What's Affecting Markets Today

Asia-Pacific Markets Rise as Investors Weigh Japan’s GDP and Weak China Data

Asia-Pacific equities advanced on Friday as investors assessed stronger-than-expected Japanese GDP figures alongside disappointing Chinese economic data.

China’s July growth indicators undershot forecasts, signalling ongoing weakness in domestic demand. Retail sales rose 3.7% year-on-year, below expectations of 4.6% and slower than June’s 4.8%. Industrial output increased 5.7%, its weakest pace since November, while fixed-asset investment grew 1.6% year-to-date, missing estimates of 2.7%. Property investment contracted 12% in the first seven months.

In contrast, Japan’s economy expanded 0.3% in the June quarter, exceeding forecasts of 0.1% and improving from 0.1% in the previous quarter, despite U.S. tariff headwinds. Annual GDP growth came in at 1.2%, below Q1’s 1.8%. The second quarter was marked by trade uncertainty, with a new U.S. deal imposing a 15% tariff on all Japanese exports from July 23.

By mid-morning trade, Japan’s Nikkei 225 was up 0.67% and the Topix gained 0.99%. Australia’s S&P/ASX 200 edged 0.12% higher, while South Korean markets remained closed for a holiday.

ASX Stocks

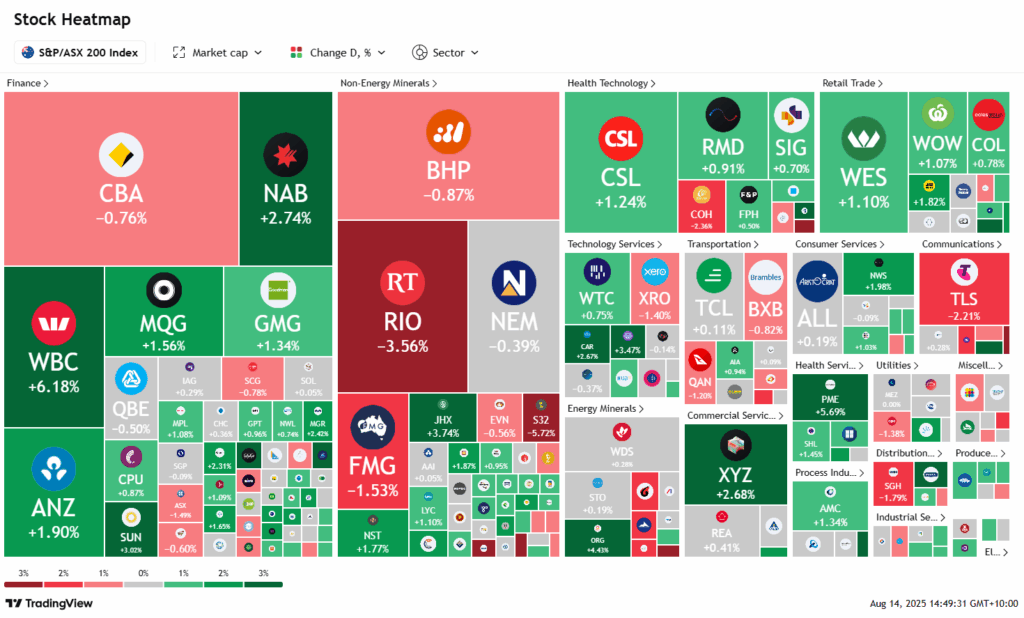

ASX 200 8,916.9 (+0.49%)

ASX Extends Record Run as Rate Cut and Stronger Outlook Lift Markets

The Australian sharemarket is poised for a second consecutive weekly gain, with the S&P/ASX 200 rising 38.5 points, or 0.4 per cent, to 8912.3 at 1.55pm AEST after reaching an intraday high of 8914.2. The index is tracking a 1.1 per cent weekly gain, marking a fifth straight record close – the longest streak in a decade – driven by the Reserve Bank’s rate cut and steady July jobs data.

Analysts expect the index to target 9000 in coming weeks, provided it holds above 8630. Utilities led sector gains, with Origin Energy up 2.7 per cent. Energy was buoyed by Ampol’s 7.3 per cent surge following its $1.1 billion acquisition of EG Australia. Materials strengthened on UBS’s higher gold forecasts, lifting Newmont (0.8 per cent) and Northern Star (1.1 per cent).

Corporate highlights included Baby Bunting soaring 38.7 per cent on stronger profit guidance, while Amcor slumped 10.2 per cent after weaker North American volumes. Westpac rose 1.9 per cent, while CBA slipped 0.2 per cent, extending its losing streak.

Leaders

ALD Ampol Ltd (+7.44%)

GGP Greatland Resources Ltd (+5.71%)

IEL Idp Education Ltd (+5.56%)

IPX Iperionx Ltd (+5.32%)

ALK Alkane Resources Ltd (+5.09%)

Laggards

WA1 WA1 Resources Ltd (-12.20%)

TPW Temple & Webster Group (-10.41%)

AMC Amcor Plc (-10.03%)

CTD Corporate Travel (-4.30%)

QOR QORIA Ltd (-3.31%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!