What's Affecting Markets Today

ASX Stocks

ASX Lower as Miners Weigh, Coles Surges

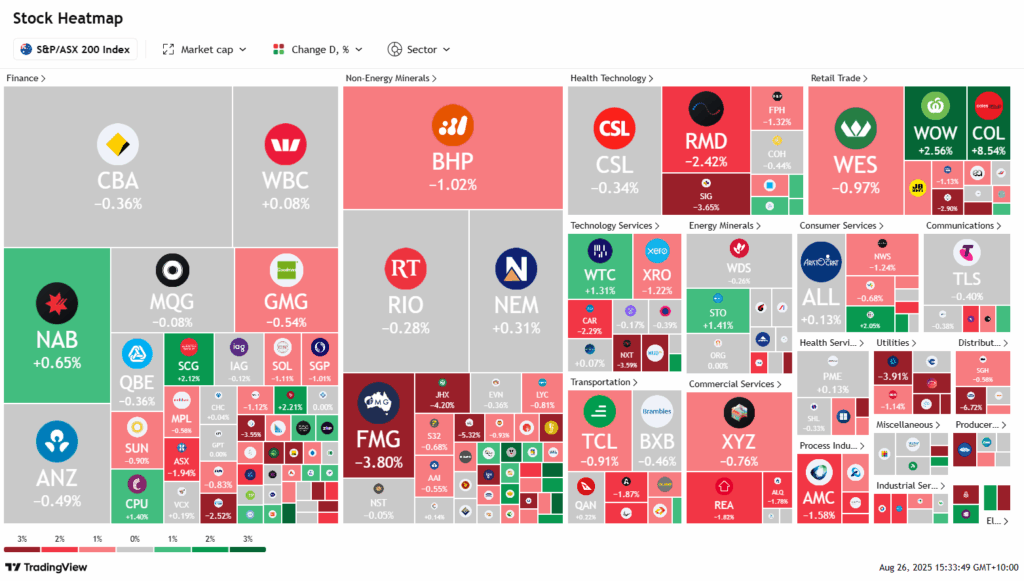

The Australian sharemarket retreated on Tuesday, mirroring weaker global sentiment after US President Donald Trump threatened higher tariffs on digital services and announced plans to remove Federal Reserve governor Lisa Cook. The S&P/ASX 200 Index declined 34.3 points, or 0.4 per cent, to 8938.10 at 1.50pm AEST, with eight of 11 sectors in the red.

Materials led losses as Fortescue reported a 41 per cent fall in full-year profit to $US3.37 billion, cutting dividends to a seven-year low. Shares dropped 2.5 per cent, while BHP and Rio Tinto slipped 1 per cent and 0.6 per cent respectively. Utilities also weakened, with AGL down 4.1 per cent.

By contrast, consumer staples outperformed. Coles soared 8.6 per cent after reporting EBIT above forecasts and $44.5 billion in sales. SPC Global gained 12 per cent on stronger revenue and integration benefits.

Among other movers, Nuix jumped 12.9 per cent on broker upgrades, while Imdex plunged 16 per cent on downgrades. Scentre Group rose 2.4 per cent after lifting distribution guidance.

ASX 200 8,932.6 (-0.45%)

Asia-Pacific Markets Retreat as Tariff Tensions Escalate

Asia-Pacific equities slipped on Tuesday as investors reacted to heightened trade tensions following U.S. President Donald Trump’s latest tariff threats and his dismissal of Federal Reserve Governor Lisa Cook.

Trump warned of imposing tariffs of “200% or something” on China should it restrict exports of rare-earth magnets to the U.S., while also threatening levies on countries maintaining digital taxes. The move to fire Cook added to concerns about political interference in U.S. monetary policy.

Gold firmed 0.21 per cent to $3,373.12 by midday in Singapore, while the U.S. dollar index steadied after early weakness. Yields on 10-year Treasuries rose 2.5 basis points to 4.3023 per cent.

Regional markets were broadly weaker. Japan’s Nikkei 225 and Topix both lost 0.85 per cent and 0.83 per cent respectively. South Korea’s Kospi dropped 0.85 per cent, though the Kosdaq added 0.31 per cent. Australia’s S&P/ASX 200 shed 0.52 per cent. Hong Kong’s Hang Seng slipped 0.22 per cent, while China’s CSI 300 edged up 0.14 per cent. India’s Nifty 50 fell 0.77 per cent and the Sensex 0.65 per cent.

Leaders

KLS Kelsian Group Ltd (+15.63%)

NAN Nanosonics Ltd (+12.41%)

IDX Integral Diagnostics Ltd (+11.40%)

COL Coles Group Ltd (+8.54%)

OBM Ora Banda Mining Ltd (+7.53%)

Laggards

IMD IMDEX Ltd (-13.85%)

EQT EQT Holdings Ltd (-10.03%)

ASK Abacus Storage King (-9.06%)

REG Regis Healthcare Ltd (-8.79%)

CU6 Clarity Pharmaceuticals Ltd (-7.67%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!