 from $3.50.

Leaders

PLS Pilbara Minerals Ltd (+17.36%)

LTR Liontown Resources Ltd (+16.86%)

MIN Mineral Resources Ltd (+11.95%)

IEL Idp Education Ltd (+9.69%)

IGO IGO Ltd (+9.40%)

Laggards

XYZ Block, Inc (-9.04%)

JBH JB Hi-Fi Ltd (-8.64%)

IRE Iress Ltd (-8.40%)

AMP AMP Ltd (-5.47%)

TLX TELIX Pharma (-3.91%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!