What's Affecting Markets Today

Asia-Pacific Markets Mixed; Australia Jobless Rate Falls, Tencent Beats Forecasts

Asia-Pacific markets traded mixed on Thursday as investors positioned for a potential U.S. Federal Reserve rate cut next month.

In Australia, the unemployment rate eased to 4.2% in July, down from 4.3% in June and matching Reuters’ consensus forecast. The Australian Bureau of Statistics reported employment rose by 24,500, just below market expectations of 25,000. The Australian dollar strengthened 0.32% to US$0.6564, its highest since July 28, following the release.

In equities, Chinese and Hong Kong markets were mixed. The Hang Seng Index gained 0.58%, while mainland China’s CSI 300 traded flat by mid-morning.

Tencent Holdings advanced more than 2% after delivering stronger-than-expected second-quarter earnings. The tech giant posted a 15% year-on-year revenue increase to 184.5 billion yuan (US$25.7 billion), driven by robust growth in its gaming division and continued investment in artificial intelligence. This compares with 161.1 billion yuan in the prior-year quarter, reinforcing investor confidence in Tencent’s diversified revenue streams amid a competitive technology landscape.

ASX Stocks

ASX 200 8,881.9 (+0.62%)

ASX Edges Higher on Westpac Surge; South32 Slumps

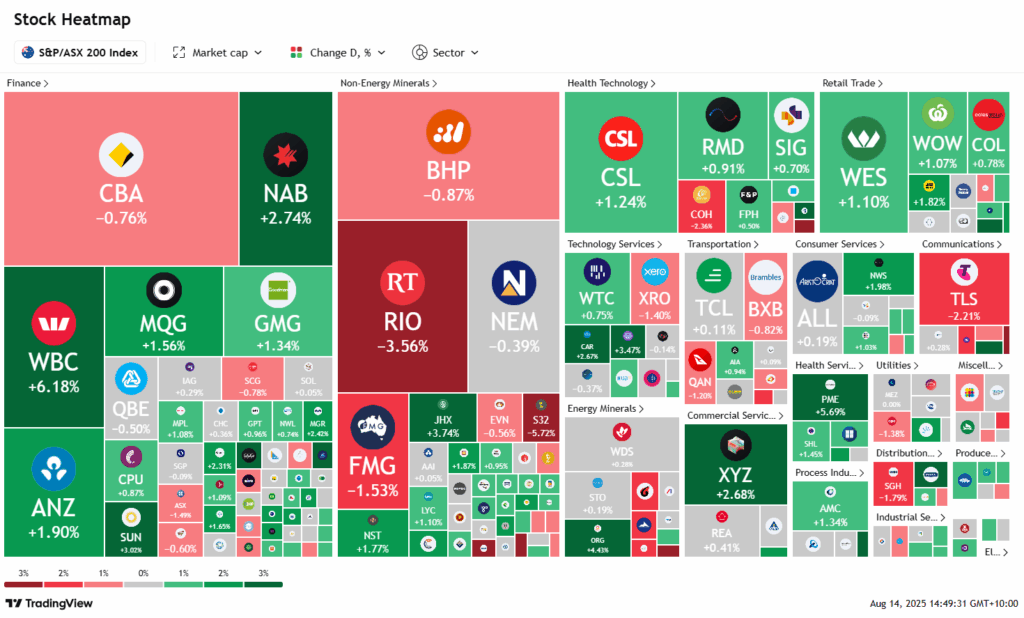

The Australian sharemarket advanced towards a record close on Thursday, buoyed by strong financial sector gains led by Westpac’s standout quarterly result. At 2pm AEST, the S&P/ASX 200 rose 48.9 points to 8876, after hitting an intraday peak of 8899.10 – its fourth consecutive record high this week.

Seven of the 11 sectors gained, with utilities leading as Origin Energy jumped 4.2% on a 26% lift in core net profit, driven by LNG earnings. Financials rebounded from Wednesday’s sell-off, with Westpac soaring 6.1% on a 14% rise in quarterly net profit to $1.9b – its biggest one-day gain since 2020. NAB added 2.6% and ANZ 1.7%, while CBA slipped 0.7%.

Key movers included Suncorp (+3.2%), Pro Medicus (+5.7%), Orora (+3.8%) and Temple & Webster (+7.9%). South32 fell 5.4% on a $US372m impairment at its Mozal smelter, while ASX Ltd eased 0.9% and Telstra dropped 2.8% despite announcing a $1b buyback.

Leaders

EOS Electro Optic Systems Holdings Ltd (+9.29%)

FCL Fineos Corporation Holdings Plc (+7.97%)

TPW Temple & Webster Group Ltd (+7.37%)

WBC Westpac Banking Corporation (+6.36%)

PME Pro Medicus Ltd (+5.93%)

Laggards

LTR Liontown Resources Ltd (-5.97%)

S32 SOUTH32 Ltd (-5.56%)

BVS Bravura Solutions Ltd (-4.46%)

NEU Neuren Pharmaceuticals Ltd (-4.08%)

SLX SILEX Systems Ltd (-4.03%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!