What's Affecting Markets Today

Asia-Pacific Markets Climb as Nikkei Hits Record; ASX Extends Gains Post-RBA Cut

Asia-Pacific markets mostly advanced on Tuesday, with Japan’s Nikkei 225 hitting a record high as investors welcomed the U.S.-China trade truce extension, allowing more time for negotiations. Attention remained on the Reserve Bank of Australia, widely expected to cut rates later in the day.

Australia’s S&P/ASX 200 reached a fresh record, rising 0.28% to 8,869.70 by 2:45pm AEST following a 25-basis-point RBA rate cut. In Japan, SoftBank Group extended its winning streak to a fifth session, up 7.54%, while Lasertec gained 7.3%. Other notable movers included Advantest (+7.06%), Japan Display (+5.56%), and Renesas Electronics (+2.75%).

In South Korea, SK Hynix rose 1.69% and Samsung Electronics added 1.06%. Taiwan’s TSMC edged up 0.42%, while Hon Hai slipped 0.51%. Hong Kong’s Hang Seng Tech Index fell 0.35%, led lower by Kingdee International (-7.16%), Kuaishou Technology (-6.15%), and Bilibili (-2.84%). Alibaba dropped 1.6%, Xpeng fell 1.53%, and Li Auto declined 1.49%.

The mixed tech sector performance followed U.S. President Donald Trump’s decision to permit Nvidia and AMD to resume some chip sales to China.

ASX Stocks

ASX 200 8,876.50 (+0.35%)

ASX Hits Record High as RBA Delivers Rate Cut

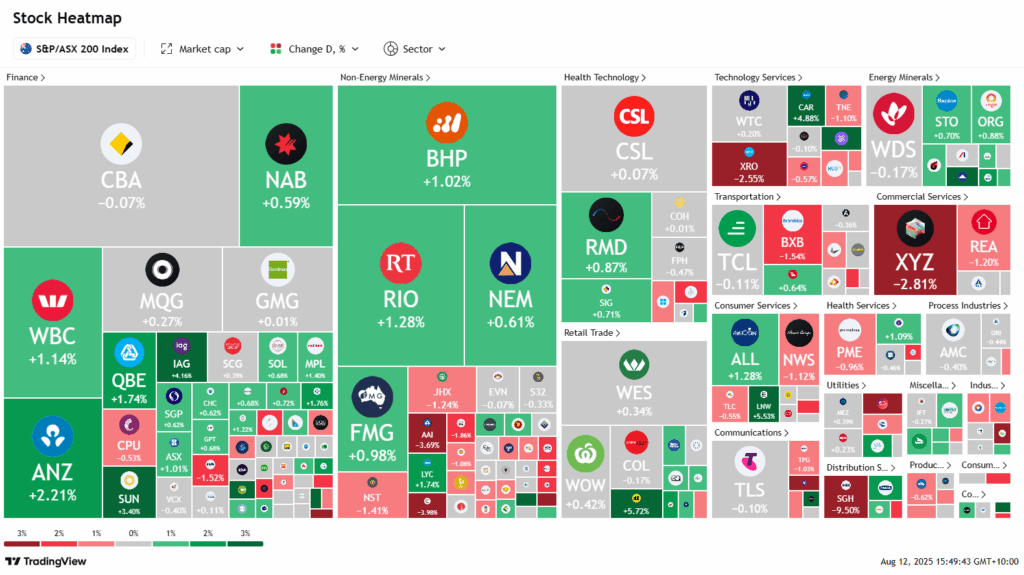

The S&P/ASX 200 climbed to a record high after the Reserve Bank of Australia unanimously cut the cash rate by 25 basis points to 3.6 per cent, its lowest level in over two years. The index gained 0.3 per cent, or 23.7 points, to 8,868.50 at 2:43pm AEST, after reaching an intraday peak of 8,870.10 moments after the 2:30pm decision.

The Australian dollar eased to US65¢ from US65.12¢, while bond yields dipped, with the three-year yield down 3 basis points to 3.38 per cent and the 10-year off 1 basis point to 4.26 per cent. Markets are almost fully pricing in another rate cut in November.

Retail stocks led gains, with JB Hi-Fi up 5.8 per cent after a Macquarie upgrade, and Breville adding 1.4 per cent. Financials were mixed, with ANZ up 2.1 per cent and CBA down 0.2 per cent. Industrials lagged as SGH tumbled 9.1 per cent on weak guidance.

Life360 soared 8.4 per cent on upgraded full-year guidance, while Seven West Media fell 6.7 per cent on weaker earnings.

Leaders

TUA Tuas Ltd (+28.13%)

EOS Electro Optic Systems (+13.05%)

360 LIFE360 Inc (+9.10%)

JBH JB Hi-Fi Ltd (+5.92%)

LNW Light & Wonder Inc (+5.53%)

Laggards

ALK Alkane Resources Ltd (-9.55%)

SGH SGH Ltd (-9.08%)

LTR Liontown Resources Ltd (-9.00%)

CU6 Clarity Pharmaceuticals Ltd (-8.85%)

DGT Digico Infrastructure REIT (-8.17%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!