What's Affecting Markets Today

Asia-Pacific Markets Mixed as Korea Holds Rates; Qantas Hits Record

Asia-Pacific equities traded mixed on Thursday as investors assessed the Bank of Korea’s latest policy decision and a series of corporate updates.

South Korea’s central bank kept its benchmark rate unchanged at 2.5% for the second consecutive meeting, in line with expectations. The Kospi rose 0.28% while the tech-heavy Kosdaq slipped 0.33%. The Korean won strengthened 0.24% to 1,389.8 per U.S. dollar.

In Japan, the Nikkei 225 added 0.24% and the Topix gained 0.14%. Australia’s S&P/ASX 200 was little changed, with investors focused on key corporate developments. Lynas Rare Earths announced a A$750 million ($488 million) discounted share placement at A$13.25 per share, about 10% below its last close, to fund processing and exploration activities. Trading in its shares was halted.

Meanwhile, Qantas surged to a record high after reporting a stronger-than-expected full-year result. Underlying profit before tax climbed 15% to A$2.39 billion, topping estimates, as revenue rose 8.6% to A$23.82 billion on robust demand across domestic and international routes.

Hong Kong’s Hang Seng index fell 0.79% and China’s CSI 300 slipped 0.18%.

ASX Stocks

ASX 200 8,973.6 (+0.16%)

ASX Edges Higher as Banks Lead Gains

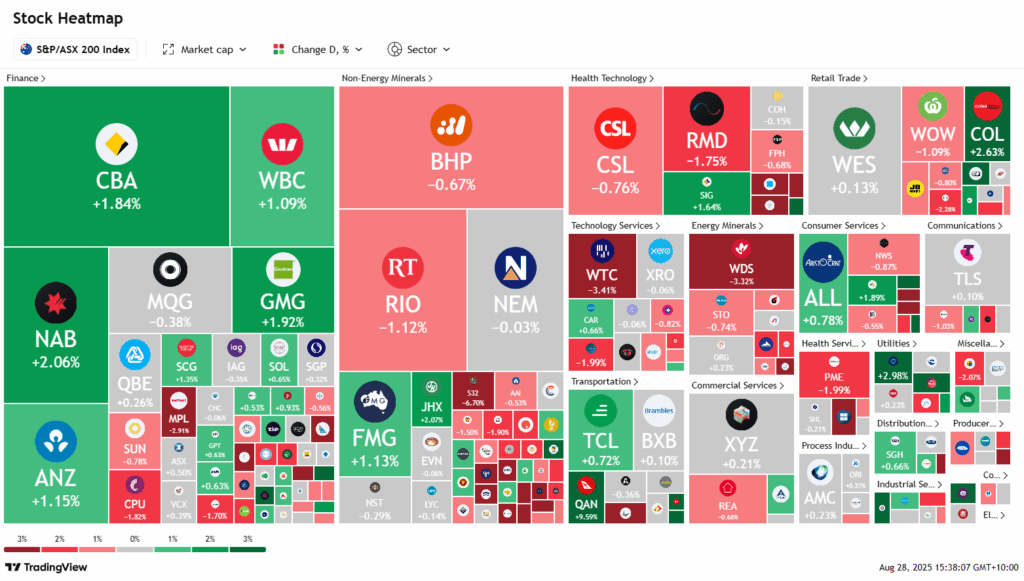

The Australian sharemarket finished marginally higher on Thursday, with investors consolidating positions as reporting season winds down. The S&P/ASX 200 Index rose 7.3 points, or 0.1 per cent, to 8967.8 at 2.05pm AEST. Gains in financials and select industrials offset weakness in energy, materials, and healthcare.

Financials drove the market as investors rotated into the banks. National Australia Bank advanced 2.1 per cent after a Morgan Stanley upgrade, while Commonwealth Bank added 1.6 per cent, ANZ 1.3 per cent, and Westpac 0.9 per cent. Industrials were supported by Qantas, which surged 8.6 per cent to a record $11.60 on strong Jetstar earnings.

Company-specific moves were pronounced. IDP Education rocketed 28.9 per cent on upbeat guidance, while Eagers Automotive jumped 12.7 per cent after a profit lift and strong EV sales. Lifestyle Communities rose 11.7 per cent. Conversely, Telix Pharmaceuticals tumbled 16 per cent on FDA issues, Ramsay Health Care slid 11.3 per cent on weaker results, and Beacon Lighting plunged 35.8 per cent after softer profits. Energy lagged, with Woodside down 3.3 per cent as oil prices eased.

Leaders

IEL Idp Education Ltd (+28.41%)

APE Eagers Automotive Ltd (+12.42%)

QAN Qantas Airways Ltd (+8.51%)

TAH Tabcorp Holdings Ltd (+7.96%)

DDR Dicker Data Ltd (+6.89%)

Laggards

TLX TELIX Pharmaceuticals Ltd (-17.66%)

RHC Ramsay Health Care Ltd (-11.37%)

NEC Nine Entertainment (-10.87%)

EOS Electro Optic Systems -10.78%)

MAQ Macquarie Technology (-8.06%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!