What's Affecting Markets Today

Asia-Pacific Markets Slide on Weak Japan Trade Data and China Rate Hold

Asia-Pacific equities fell on Wednesday, following overnight declines on Wall Street, as investors weighed Japan’s disappointing trade figures and China’s decision to keep lending rates unchanged.

Japan’s exports dropped 2.6 per cent year-on-year in July, the sharpest fall in more than four years, exceeding economists’ forecast of a 2.1 per cent decline and worsening from June’s 0.5 per cent drop. The weak data pressured Japanese equities, with the Nikkei 225 slipping 0.93 per cent and the Topix down 0.31 per cent. Technology stocks led losses, with SoftBank Group tumbling as much as 9.17 per cent after its $2 billion investment in Intel. Despite Intel’s 6.97 per cent rise on Wall Street, SoftBank shares fell for a second straight session.

Elsewhere, South Korea’s Kospi fell 1.52 per cent and the Kosdaq 1.77 per cent, while Australia’s S&P/ASX 200 opened 0.24 per cent lower. Hong Kong’s Hang Seng retreated 0.71 per cent, and China’s CSI 300 slipped 0.48 per cent after the central bank held loan prime rates steady for a third month. Taiwan’s Taiex fell over 2 per cent.

Notably, Chinese toymaker Pop Mart rebounded, surging more than 8 per cent after initially falling, buoyed by a near-400 per cent jump in net profit on strong global demand for its Labubu dolls.

ASX Stocks

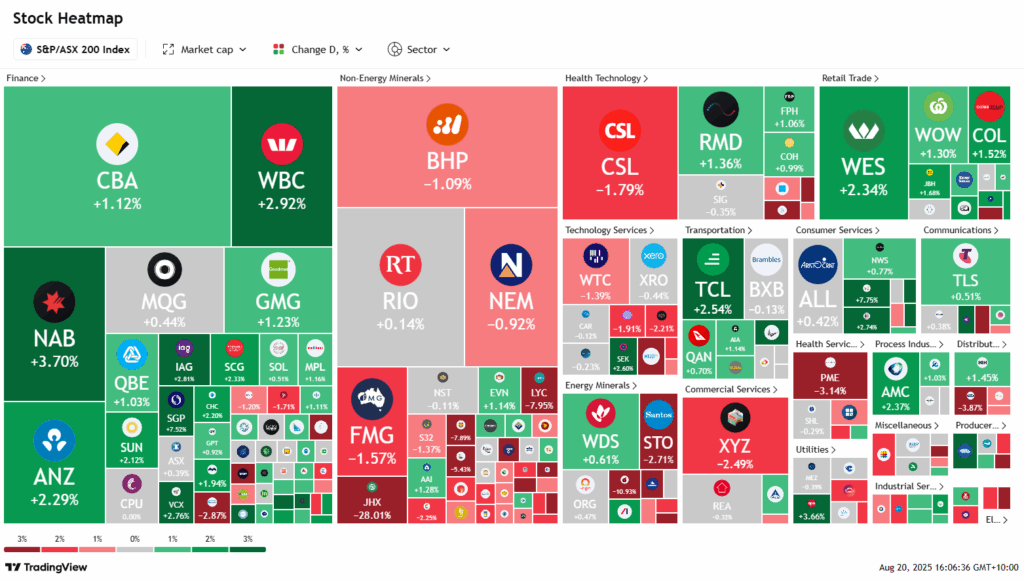

ASX 200 8,925.5 (+0.33%)

ASX Edges Higher as Banks Outperform, Materials Weigh

The Australian sharemarket traded slightly higher in afternoon trade, buoyed by a strong rebound in the banking sector that helped offset heavy losses in materials and healthcare. The S&P/ASX 200 Index rose 17.3 points, or 0.2 per cent, to 8913.50 at 2.03pm AEST, with seven of 11 sectors advancing.

National Australia Bank surged 3.5 per cent, Westpac added 2.7 per cent, and ANZ climbed 2.4 per cent, while Commonwealth Bank lagged with a 0.9 per cent gain. In contrast, materials were weighed down by James Hardie, which plunged 29.1 per cent after reporting weaker-than-expected earnings guidance and a 60 per cent drop in quarterly net income.

Healthcare was also under pressure, with CSL trimming losses to 2.1 per cent following its sharp 17 per cent fall a day earlier.

Elsewhere, APA Group gained 3.4 per cent on solid results, Magellan jumped 3.8 per cent despite weaker profit, and Transurban added 2.7 per cent. Lynch Group soared 24 per cent after receiving a $270 million takeover offer from TPG Capital’s Hasfarm Holdings.

Leaders

HMC HMC Capital Ltd (+17.74%)

CNI Centuria Capital Group (+9.30%)

TLC The Lottery Corporation Ltd (+8.03%)

SGP Stockland (+7.43%)

SSM Service Stream Ltd (+7.43%)

Laggards

JHX James Hardie Industries Plc (-28.58%)

EOS Electro Optic Systems Holdings Ltd (-12.04%)

YAL Yancoal Australia Ltd (-11.17%)

DRO Droneshield Ltd (-10.89%)

CU6 Clarity Pharmaceuticals Ltd (-10.54%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!