What's Affecting Markets Today

Asia-Pacific Markets Mixed as Regional Data and Politics Weigh

Asia-Pacific equities ended Friday mixed, diverging from Wall Street as investors digested key economic releases and political developments.

In Japan, the Nikkei 225 fell 0.41% and the Topix dropped 0.39% after Tokyo’s core consumer price index rose 2.5% year-on-year in August, easing from July’s 2.9% but remaining above the Bank of Japan’s 2% target. The result aligned with forecasts, reinforcing expectations of steady monetary policy. Japan’s unemployment rate improved to 2.3% in July from 2.5%, adding some support to the labor market outlook.

South Korea’s Kospi slipped 0.22% and the Kosdaq declined 0.27% as political tensions resurfaced following the indictment of former first lady Kim Keon Hee on corruption charges. The won weakened 0.15% to 1,387.38 against the US dollar.

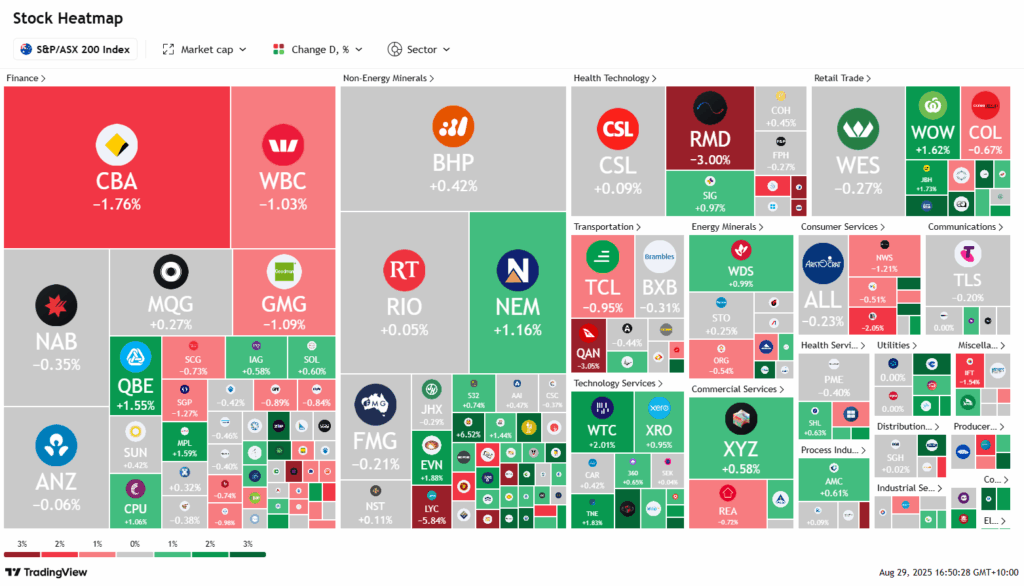

Australia’s S&P/ASX 200 edged down 0.14%, while Hong Kong’s Hang Seng index rose 0.51% and mainland China’s CSI 300 gained 0.13%. Looking ahead, markets will watch the Shanghai Cooperation Organization summit in Tianjin, where Indian Prime Minister Narendra Modi and Chinese President Xi Jinping may hold their first bilateral talks in seven years.

ASX Stocks

ASX 200 8,973.1 (-0.07%)

ASX Wrap: Market Slips but Secures Fifth Month of Gains

The Australian sharemarket edged lower on Friday, though it managed to close out August with solid momentum. The S&P/ASX 200 Index dipped 6.9 points, or 0.1 per cent, to 8973.10. Despite the mild weekly gain of 0.1 per cent, the benchmark advanced 2.6 per cent for the month, extending its winning streak to five months and remaining up more than 25 per cent from April lows.

Real estate stocks led declines, with Stockland down 1.4 per cent, while banks weighed as Commonwealth Bank slipped 1.2 per cent and Westpac lost 1.1 per cent. Tech outperformed as NextDC surged 17.4 per cent after outlining capital efficiency plans that reduced near-term equity raise risks.

Corporate results drove sharp moves. Harvey Norman jumped 10.4 per cent on a 39 per cent profit lift, while Austal rose 14.5 per cent on a record order book and new defence deal. By contrast, PEXA fell 8.6 per cent on weaker-than-expected earnings, and Mesoblast tumbled 9.5 per cent after widening losses. Boss Energy gained 7.7 per cent on first full-year cash flow, while Bubs climbed 9 per cent after reporting its first statutory profit.

Leaders

NXT – NEXTDC Ltd (+17.44%)

ASB – Austal Ltd (+15.11%)

SIQ – Smartgroup (+12.01%)

HVN – Harvey Norman (+11.49%)

APE – Eagers Auto(+9.46%)

Laggards

MSB – Mesoblast Ltd (-9.92%)

PXA – Pexa Group Ltd (-9.34%)

CU6 – Clarity Pharma (-6.29%)

HLI – Helia Group Ltd (-6.09%)

LYC – Lynas Rare Earths Ltd (-5.84%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!