What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Eye Fed Meeting

Asia-Pacific equities traded mixed on Tuesday as investors digested overnight declines on Wall Street and awaited the U.S. Federal Reserve’s policy meeting later this week. Political developments also weighed on sentiment, with U.S. President Donald Trump hosting Ukraine’s Volodymyr Zelenskyy and European leaders at the White House to discuss ending the Moscow-Kyiv conflict.

Japan’s Nikkei 225 slipped 0.12 per cent in volatile trade, retreating from Monday’s record close, while the Topix index was flat. SoftBank Group shares snapped a nine-day winning streak, plunging as much as 5.69 per cent after the company announced a $2 billion investment in Intel, purchasing shares at $23 apiece against Monday’s $23.66 close.

In South Korea, the Kospi fell 0.31 per cent and the Kosdaq shed 0.71 per cent. Mainland China’s CSI 300 edged up 0.13 per cent, extending gains after hitting its highest level since October 2024, while Hong Kong’s Hang Seng Index added 0.19 per cent. Australia’s S&P/ASX 200 underperformed, sliding 0.74 per cent amid broad weakness.

ASX Stocks

ASX 200 8,888.8 (-0.79%)

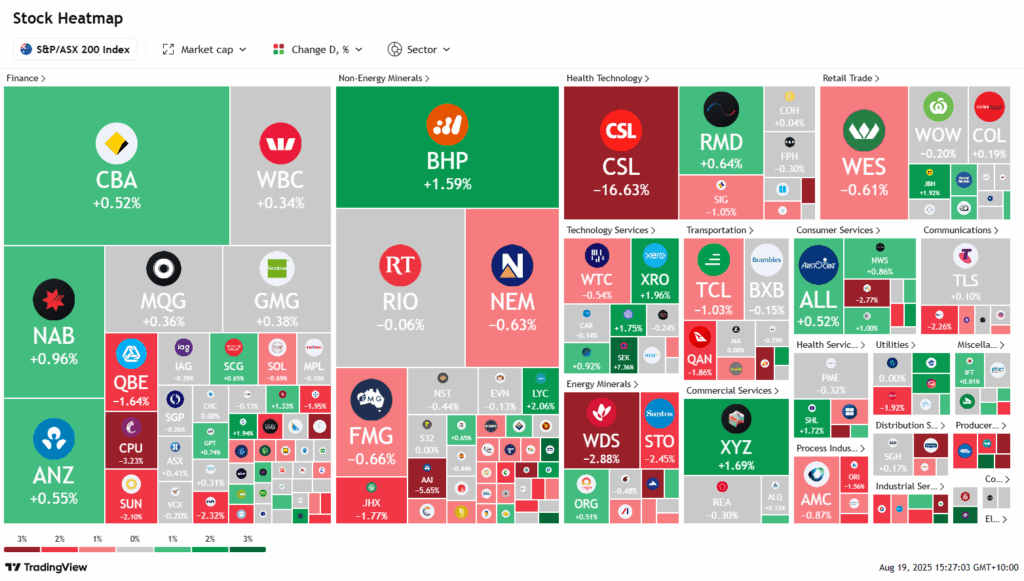

ASX Slumps as CSL Suffers Record Sell-Off

The Australian sharemarket retreated from record highs on Tuesday as a wave of earnings reports weighed on sentiment, led by a sharp decline in CSL. The S&P/ASX 200 fell 68.2 points, or 0.8 per cent, to 8891.1 by mid-afternoon, with healthcare stocks plunging 8.2 per cent. CSL tumbled 15.8 per cent — its largest drop on record — after posting weaker-than-expected revenue and announcing plans to cut 3000 jobs globally. The move wiped 53 points from the benchmark index.

Energy names also dragged, with Santos down 2.3 per cent on deal uncertainty and Woodside slipping 1.9 per cent after a 24 per cent profit fall. In contrast, BHP gained 1.5 per cent despite a 26 per cent earnings slide and dividend cut.

Financials offered some resilience, led by NAB up 0.8 per cent and CBA up 0.6 per cent. Among individual movers, Seek surged 6.6 per cent on stronger revenues, ARB rose 6.5 per cent, while Judo Capital added 3.1 per cent. Weak spots included Sims (-4.3%), Reliance Worldwide (-8%), Strike Energy (-12.5%), and HMC Capital (-10.4%).

Leaders

BVS Bravura Solutions Ltd (+7.79%)

CU6 Clarity Pharmaceuticals Ltd (+6.69%)

LTR Liontown Resources Ltd (+6.51%)

ALK Alkane Resources Ltd (+6.25%)

LLC Lendlease Group (+4.96%)

Laggards

DGT Digico Infrastructure REIT (-10.31%)

OML Ooh!Media Ltd (-9.75%)

NHC New Hope Corporation Ltd (-5.29%)

TPW Temple & Webster Group Ltd (-5.11%)

BSL Bluescope Steel Ltd (-4.27%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!