What's Affecting Markets Today

Asia-Pacific Markets Rally on Fed Rate-Cut Hopes; Tencent Music Surges

Asia-Pacific equities opened higher Wednesday, buoyed by Wall Street gains after U.S. inflation data strengthened expectations of a Federal Reserve rate cut next month.

Tencent Music Entertainment Group led notable corporate moves, soaring 16% after second-quarter revenue and profit exceeded forecasts on strong online music subscription growth. Revenue climbed 18% year-on-year to 8.44 billion yuan (US$1.18 billion), with subscription services up over 26%. Net profit jumped 37.4% to 2.57 billion yuan, surpassing Reuters’ estimates of 7.98 billion yuan in revenue and 2.29 billion yuan in profit. Executive Chairman Cussion Pang cited momentum across advertising, concerts, and merchandise.

In broader markets, Chinese and Hong Kong equities advanced, with the Hang Seng Index up 1% and the CSI 300 gaining 0.33%. The Shanghai Composite hit its highest intraday level since December 2021. Japan’s Nikkei 225 set a fresh record high, led by Yokohama Rubber (+10%) and Renesas Electronics (+7%). South Korea’s Kospi rose 1.07%, while Australia’s S&P/ASX 200 gained 0.29%.

ASX Stocks

ASX 200 8,840.3 (-0.46%)

ASX Slips as Bank Stocks Tumble; Tyro Jumps on Takeover Interest

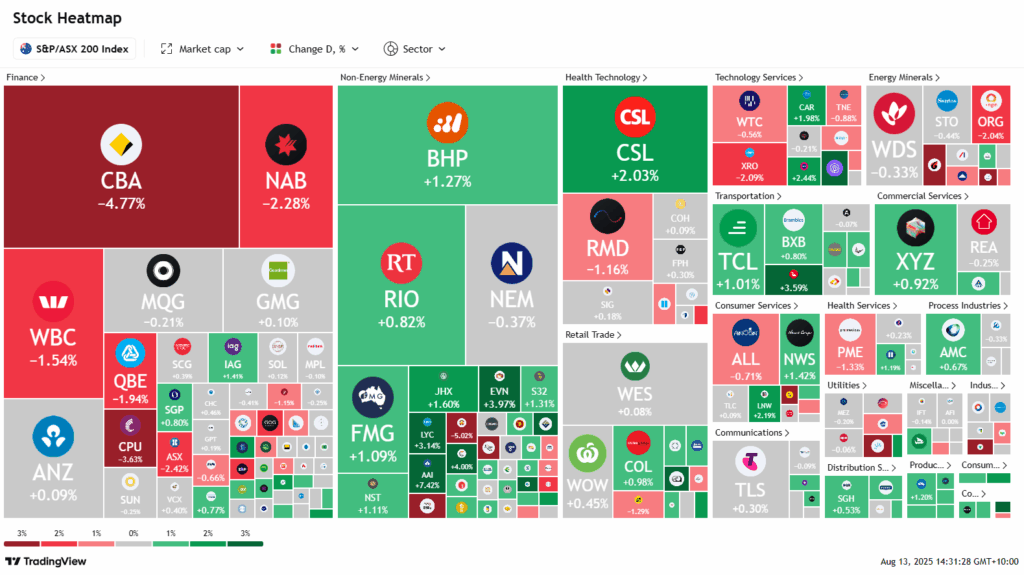

The Australian sharemarket is on track for its sharpest one-day fall in nearly two weeks, driven by heavy selling in major bank stocks, particularly Commonwealth Bank (CBA). After opening at a record high of 8890.50, the S&P/ASX 200 Index slid 42.50 points, or 0.5%, to 8838.30 by 2.05pm AEST.

CBA shares plunged 4.7% despite reporting a $10.25 billion cash profit, with analysts citing its “lofty” valuation of nearly 30 times forward earnings and margin pressures from the Reserve Bank’s new rate-cut cycle. The sell-off also weighed on peers, with NAB down 2.3% and Westpac falling 1.8%.

Healthcare and materials outperformed, led by CSL (+2%) and Clarity Pharmaceuticals (+7%), while iron ore giants BHP, Rio Tinto, and Fortescue gained over 1% on stronger commodity prices.

AGL dropped 12.1% on weaker profit, while Tyro Payments surged 8.9% after receiving unsolicited takeover interest. Treasury Wine Estates rose 1% on a dividend lift and $200 million buyback; IAG gained 1.3% on a 51% profit increase.

Leaders

AAI Alcoa Corporation (+7.55%)

CU6 Clarity Pharmaceuticals Ltd (+7.14%)

QOR QORIA Ltd (+5.68%)

360 LIFE360 Inc (+5.47%)

AOV Amotiv Ltd (+4.74%)

Laggards

AGL AGL Energy Ltd (-12.23%)

BVS Bravura Solutions Ltd (-6.61%)

BPT Beach Energy Ltd (-5.66%)

PLS Pilbara Minerals Ltd (-5.02%)

CBA Commonwealth Bank (-4.61%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!