What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Eye U.S.–Ukraine Talks

Asia-Pacific equities traded mostly higher on Monday as investors awaited the outcome of talks between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskiy, following last week’s U.S.–Russia summit that ended without a ceasefire deal.

Japan led regional gains, with the Nikkei 225 rising 0.96% and the broader Topix up 0.7%. In China, sentiment improved as the CSI 300 advanced 1.5%, its strongest level since October 2024, while Hong Kong’s Hang Seng Index added 0.62%. Taiwan’s Taiex gained 0.43% after touching an intra-day high of 24,433.32.

In contrast, South Korea lagged, with the Kospi dropping 1.17% and the tech-heavy Kosdaq sliding 1.78%. India’s benchmarks performed strongly, with the Nifty 50 climbing 1.35% and the BSE Sensex up 0.89%.

Australia’s S&P/ASX 200 briefly touched a fresh intraday peak of 8,960 before settling 0.11% higher. In Singapore, trade data disappointed as non-oil domestic exports fell 4.6% year-on-year in July, sharply reversing from June’s revised 12.9% surge and missing forecasts for a milder decline.

ASX Stocks

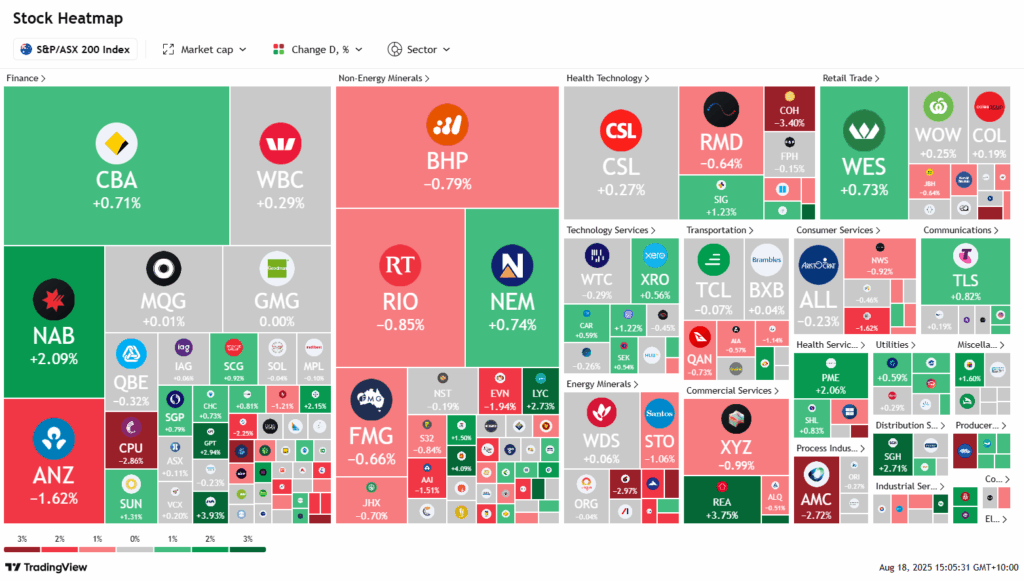

ASX 200 8,947.6 (+0.10%)

ASX Seesaws as Earnings Season Drives Market Moves

The S&P/ASX 200 hovered in a tight range on Monday, up 0.1 per cent at 8948.70 by 2pm, as investors digested a wave of earnings reports. The benchmark briefly touched 8960.90, its sixth consecutive intraday record.

Banking stocks led gains, with National Australia Bank climbing 2.3 per cent despite higher expense forecasts linked to payroll issues. Commonwealth Bank also rose 1 per cent. In contrast, energy and coal stocks weighed, with Brent crude below $US66 a barrel ahead of U.S.–Ukraine peace talks. Santos slipped 1.1 per cent and Yancoal and Whitehaven both fell around 2.5 per cent.

Among individual names, BlueScope Steel dropped 4 per cent after reporting a sharp profit fall and U.S. writedown, while DigiCo REIT slumped 10.3 per cent on softer earnings. oOh!media tumbled 9.6 per cent on weaker results and guidance.

Notable gainers included GPT Group (+3.5%), Lendlease (+5.1%) on a return to profit, REA Group (+3.2%) following a CEO appointment, and Aurizon (+2.1%) on buyback plans. Meanwhile, Kogan (-3.9%) and Michael Hill (-3.7%) declined on disappointing updates.

Leaders

BVS Bravura Solutions Ltd (+7.79%)

CU6 Clarity Pharmaceuticals Ltd (+6.69%)

LTR Liontown Resources Ltd (+6.51%)

ALK Alkane Resources Ltd (+6.25%)

LLC Lendlease Group (+4.96%)

Laggards

DGT Digico Infrastructure REIT (-10.31%)

OML Ooh!Media Ltd (-9.75%)

NHC New Hope Corporation Ltd (-5.29%)

TPW Temple & Webster Group Ltd (-5.11%)

BSL Bluescope Steel Ltd (-4.27%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!